Recession, what's in a name?

Your monthly question on economic trends shaping housing markets

6 minutes to read

Given the headlines you’d be forgiven for thinking we were in the depths of a terrible economic crisis, is that the case?

If you’ve only got a minute, here’s the top line. If you have a few more, the full discussion can be found below.

• Reading the headlines with caution. They don’t give the full picture until you read more.

• We are experiencing a slowdown in economic activity but not necessarily a big reversal. The broader definition of a recession is yet to be met and the picture is more nuanced.

• Don’t say it’s different – but it’s different. Covid trends and social media mean this is unlike any other downturn.

• However, there are significant headwinds to come. There is an acute cost of living crisis and this will worsen in the UK, coupled with a rise in interest payments on mortgages as central banks fight the inflationary fires.

• The savings and job security may cushion the blow and a new Prime Minister will undoubtedly put in place some measures to support consumers.

• We could see ‘the millennium bridge effect’, where the constant doom and gloom in the age of social media, causes small changes from enough consumers to cause a slowdown – a self-fulfilling prophecy more than anything.

• Any recession or downturn is likely to be shallow in nature, given many underlying factors, notwithstanding any sizeable shocks.

• The UK housing market is returning to more normal patterns, after two years of supply disruption and Covid trends the feed through of higher rates and more supply we will see a pattern of normality return to the market.

Read headlines with caution

The oft cited definition of a recession is two quarters of declining GDP figures. Although not taken as gospel by economists, this definition has this has now been achieved in the US. However, officially it is The National Bureau of Economic Research (NBER) that make the call in the US, and they take a more measured approach. A recession is defined as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” In the US and UK this definition has not yet been met.

We are experiencing a slowdown in economic activity but not a reversal.

GDP is not the be-all and end-all. The US has experienced two quarters of GDP declining yet other indicators point to a less gloomy outlook. So far in 2022, 470,000 new jobs have been created on average each month. Compare that to 2008 when a contracting labour market pre-dated the official start of the recession. The other indicators which the NBER look for paint a mixed picture, but the narrative is one of a slowdown from the rapid bounce in 2021 than a reversal. Deloitte note the same trend in global PMIs which are more telling and timely.

This chimes with our expectations for the UK housing market too. On the surface headlines point to prices and demand falling but read further and it’s hard to distinguish from the usual seasonal patterns and underlying demand is still there.

Don’t say it’s different – but it’s different

There are two critical differences which make historical comparisons, particularly with the GFC, tricky: Covid and social media. Covid has changed the economic make-up and behaviour of consumers. Simply put, being confined to our homes, or under restrictions, for prolonged periods has changed behaviour. Social media, and constant media in general, are potentially driving confidence indicators but the data tells a different story.

Consumers are continuing to spend with retail sales holding up. The Economist noted in a recent article that “inflation has caused consumer confidence to plunge, but when asked about their personal finances rather than the whole economy, people are much cheerier.”

Spending is being buoyed by a tight labour market enhancing job security in nearly all developed markets. Take the UK, for example, where unemployment hovers at near record lows of 3.8%. In May, there were more unfilled vacancies than there were people out of work, the first time this has happened in the 20-year timeseries.

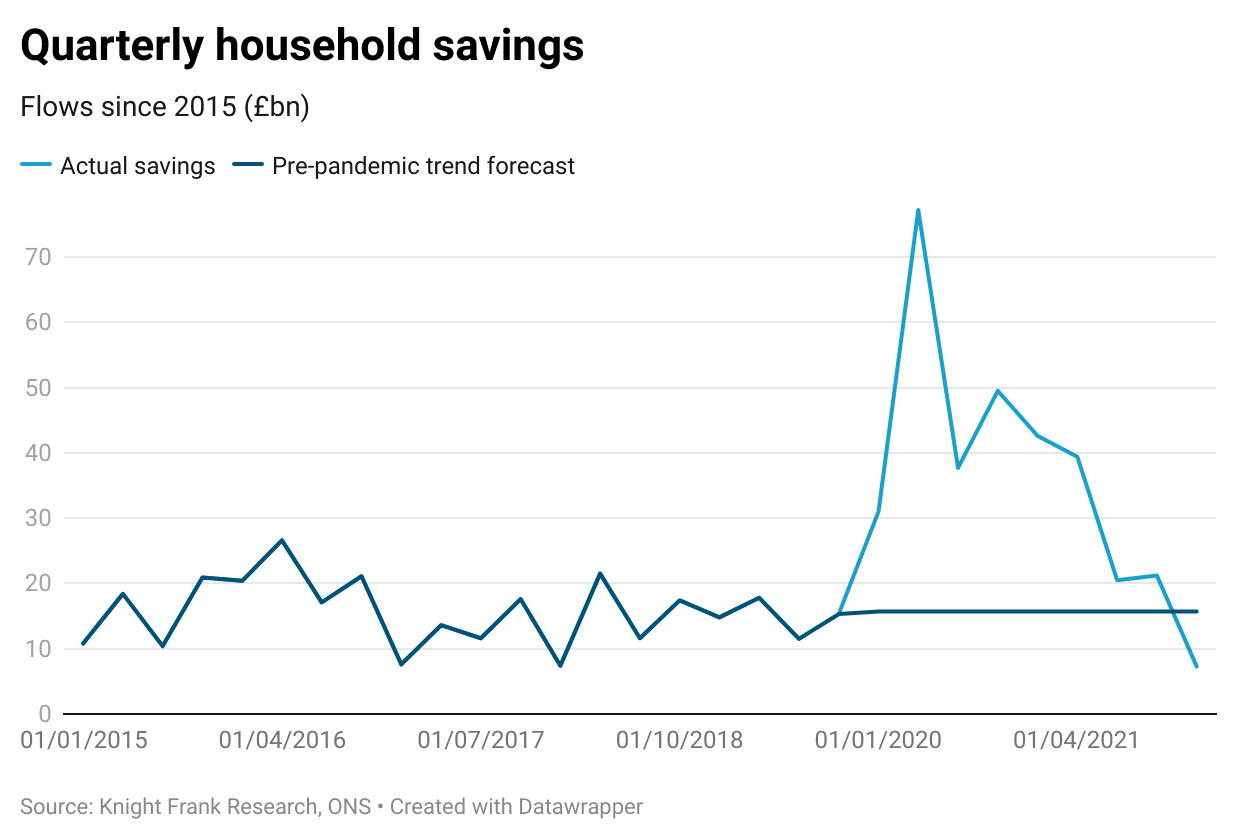

Then there is the build-up in excess savings. At the end of Q1 2022, using data from the ONS, the level of excess savings in the UK sat at £185bn which is unlike any previous period. The corresponding figure in 2008 was a peak of £30bn. Whilst the first quarter figure does represent the first fall since the onset of the pandemic, we still expect some of these savings will be recycled into property markets.

However, there are significant headwinds to come

As is well documented in the UK, and in many other large economies, there is an acute cost of living crisis. Inflation is running at multidecade highs, 10.1% in July, led largely by increases in energy and food prices. This will worsen; the Bank of England is forecasting inflation soaring to 13%, with Citigroup saying 18% is possible, by the end of the year, and the latest predictions suggest household energy bills will rise by more than three times between January 2022 to January 2023.

Couple this with a rise in interest payments on mortgages of £300 a month between a low in September 2021 and July 2022 (with more to come), and there is potential for affordability to become more squeezed.

Savings and job security may cushion the blow and a new Prime Minister will undoubtedly put in place some measures to support consumers, but as my colleague Tom Bill notes any additional support measure have not been factored into forecasts.

As household incomes are currently forecast to contract 2% in real terms despite wage growth, consumers will have to divert spending to service these bills. For now at least there may be a summer of ignorance whilst we still relish in our freedom.

The millennium bridge effect

My last point, however, is akin to what happened when the Millennium Bridge opened. If you’re constantly told something is going to be bad, you end up bracing for impact.

Even if everyone makes just small changes, the effect will be amplified – the way each pedestrian on the bridge made a small gait adjustment for the sway and the bridge started to swing wildly.

If this happens then a recession, or marked slowdown, might become a self-fulfilling prophecy. The last big downturn was in 2008/09 when social media, and to some extent traditional media, weren’t as prevalent and omnipresent. According to Our World in Data there were around 650 million users of social media globally in 2008. The latest estimates of 2022 from Global WebIndex puts this at 4.62 billion or 58.4% of the world’s population. That is a lot of people being told how bad it will get.

We will almost certainly see what many define as a technical recession in the final quarter of 2022 and the Bank of England agrees. The truth is there won’t be clarity on the depth or length until it is over, hindsight is brilliant that way.

Given many underlying factors, notwithstanding any sizeable shocks, I believe it will be shallow, something with which KPMG’s Chief Economist Yael Selfin agrees. There could even be some positives, such as increased attention and investment for renewable energy, as noted by The Economist.

For the UK housing market, this supports our view that we will see a slowdown followed by a return to more normal patterns, even with rates rising to 3%. House prices have largely been subject to similar influences as inflation – namely supply chain disruption resulting in a lack of stock relative to demand. With higher rates and more supply, the distortions of the past few years should ease. Just be prepared for more doomy headlines in the meantime.

Photo by Alberto Zanetti on Unsplash