India outlook: Top five trends for real estate in 2022

The Indian real estate market is adapting to change brought about by the pandemic, but what are the key trends to look out for in 2022?

3 minutes to read

After going through a tumultuous two years marred by the Covid-19 pandemic, the Indian economy is showing signs of recovery. Most economic indicators have either breached pre-pandemic levels or reached close to those levels.

The country’s central bank is projecting GDP growth of 9.5% for Financial Year (FY) 2022 on the back of the low base of the previous year. The real estate sector is poised to benefit from this upsurge in economic activity with sectors like residential, office, warehousing and data centres expected to receive most attention.

We list here the top trends across these key markets to watch out for in 2022.

1. Residential market on a strong foot

After a prolonged period of falling and then stabilising, residential prices are likely to start rising again. We project around 5% capital value growth for the residential property segment in the country in 2022. Many of the supply and demand-side factors, assessed over the last decade, have started putting upward pressure on house prices. Residential sales momentum is expected to continue in 2022 as prospective homebuyers’ preferences for bigger homes, better amenities and attractive pricing will keep them interested to seal the deals.

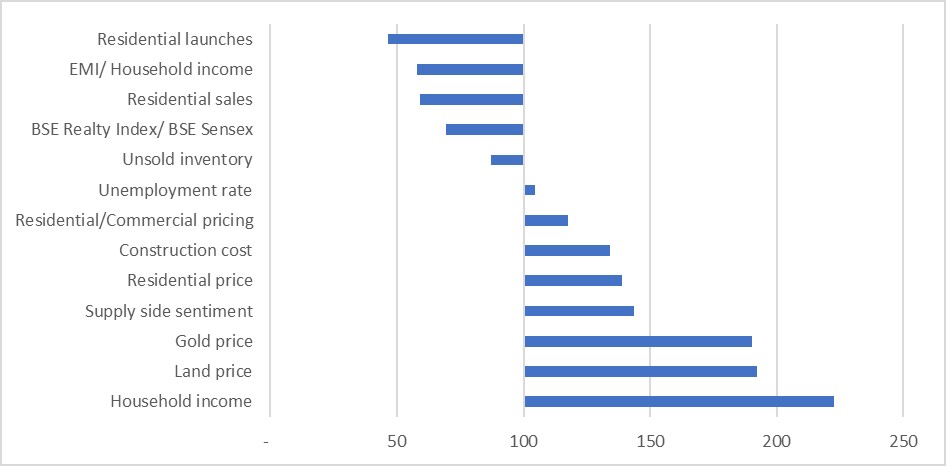

Chart: Summary of parameter values as of 2021 compared to 2011

Source: Knight Frank Research

Note:

1.Index base value of 100 in 2011. Chart depicts movement as of 2021

2. EMI/Household Income identifies affordability. Lower number indicates improved affordability.

3. Unemployment data available since 2016; Supply side sentiment captured since 2013 and includes sentiments of Real estate Developers, Financial Institutions and Investors

2. Office sector has tailwinds of record Information Technology Sector hiring

Office markets will be driven by the upswing in Information Technology Sector’s leasing momentum. Based on the hiring in the past 18 months, Knight Frank Research estimates the top five IT companies’ incremental demand for office spaces to be nearly 1.08 mn sq m (11.67 mn sq ft) in the near future.

3. Co-working in flexible occupier workspace strategy

In the uncertain times created by the COVID-19 pandemic, businesses want to remain flexible on most cost components. In this turn of planning patterns, the co-working sector will benefit as the pandemic reinforces the need for agility like never before. Agility, a keyword associated with the co-working sector, will drive the demand rebound for flexible office spaces despite the return of normalcy.

4. E-commerce boom to benefit warehousing sector

E-commerce segment will drive growth in the warehousing sector, with its share in total warehousing transactions increasing to 36% in FY 2023 (Financial Year April- March) from 31% in FY 2021. Overall warehousing transactions are projected to grow at a compound annual growth of 20% in FY 2023. In this scenario, speed and technology will emerge as key considerations for occupiers’ warehousing strategy.

5. Digital consumption and policy impetus to drive data centre growth

With the imminent implementation of 5G and data localisation norms, the need for data storage to be closer to its users assumes greater importance and requires the country’s data centre capacity to scale up quickly to meet the needs of the country’s user base.

Given the significant volume of capacity already under construction, we estimate that approximately 290 MW of IT load will be added in 2022 to the market, to take the total-built IT capacity to 735 MW by the end of the year.