Freedom to buy with a 95% mortgage

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

UK house prices dipped 0.1% in May and have been largely flat through spring, Halifax said this morning.

We still expect a small rally in values later this year, but sentiment took a knock during the early weeks of spring when it became clear that inflation wasn't going to glide back to target as the Bank of England had hoped. How quickly inflation will cross the final percentage point or two to target remains a puzzle across western economies.

The European Central Bank, which until recently looked likely to diverge meaningfully from the Federal Reserve, delivered "a reluctant cut" to interest rates yesterday and may only deliver one more before the year is out. Meanwhile, the Federal Reserve, which until a fortnight ago looked unlikely to cut rates at all this year, now faces several weakening indicators and traders are once more ramping up bets on earlier cuts. Both central banks are nearly in alignment, but for how long is anyone's guess.

Here is Knight Frank's Tom Bill on the Halifax figures:

“House prices remain under pressure as an interest rate cut moves further over the horizon. Demand will typically rise in spring but there has been a 0.3% price decline over the last three months thanks to stubborn services inflation and rising swap rates. There should be a more noticeable bounce this autumn when the first rate cut since March 2020 is likely to have happened and the political backdrop will have stabilised. We expect UK prices to rise by 3% this year as the prospect of more mortgages starting with a ‘3’ gets closer.”

Freedom to buy

Labour this morning pledged to launch a permanent, government mortgage-guarantee scheme called "freedom to buy". First-time buyers will be able to access loans up to 95% of a property's value and will get "first dibs" on new developments, according to the Times.

That's it in the way of detail for now - the pledge was mentioned in a broader piece on Labour's plans to curtail the development of what it calls "identikit homes". The party appears inclined to take forward Michael Gove's ambition to ensure new developments are "beautiful" and is working with the same consultancy Create Streets that championed the "gentle density" design ethos with Mr Gove. Here is the Times:

"While senior Labour figures are sceptical about the subjective nature of Gove’s focus on beauty, they agree with him that better design would reduce local objections to development."

A blueprint for the next government

Both the housebuilding industry and the government agree that blockages in the planning system need to be cleared, but they have different solutions, at least for the time being.

The Home Builders Federation yesterday published a blueprint for the next government, outlining the policy priorities of the industry. There are some areas of overlap - a targeted first time buyer scheme and a review of the green belt to identify areas of poor ecological value are in the Labour manifesto - however there is much, much more that needs to be done, according to the HBF. There are too many suggestions to share here, but a few of the eye catching ones include:

- Encourage the purchase of more energy efficient homes by abolishing stamp duty for purchasers of all homes with an EPC rating of B or above.

- Reverse the December 2023 changes to the NPPF, with a particular focus on reinstating mandatory housing targets and the Five-Year Housing Land Supply.

- Bring forward new legislation to enable the 160,000+ new homes currently blocked by Natural England’s nutrient neutrality mitigation measures (and other issues such as water neutrality) to be built. Plus, commit to working with Natural England to review its nutrient mitigation

calculator to reflect the minor contribution (<1%) that the occupancy of new homes makes toward nutrient pollution.

- Take the politics out of housing by establishing a fixed national scheme of delegation (introducing a higher threshold for reserved matters submissions to be determined by committee).

That last one is among the most conscientious and gets a write up in the FT. Stewart Baseley, HBF executive chair tells the paper that decisions about where to put new homes should be made by councils when they drew up their local plans to guide development, and not rehashed for each specific application:

“The planning application on that land should then be done in a professional manner by professional planning officers... What all too often happens when developers make an application on zoned land is that the whole debate about the principle [of where to build homes] gets reopened.”

Walking a tightrope

The public finances are in a sub-optimal state, to say the least. Both political parties are walking a tightrope when it comes to election promises that won't require substantial cuts to public services if they are to be funded. Both Labour and the Conservatives have made it their target to have the UK’s debt pile shrinking within five years.

The parties are basing policy pledges on Office for Budget Responsibility forecasts that are more optimistic than others, perhaps most notably the Bank of England. Earlier this week, the Resolution Foundation think tank warned that "the uncertainty surrounding the fiscal outlook dwarfs sums involved in political arguments made in the campaign." It reckons that a downgrade to the OBR's assumption around trend growth would leave a £12 billion gap against commitments to get debt falling.

The Institute for Fiscal Studies takes that warning a step further. Projections from the Bank of England would actually see debt rising by a margin of £28bn in 2028 to 2029, according to the group's calculations. That would be a big hole to fill.

Construction

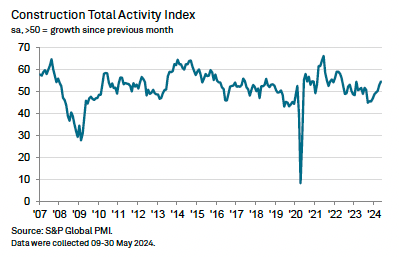

Growth in construction gathered pace in May, according to the latest S&P Global UK Construction PMI. Housebuilding returned to growth for the first time for the first time since the mini-budget.

Conditions look very positive indeed. Rising workloads prompted renewed expansions in purchasing activity and employment, while business confidence also strengthened. Firms linked

higher new orders to the winning of new contracts and the commencement of previously delayed projects. Supply-chain conditions continued to improve amid reports of good stock availability at vendors. This contributed to the pace of input cost inflation slowing to a marginal pace.

In other news...

Cadogan Estates in hotels push to boost returns made in Chelsea (FT), UK rental growth drops back in spite of strong demand from tenants (FT), and finally, Blackstone has deployed US$20 billion of equity on real estate in just six months (Bloomberg).