Tenants Push Back on Rent Increases as Supply Builds in Prime London Postcodes

April 2024 PCL lettings index: 220.1

April 2024 POL lettings index: 220.6

2 minutes to read

Rental value growth in prime London postcodes has narrowed to levels last seen in the summer of 2021.

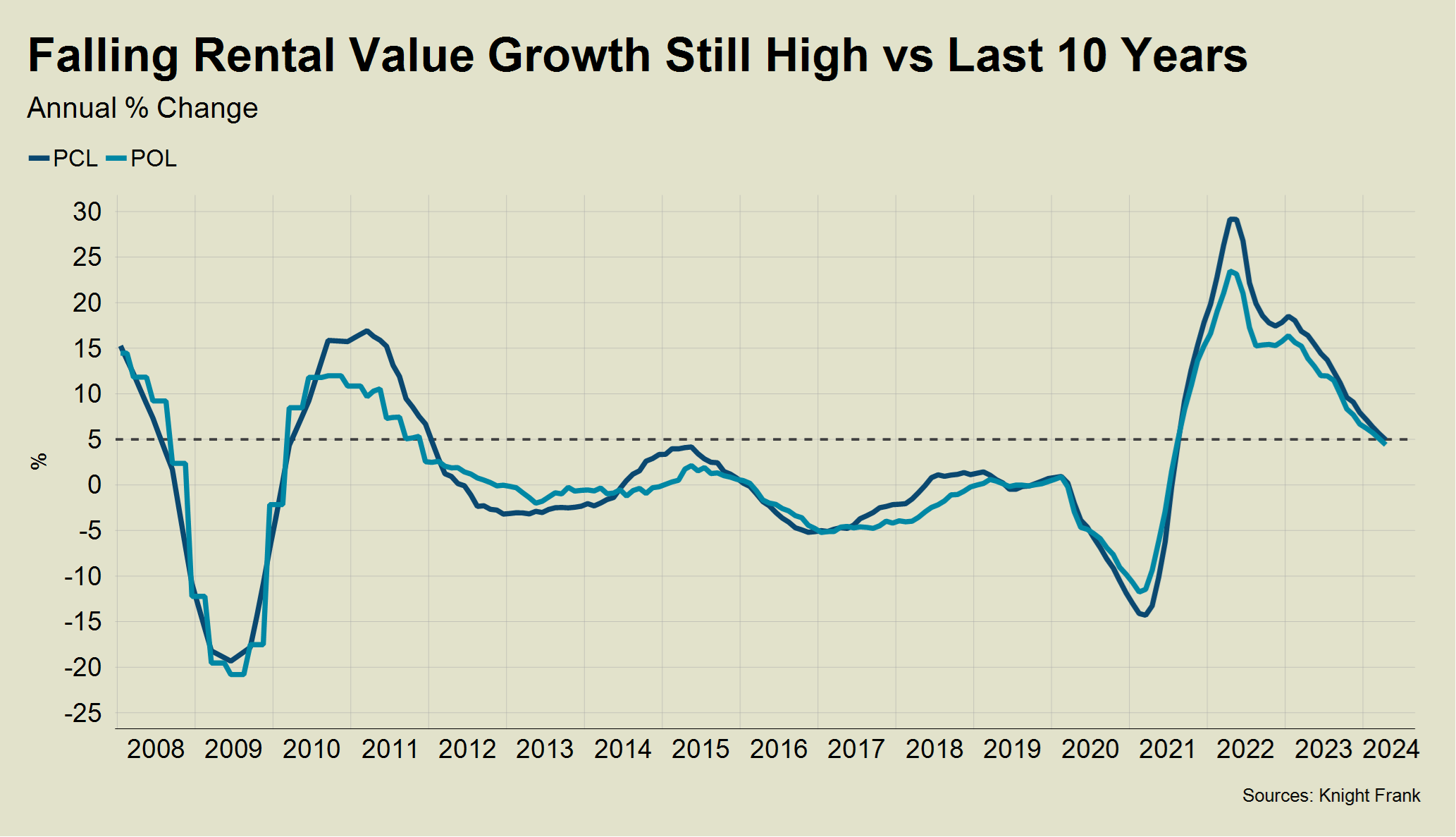

Average rents in prime central London (PCL) grew by 4.9% in the year to April, while the figure was 4.4% in prime outer London (POL).

The increases may be down but are still relatively high by historical standards, as the chart shows.

It is largely the result of rising supply. An active sales market during the pandemic, particularly throughout a 14-month stamp duty holiday from July 2020, meant lettings stock fell as owners capitalised on buoyant conditions by selling.

On top of that, landlords have also been leaving the sector in recent years due to proliferating red tape and tax. Those who haven’t sold up typically have preferred shorter tenancy lengths to leave themselves the flexibility to do so.

While that is good news for tenants, the fact rental value growth has calmed down over the last six months is potentially another disincentive for landlords.

The Renters Reform Bill currently going through Parliament is adding to the mood of uncertainty. Any proposed changes by the Conservative Party could be expanded upon by Labour if they win power.

Several months ahead of a general election, there are early signs that more landlords are considering a sale.

The number of new lettings instructions across London was 4% lower in April compared to the same month last year, Knight Frank data shows. Meanwhile, sales instructions were up by 16% over the same period.

With prices either flat or falling across many prime London sales markets, these properties may revert to the lettings market if the asking price is not achieved.

Overall, lettings supply has grown in recent years, and new instructions were 11% higher over the first four months of this year than the same period two years ago, a time when rents were growing by over 20%.

As a result, tenants are increasingly pushing back against the sort of large rent increases that have been common since then, either by re-negotiating or leaving at the end of the tenancy.

The balance of power has tipped even more towards tenants in higher-value markets, for reasons we explored last month.

As rents continue to increase and sales values decline, gross average yields have risen. A figure of 4.24% in prime central London in April was the highest it has been since March 2007.