A soaring services sector, energy pressures, and a strong Q1 for CRE investment

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Survey data highlight inflationary pressures.

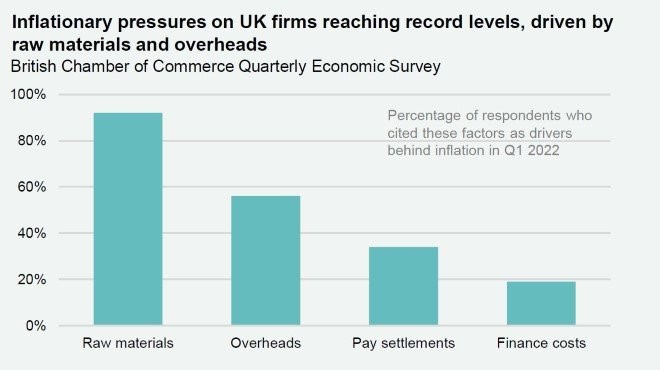

At 62.6, the latest PMI readings for the service sector point to an almost record pace of expansion, while the latest British Chamber of Commerce survey corroborates the evidence of a healthy Q1 expansion. However, that survey also finds that three quarters of businesses cite inflation as a growing concern. Over 60% expect to raise prices, and the anticipated boom in appetite for business investment is yet to materialise. Meanwhile, survey data from Lloyds Bank highlighted an ongoing desire for increased hiring and found that the largest businesses were those most likely to offer the biggest increase in average pay. The risk of ‘second round’ effects driving inflation higher is growing.

Mounting pressure to boost renewable domestic energy production

Caps on UK consumer energy tariffs were lifted last week, adding a further upward jolt to the cost of living and causing the OBR to raise its forecast of CPI inflation to 8.7% by Q4. Although falling in 2021 (albeit to the second highest level on record), renewable energy generation will play a strong role in the government’s delayed energy strategy, due for release later this week.

UK commercial property records an active Q1

Reflecting perceived inflation hedging and safe-haven characteristics, UK commercial property has seen strong inflows: Q1 investment volumes are likely to reach ca. £15bn once final figures are agreed, with more than 50% of this capital arriving from overseas. This chimes with our Active Capital research, in which we forecast the UK office sector to be a key recipient of US capital in 2022, with a particular focus on the office sector.

Download the latest dashboard