India leads Asia-Pacific office rents amidst regional fluctuations in Q3 2024

5 minutes to read

India has emerged as a standout in the Asia-Pacific office rental market, as shown in Knight Frank’s Asia-Pacific Q3 2024 Office Highlights. This trend contrasts with the broader region, which has experienced a slight decline in prime office rents.

Key cities in the Indian office market demonstrated impressive performance. Mumbai has seen a 5% year-on-year (YoY) growth, while Bengaluru experienced a 3% YoY increase, with the National Capital Region (NCR) maintaining stable rents. This growth is underpinned by strong occupier demand and a constrained supply scenario. Transaction volumes in these three markets have reached consecutive all-time highs in Q2 and Q3 2024.

The primary drivers of this growth are Global Capability Centers (GCCs) and India-facing businesses. GCCs remain a significant force, particularly in Bengaluru, which accounts for 62% of transacted space. India-facing businesses constitute the bulk of volumes in Mumbai and NCR.

The confidence in India's office market can be attributed to several factors: a positive outlook for the Indian economy, a high-quality talent pool, a favourable policy environment, and steady growth in consumer markets.

Asia-Pacific office market: a mixed performance

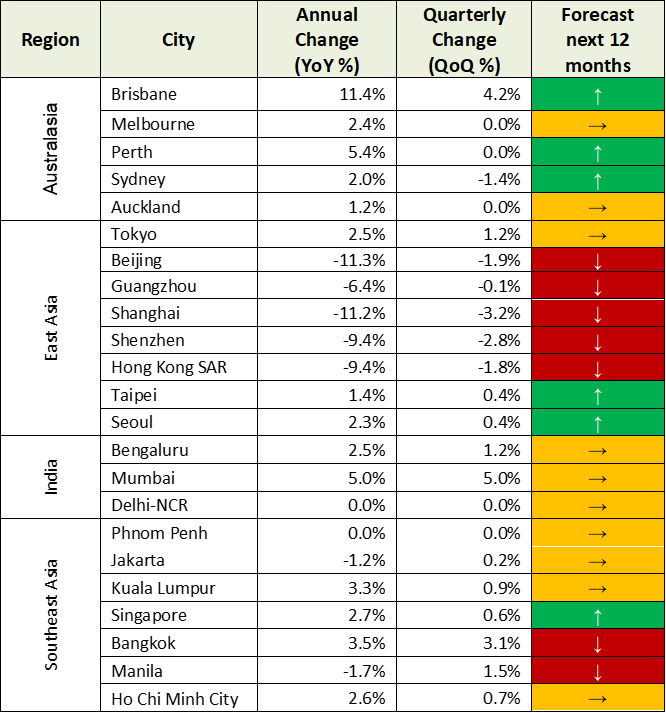

While India shines, the broader Asia-Pacific region presents a more complex picture. Overall, prime rents fell 0.1% quarter-on-quarter and 2.5% year-on-year. The Chinese mainland experienced an 11.0% YoY decline, steeper than the previous quarter's 10.6% drop.

However, there are positive signs, with 16 out of 23 monitored cities reporting stable or increasing rents YoY, up from 15 in the previous quarter, influenced by several factors. Companies are cautiously managing expenses amid global economic uncertainty, while the new normal of flexible work arrangements continues to shape office space requirements. This trend is reflected in the increasing adoption of hybrid work models, with over 60% of companies in Asia-Pacific achieving stable office attendance through such arrangements.

Looking ahead: 2025 forecast

The Asia-Pacific prime office sector is projected to maintain a tenant-favorable environment in 2025, albeit with notable shifts on the horizon. A significant reduction in the supply pipeline is anticipated, with forecasts indicating a decrease of approximately 20% compared with 2024 levels. This contraction is expected to gradually diminish the availability of prime office spaces across the region, potentially shifting the balance of power between tenants and landlords. As a result, while tenants may still hold an advantage in 2025, they might face increased competition for premium spaces in prime areas, potentially leading to more competitive leasing conditions in these submarkets.

Forecast for the next 12 months:

A snapshot of the region

Australasia

Australia's largest office markets experienced a notable uptick in prime rents, with a 3.0% increase in Q3 2024 compared with the same period last year. Brisbane led the region in rental growth for another consecutive quarter. The city's prime rents grew by over 11% year-on-year, driven by strong demand and a scarcity of imminent development projects. In contrast, Sydney's office market experienced a divergence in rental growth across different submarkets, primarily due to a pronounced flight-to-quality trend. This shift in tenant preferences has led to increased incentives offered by landlords, particularly in areas facing competitive pressure from new developments.

Auckland's prime office market, in contrast to its Australian counterparts, has shown signs of softening. Prime office rents in the city remained flat for the fourth consecutive quarter, indicating a period of stability but also suggesting potential underlying challenges. The vacancy rates in Auckland have risen significantly, reaching over 13%. This increase can be attributed to an influx of new supply in the first half of 2024, which has expanded the options available to tenants.

Southeast-Asia office markets: mixed trends amid economic shifts

Southeast Asia's emerging office markets experienced an improvement in vacancy rates, with a 0.6 percentage point decrease quarter-on-quarter, bringing the overall vacancy rate to 24.0%. This positive trend was primarily driven by reduced availabilities in key cities such as Ho Chi Minh City (HCMC), Jakarta, and Kuala Lumpur, signaling a gradual recovery in these markets.

In Bangkok, the preference for prime office spaces remains a key driver of relocations. Interestingly, despite rising vacancies, landlords in the Thai capital have shown reluctance to lower asking rents. Instead, they have offered substantial incentives to attract and retain tenants. This strategy has paradoxically led to an increase in overall rent figures, as the face value of rent remains high while the effective rate is moderated through incentives.

Ho Chi Minh City is witnessing a similar trend, with more tenants relocating to new buildings with sustainability accreditations. Attractive incentives offered by landlords of these modern, eco-friendly properties further encourage this movement.

In contrast to the emerging markets, Singapore, a developed market in the region, has observed a slowdown in leasing momentum. Companies are adopting a more conservative approach to capital expenditure and expansion plans, reflecting broader economic uncertainties. Despite this cautious sentiment, Singapore's office rents achieved a marginal 0.8% increase quarter-on-quarter. However, it's worth noting that this growth was largely driven by lease renewals rather than new leases or expansions, indicating a preference for stability among existing tenants.

Chinese Mainland and Hong Kong SAR office markets: challenges persist

The Chinese mainland's office markets in first-tier cities continue to face significant headwinds. In Q3 2024, office rents in key urban centers saw a sharp 11.6% year-on-year decline, accelerating from the 10.0% drop observed in Q2 2024. Vacancy rates in these markets reached 20%, a 0.4 percentage point increase from Q2 2024. This rise can be attributed to the delivery of new supply in major cities like Guangzhou and Shanghai.

The ongoing trade tensions with the United States have had a tangible impact on the office market. US law firms, in particular, are reportedly downsizing their office footprints in response to these geopolitical pressures. Additionally, companies relocating away from core Central Business Districts (CBDs), potentially seeking more cost-effective locations.

The situation in Hong Kong SAR mirrors the challenges faced in mainland China, with office rents continuing to decline amid weak leasing momentum. The market is further impacted by the creation of backfill spaces, a consequence of recentralisation efforts and the ongoing flight-to-quality trend.

The full report can be found here.