The Rural Update: Actions speak louder than words

Your weekly dose of news, views and insight from Knight Frank on the world of farming, food and landownership.

10 minutes to read

Viewpoint

It was to be expected. A post-election flurry of ministerial announcements, promises and a bit of tactical mudslinging aimed at the previous government. New Defra Minister Steve Reed was quick to seize on the results of a survey (see below) that showed farmer confidence is currently at a pretty low ebb and then shout about a grand plan to turn things around.

Although Tory policymakers do need to take some of the blame for the gloom – they took too long to sort out the Sustainable Farming Incentive and rushed to strike trade deals that disadvantaged UK agriculture, for example – other optimism-sapping things such as the weather and volatile commodity markets were outside their control.

So far, Reed and his team seem sympathetic to the plight of farmers and are saying the right things, but the honeymoon won’t last long and soon they will have to actually start making a difference, all at a time when the purse strings are tightening.

In this week's update:

• Milk price up, but producers move on

• Rates - Going down at last

• Planning policy reform

• Furnished holiday let downer

• Minister pledges stability boost

• Farmer sentiment low

• Poor marks for environmental delivery

• Environmental act target review

• Earth overshoots

• Government failed neonic legal test

• Cultured meat opportunities

• Country houses - Dipping but outlook brighter

• Farmland - Values hold firm

• Development land - Market stays flat

• Oven-ready green investment

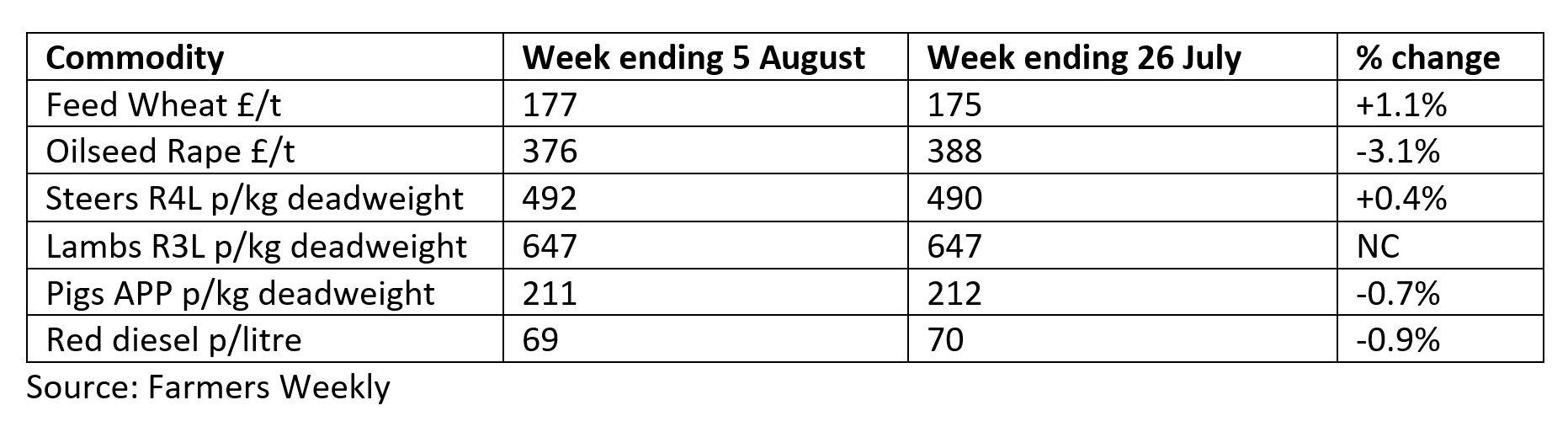

Commodity markets

Milk price up, but producers move on

While grain and oilseed markets yo-yo based on the latest weather and production forecasts, milk prices are steadily climbing up. A number of processors, including Arla, have announced autumn rises that will take farm-gate values for their suppliers to around 42p/litre. However, the latest Defra figures show that the average price across the UK in June was only 38p/litre, well short of the almost 52p/litre peak that was hit in December 2022. This probably explains why some farmers have had enough. Last year, according to AHDB, 440 producers (6% of the UK’s total) called it a day.

Headlines

Rates - Going down at last

Some much-needed good news for Keir Starmer to help celebrate one month in power. Last Thursday the Bank of England’s rate-setting committee voted narrowly 5-4 to cut interest rates by a quarter of a point to 5%, the first cut since 2020. Although the move won’t have much of a near-term impact on borrowing costs as lenders had already factored a cut at some point over the next few months into their deals, the fact the drop came quicker than many were expecting will certainly add confidence to the market.

Bradley Smith, a rural lending expert at Knight Frank Finance, comments: “The first rate cut since the start of the pandemic means the Bank of England believes that the underlying sources of inflation are now under control. This cut is much needed in the rural economy given the difficulties felt in the sector with the turbulent weather we have had. Having had many discussions with economists from various banks and institutions in recent weeks, the overall consensus is that there will be one or two more quarter-point cuts by the end of this year, possibly even finishing 2025 at sub 4%.

“With the feeling that rates are now on the march down, albeit slowly, this should bring confidence to the market and help people plan for the future. I expect Thursday’s announcement will bring a boost to the property market through the autumn with those who have been waiting for some positive news now likely to put their plans into motion.”

Planning policy reform

In a speech to parliament last week the Deputy Prime Minister Angela Rayner set out the changes the Labour government plans to make to the National Planning Policy Framework (NPPF) to help it hit its five-year 1.5 million housebuilding target. Local housing targets will become mandatory and there will be a change in the methodology used to calculate housing need. It will now be based on the size of existing settlements not historic figures. Rayner said this means a collective 70,000-home rise in annual housebuilding targets to 370,000. A consultation on the proposed NPPF changes closes on September 24th. Read more insight from Knight Frank’s planning and development experts.

In brief

Furnished holiday let downer

Bad news for rural property owners with furnished holiday lets (FHLs) in their portfolios. The new government has confirmed that it will be implementing the Conservatives’ pre-election proposals to remove the tax advantages conferred on the income and capital gains associated with FHLs and bring them in line with the rest of the residential rental market. The new rules will kick in from April 1st 2025.

Minister pledges stability boost

Defra Minister Steve Reed announced a “new deal” for farmers last week “to boost Britain’s food security and drive rural economic growth”. The raft of measures includes optimising environmental land management schemes so they produce the right outcomes for all farmers, seeking a new veterinary agreement with the EU to cut red tape at our borders, protecting farmers from being undercut by low welfare and low standards in trade deals, using the government’s purchasing power to back British produce, and introducing a land-use framework that balances long-term food security and nature recovery.

Farmer sentiment low

Mr Reed certainly needs to do something, because farmers are feeling pretty gloomy, according to the results of the government’s own 2024 Farmer Opinion Tracker. Farmers on 64% of holdings are not at all confident that the government’s changes to schemes and regulations will lead to a successful future for farming. And only 6% feel very positive about their future in farming.

Poor marks for environmental delivery

Whenever the government gets assessed on its progress towards meeting its biodiversity or net zero targets the results are always pretty scathing. An audit published last week of the 2023 Environmental Improvement Plan covering the last year of the previous administration didn’t break the trend. It found that plans for “thriving plants and wildlife” and “clean air” had deteriorated and that there was no data to measure many of the metrics such as habitat creation for wildlife and the status of sites of special scientific interest. It also said the government had been off track to meet its woodland creation targets.

Environmental act target review

Whether the new government can do any better remains to be seen, but Defra minister Steve Reed has just announced a rapid review of the Environmental Improvement Plan (EIP) to be completed by the end of the year to “deliver our legally binding targets to save nature”. Mr Reed said the government would develop a new, statutory plan to protect and restore the natural environment with delivery plans to meet each of its ambitious Environment Act targets.

Earth overshoots

The Earth officially overshot its capacity to regenerate to make up for the demands imposed on it by humans last week. Earth Overshoot Day, calculated by Global Footprint Network, fell on August 1st signifying that humanity is currently using nature 1.7 times faster than our planet’s ecosystems can cope with. In 1971 Overshoot Day didn’t occur until the end of December.

Government failed neonic legal test

The previous administration ignored a legal requirement to assess how the use of a banned noenicitinoid sugar beet seed treatment would affect protected areas before granting an emergency derogation for its use, environmental campaigners claim. Despite being banned in the UK and Europe since 2018 due to its effect on bee populations, the government has given sugar beet farmers emergency authorisation to use Cruiser SB for the past four years to help battle virus yellows disease, which can devastate crops. The government indicated the requirement in relation to protected areas was too difficult to implement.

Cultured meat opportunities

If you’re concerned about the impact of cultured meat technology on livestock farmers, a recently published study from the Royal Agricultural University makes for interesting reading. Culture Clash – What cultured meat could mean for UK farming says as well as threats there could be opportunities for producers if the technology builds momentum. These included the opening up of new potential markets supplying animal cells or agricultural by-products, like glucose and amino acids, for the growth media used for cultured meat production.

Out and about

Carbon credit confidence

Mark Topliff and James Shepherd of Knight Frank’s Rural Consultancy team had an intense couple of days attending the University of Lincoln’s conference on Nature-based Solutions using Carbon and Biodiversity Credits. Mark comments: “The event highlighted the key challenges and opportunities in the field from different viewpoints. It was suggested that confidence in the voluntary biodiversity credits market is waning, with a shift towards bespoke credits tailored to specific buyers. To grow biodiversity markets, more investable projects are needed, focusing on aggregation and scaling rather than over-investing in baselining. The ‘carbon plus’ route, combining biodiversity benefits with carbon credits, is crucial for attracting private investment. Transparency and integrity issues in the carbon market threaten biodiversity markets, necessitating standards from more organizations to build investor confidence.”

Research

Country houses - Dipping but outlook brighter

The average value of country houses nudged down by a further 0.6% in the second quarter of the year taking the 12-month fall to 3%, according to the latest results from the Knight Frank Prime Country House Index. Homes priced between £1 million and £2 million recorded the biggest annual fall of almost 4%, while those worth between £4 million and £5 million dipped by just 0.4% - potential buyers at this level are less dependent on mortgage funding, points out Head of UK Residential Research Tom Bill. He predicts a total average price slide of 2% this year, with values bouncing back by 3% in 2025 as interest rate cuts boost market confidence.

Farmland - Values hold firm

The farmland market in England and Wales shrugged off the potential impact of the recent general election to register another quarterly price increase, according to the latest results from the Knight Frank Farmland Index. Average values nudged up by almost 1% in the second quarter of the year to hit £9,335/acre. For more insight and data please download the full report.

Development land - Market stays flat

The value of greenfield development sites remained static in the second quarter of the year, according to the latest results of the Knight Frank Residential Development Land Index. Over the past 12 months the index is down 2%. According to Anna Ward, who compiles the index, developers have welcomed Labour’s commitment to reinstate local housing targets and recruit more planning officers. But with interest rates failing to shift and build costs increasing, homebuilders still face significant headwinds, she adds. Download the full report for more insight and data.

Property of the week

Oven-ready green investment

Plenty of stunning farms and estates have graced The Rural Update, but this week’s property is genuinely unique and is set to be an intriguing test of the market for land-based green investments. Far Ralia, a 3,668-acre block of land in Scotland’s Cairngorm’s National Park, offers one of the largest quantified forestry and peatland carbon sequestration opportunities in the UK. It includes a fully funded and approved 2,103-acre tree-planting programme of close to 1.5 million trees. Planting is already underway, with 75% of the trees now planted with four of the five planting compartments complete. Far Ralia offers numerous amazing nature restoration opportunities and the ability to transform an entire landscape for the benefit of the environment and society as a whole. There is also the potential to generate an array of high-integrity nature-based income streams. The guide price is £12 million. Watch the video to be inspired and for more information please contact Claire Whitfield.