The spectre of "the 4 Ds", employers plan pay rises & regulator's alarm over European house prices

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

The decoupling

The European residential property market has "decoupled" from the rest of the economy and seven nations have been put on notice that there are growing vulnerabilities in their domestic markets, according to a warning from the European Systemic Risk Board (ESRB) - the authority set up to monitor financial system risks in the EU. This is a good write up in the FT for those short on time.

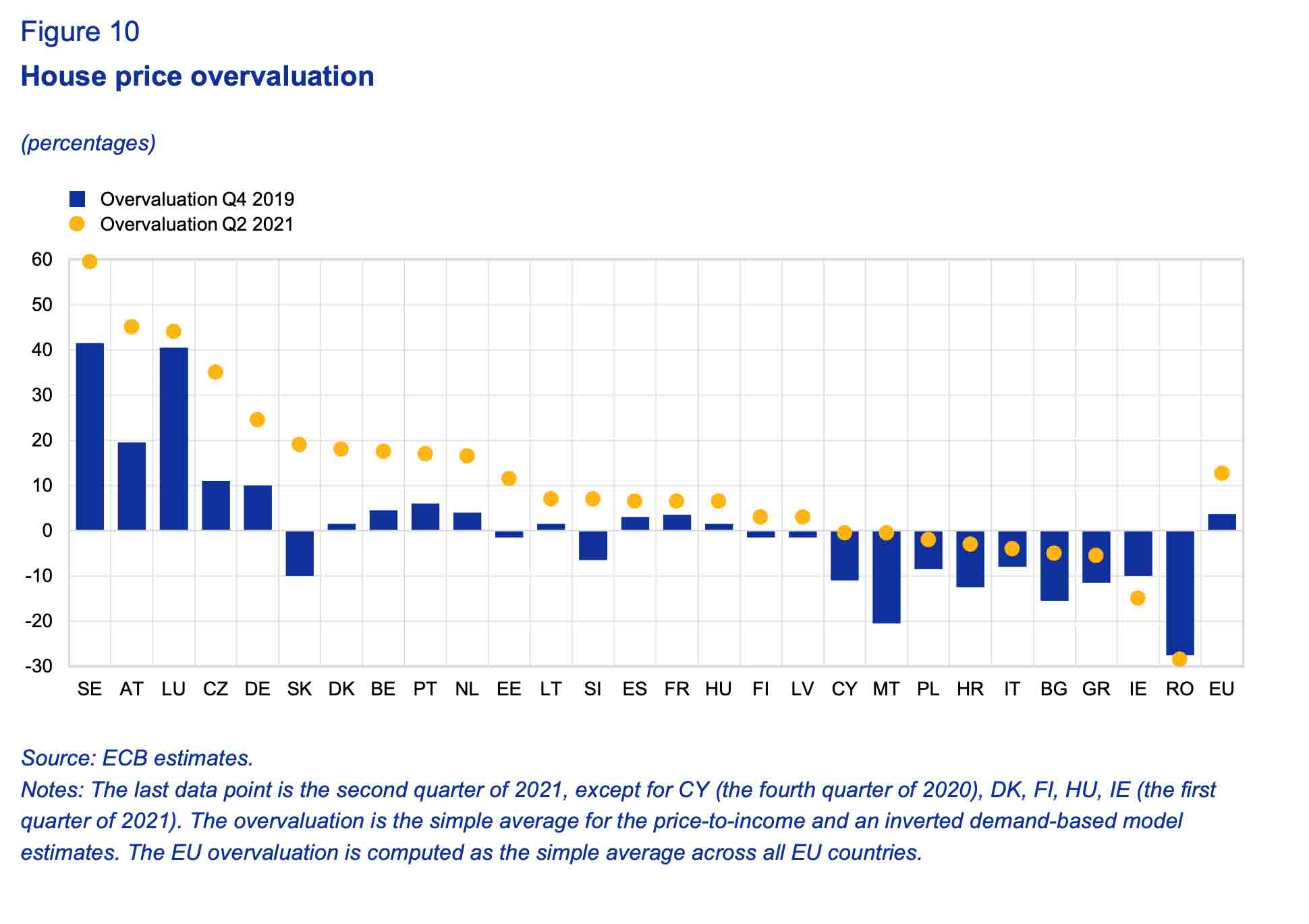

Austria and Germany, both of which received warnings in 2016 and 2019, should introduce new safeguards to curb household debt and shore up bank balance sheets. Bulgaria, Croatia, Hungary, Slovakia and Liechtenstein received warnings. Many other nations receive mentions for overvalued homes (see chart), high levels of household indebtedness and a loosening of lending standards.

These were all problems at the outset of the pandemic that have grown over the course of the crisis. The ESRB notes that the massive stimulus packages introduced to shore up growth kept a floor under disposable incomes and held borrowing costs at near record lows. That prompted the property cycle to decouple from the economic cycle, widening what was already a worrying gap between house price growth and household disposable incomes.

Inflation

Bank of England governor Andrew Bailey has been pilloried for suggesting workers help curb inflation by not asking for pay rises. All evidence suggests that few people are heeding the call.

Employers expect to raise pay by the most in at least nine years, according to the latest survey from the Chartered Institute of Personnel and Development (CIPD). Planned median annual pay settlements for 2022 rose to 3%, from 2% the previous quarter.

That's the first unwelcome datapoint of the week for Mr Bailey. The second will probably come on Wednesday, when the UK publishes its official rate of consumer price inflation. Two thirds of economists in the latest Reuters survey expect another rate hike at the next Monetary Policy Committee meeting on March 17th. A slim majority, 21 of 41, forecast a further increase to 1.00% next quarter.

Growth

The UK economy rebounded last year with growth of 7.5%, the fastest pace of growth since 1942, according to official figures released late last week. That's despite a small contraction in December due to Omicron.

So far so good, but where do we go from here? The same question applies in almost every nation celebrating a post crisis rebound. The global economy grew at a rate of a little over 2.5% through the 2010s, the slowest decadal pace in postwar history, as "the four Ds" - depopulation, declining productivity, deglobalisation and debt - acted as drags.

Ruchir Sharma, chair of Rockefeller International, argues that the pandemic has further entrenched all four of the Ds. We had a baby bust, a migration bust and a wave of retirement and quitting. Productivity continues to languish. Debt levels of various types are at record highs. Major powers including the US and China are turning further inward.

Inflation complicates the picture further and policy makers are being forced to turn off the stimulus taps that have sustained the latest round blockbuster GDP figures. The long term outlook looks much more muted.

New York

One of those “D’s” might be reversing - the repopulation of New York is picking up speed. Manhattan rents soared 23% in January compared to a year earlier, according to the latest report by Jonathan Miller for Douglas Elliman.

That puts rents just shy of the January record set in 2020, just before the onset of the crisis. Landlord concessions that proliferated during 2020 were offered on just a quarter of new leases, in line with the long-run average.

What was an already low vacancy rate has coincided with a rapid drop in inventory. Listings fell annually at a record rate for a six straight month. Jonathan tells Bloomberg that there's “a lot of additional room to rise at the lower half since it hasn’t reached parity with pre-pandemic levels, but most of the upside potential for the high end has probably already occurred.”

In other news...

Stephen Springham takes stock of the recent slew of profit warnings and downgrades among the online pureplay retailers. How worried should investors be? Read it here.

In a new Rural Market Update, Andrew Shirley gives his verdict on the long awaited Lump Sum Exit Scheme.

Elsewhere - the taxman makes first ever seizure of NFTs (Telegraph), End of building supplies shortage 'to boost construction' (Telegraph), It’s not really so grim up north with £300m hotels deal (Times), and finally, cities are regaining their allure after Covid, and we should be glad that they are (Times).