Mortgage lending drops to the lowest level in two years

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Mortgage lending ebbs

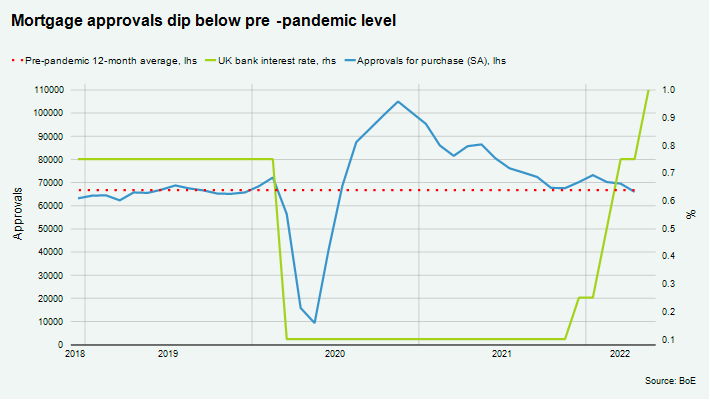

The number of mortgages granted to prospective house purchasers fell to the lowest level in two years during April. The Bank of England data, published yesterday, provides the strongest signal so far that UK housing market activity is moderating as interest rates rise.

“Rates on certain products have doubled in the past twelve months and there is a real sense of urgency among many borrowers who sense they must act soon or reassess what they can afford,” Hina Bhudia of Knight Frank Finance tells Sky News.

The Bank of England data doesn't capture when a borrower remortgages with the same lender, however anecdotally activity on that side of the aisle is particularly strong as borrowers seek to get ahead of rising interest rates. "Certain lenders allow you to book rates up to nine months in advance, so thousands of borrowers are bringing forward decisions that in normal circumstances would have been put off," Ms Bhudia adds.

Detailed forecasts from the Office for Budget Responsibility, published in March, suggest transactions will ebb over the medium term to a level consistent with longer-term average rates of housing market turnover. Meanwhile house prices climbed 11.2% in the year to May, according to Nationwide figures out this morning. That's down slightly from 12.1% growth during the year to April.

Shifting sentiment

Households borrowed an additional £1.4 billion in consumer credit during April, up from £1.3 billion in March, according to the same Bank of England release. That makes April the third consecutive month in which borrowing has been above the pre-pandemic average of £1 billion.

At the same time, households deposited an additional £5.7 billion with banks and building societies and another £0.6 billion in National Savings and Investment (NS&I) accounts. Again, the combined reading was well above pre-pandemic norms. It's likely that many consumers are utilising credit to offset inflation while those able to do so are saving while the outlook remains uncertain.

There is a similar divide emerging among businesses. Sentiment among UK companies ticked higher for the first time since February during May, excluding those in consumer-facing industries, according to a closely-watched Lloyds survey. Some 16% of firms intend to raise pay by 4% or more in the coming year.

A separate survey from the British Retail Consortium revealed that retailers raised prices at the fastest rate in a decade last month. Both the Lloyds and BRC surveys add to the probability that the Bank of England will raise the base rate again at its next meeting later this month.

The unwinding

The Bank of Canada is expected to push on with a 50bps hike to 1.5% at its meeting later today. Tightening monetary policy has had an immediate impact on the housing market, and sales dropped 12.6% in April compared to March. House prices fell 0.6% month-on-month, but are up almost 24% on an annual basis.

Similar patterns are playing out in various major housing markets, though the severity of the slow downs depend on a range of factors. Key variables include the size and scope of price gains since the onset of the pandemic and the pace of rising interest rates.

House prices across Australia fell for the first time in 20 months in May, led by declines in Sydney and Melbourne, according to Corelogic data out today. Sydney has been recording progressively larger monthly declines since February, while Melbourne has fallen across four of the past six months. Again, though prices in Sydney have fallen 1.5% since their peak, they remain up almost 23% relative to the outset of the pandemic.

Price gains in the US continue to defy gravity. Growth across 20 major cities climbed to 21.2% through March, the fourth consecutive acceleration. Various leading indicators suggest those annual gains will begin shrinking soon - existing home sales dropped to the lowest level in nearly two years in April, for example. Homebuilder sentiment has dropped to the lowest level in nearly two years.

Residential Investments

Last month we released our Residential Investments Survey of the largest investors in the sector. One of the dominant themes was housing's journey from an alternative investment class to a core investment strategy for institutional investors seeking stable income streams.

GIC and Greystar's acquisition of Student Roost, a portfolio of more than 23,000 beds, is a very large example of the growing trend. The deal announced yesterday feeds into our view that residential investment volumes will top a record £16.5 billion in 2022, a notable increase from the £10.2 billion spent in 2021.

In total, an additional £75 billion has been earmarked to deploy across residential investment sectors over the next five years, equivalent to a doubling of current committed capital from the investors we surveyed.

In other news...

Executives ‘buy the dip’ at a rate not seen since start of pandemic (FT), ‘green’ steel revolution at risk, say MPs (Times), China’s exports suffer reversal of fortune as world shakes off Covid lockdowns (FT), and finally, levelling up at risk as London leaves Red Wall behind (Telegraph).