Rural Update: Time for a tax rethink

Your weekly dose of news, views and insight from Knight Frank on the world of farming, food and landownership

7 minutes to read

Viewpoint

Over two million people and counting have now signed an online petition calling for a General Election. What better way for the Prime Minister to show he is listening than to reverse his Chancellor’s Budget raid on Agricultural and Business Property Reliefs (APR & BPR)?

He wouldn’t even have to eat much humble pie, given that one of the so-called “independent” tax experts who championed the deeply unpopular plan has now admitted he got it all wrong and that the changes won’t deliver any of their stated aims.

All Sir Keir has to do is blame the number crunchers and claim the credit for reversing a policy that saw tens of thousands of farmers and their supporters descend on London last week to vent their fury. The Welsh government has listened to farmers and just announced changes to its controversial Sustainable Farming Scheme. Let’s hope the politicians at Westminster are big enough to do the same thing.

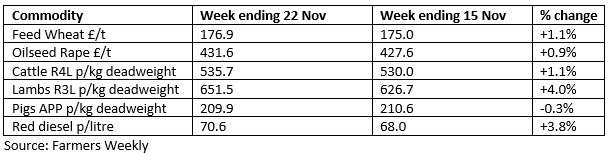

Commodity markets

Black Sea wheat jitters

Vladimir Putin’s nuclear sabre-rattling following Joe Biden’s decision to allow Ukraine to use US-supplied missiles to strike military targets in Russia has spooked some commodity investors. This helped push up wheat prices last week. However, market fundamentals remain generally bearish, with rain improving the outlook for the US 2025 wheat harvest. Despite losing a reported 18% of its farmland to the Russian invasion, Ukraine should produce 25 million tonnes of wheat next year, up from 22.4 million tonnes this harvest.

The headline

Tax expert rethinks APR raid

The “independent” tax expert who championed the government’s changes to Inheritance Tax (IHT) reliefs has now had a change of heart.

Dan Neidle, who is also an influential member of the Labour Party, says capping 100% Agricultural Property Relief (APR) and Business Property Relief (BPR) at £1 million won’t raise extra revenue for the Exchequer, won’t stop non-farmers buying up farmland to avoid paying IHT, and will hit family farms.

In a paper published on Sunday, which includes new data based on APR and BPR claims, Neidle proposes that “real” farmers should be offered a complete IHT exemption subject to a £20 million cap and a clawback provision if their heirs decide to sell any inherited agricultural property.

Whether Chancellor Rachel Reeves will amend her proposals, announced as part of the Autumn Budget, remains to be seen, but as the CLA says: “Piece by piece, the intellectual case for the Chancellor’s reform is falling apart.”

Changes to Welsh farming scheme

Speaking at Monday's Welsh Winter Fair, Rural Affairs and Climate Change Minister Huw Irranca-Davies rolled back some of the most controversial elements of the country’s proposed Sustainable Farming Scheme, which is due to be introduced in 2026. These included the requirement for all farms joining the scheme to have 10% tree cover on their holdings.

However, the requirement for farmers to manage at least 10% of their farm as wildlife habitat has been maintained. To help meet this requirement, additional options, which should be suitable for all farming systems, to create temporary habitats are being considered.

Irranca-Davies, who is also Wales’ Deputy First Minister, said: “It was clear changes were needed - we said we would listen - and we’ve done just that.

News in brief

Reed defends broken CLA promise

At the 2023 CLA Rural Business Conference, Steve Reed, then shadow Defra minister, pledged that Labour would not cut Agricultural Property Relief if it won the General Election. Last week, at this year’s conference, sponsored by Knight Frank, he was forced to explain why that promise hadn’t been kept. He said: “You deserve an explanation. I gave that answer because we did not know the full extent of the country’s financial crisis. There’s no way to turn our broken national finances around without plugging that £22 billion financial gap. So, the new government took tough decisions across the board on tax, welfare and spending – and yes, that included APR.” Read Steve Reed’s full speech.

SFI progress revealed

The government has just published for the first time figures that show the total number of English farmers signed up to both tranches of the Sustainable Farming Incentive (SFI) scheme. As of 1 October, there were 26,200 active SFI agreements. Of these, 25,300 were for the 2023 iteration of the SFI, which closed in May 2024. Since the Expanded SFI Offer opened at the end of May, a further 900 farmers have signed up. Excluding planning actions, the most popular option, covering 727,800 hectares, is: “No use of insecticide, nematicide or acaricide on arable crops and permanent crops”. There are 265,900 hectares of land in options that temporarily take land out of production – 3% of farmland.

COP29 carbon deal

The recent COP29 talks in Baku ended with a watered-down and much-criticised agreement on climate funding for developing nations. However, there was a boost for carbon markets as delegates, after 10 years of wrangling, finally reached an agreement to fully implement Article 6 of the Paris Agreement. Article 6 allows countries to collaborate on climate action through carbon markets, with two components: Article 6.2, which enables carbon credit trading between countries, and Article 6.4, which establishes a global carbon market overseen by the UN. The UN reckons this new “compliant” carbon market could be worth US$1 trillion annually by 2050.

The Rural Report – Out now

The latest edition of The Rural Report, our flagship publication for farm and estate owners, looks at the numerous opportunities and challenges arising in the countryside following the election of the new government. Find out more or request a copy

Property of the week

Suffolk stud launch

This week, we’re back in the UK with a newly launched property that will be sure to appeal to equine lovers. Martley Hall at Easton, near Woodbridge, is a 220-acre state-of-the-art stud farm, parts of which date back to the time of the Domesday Book. In addition to the moat-enclosed six-bed main house, there are four separate ensuite guest rooms located around an Italian courtyard, four cottages and a large indoor leisure complex. The equine facilities include an Olympic-sized indoor arena, 24 boxes, four heated foaling boxes, an outdoor arena, a horse walker and three all-weather turnout paddocks. The guide price is £9 million. For more information, please contact Georgie Veale.

Property markets

Country houses Q3 – Market waits

Discretionary buyers held back from a new country house purchase pending Labour’s first budget on 30 October. Offers from potential buyers were down 10% in the three months to August, according to the latest results from the Knight Frank Prime Country House Index. However, the slide in average values has slowed with prices dropping by just 1.2% in the 12 months to the end of September - the lowest annual fall since Q1 2023 - points out Head of UK Residential Research Tom Bill. He predicts a total average price slide of 2% this year, dependent on the outcome of the Budget.

Farmland Q3 – Prices flatline

The farmland market in England and Wales was also on budget alert, judging by the latest results from the Knight Frank Farmland Index. Average values for bare land nudged up by just 0.2% in the third quarter of the year to £9,351/acre. This was the smallest increase for several years. For more insight and data please download the full report.

Development land Q3 – Greenfield sites up

The average value of greenfield land values in England rose 3% in the third quarter of 2024, according to the latest instalment of our Residential Development Land Index. However, brownfield and prime central London prices stayed flat due to thin activity, with some market participants taking a “wait-and-see” approach ahead of the Budget, says the report’s author, Anna Ward. Housebuilders are also sceptical that it will be possible to deliver the 1.5 million new homes pledged by Labour over the next five years. Download the full report for more insight and data.