Residential property market suffering its own supply chain crunch

UK Residential Property Market Update – October 2021

4 minutes to read

Supply chains came under strain in September affecting business confidence, but not UK households’ belief in the residential property market, which remained steadfastly upbeat in relation to house prices.

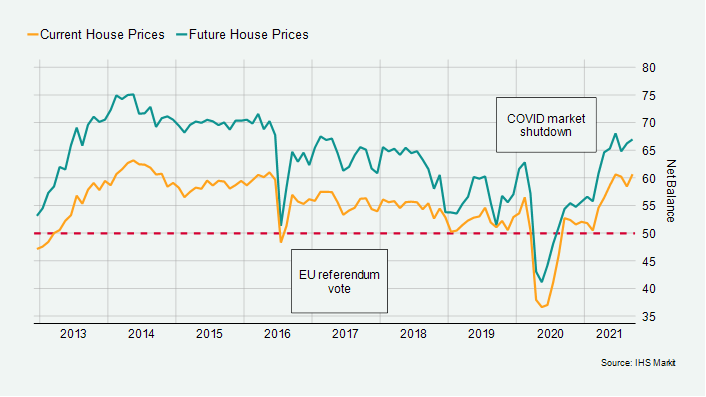

Expectations around current and future house price growth strengthened month on month, with the net balance climbing to 61 and 67 respectively in September, according to IHS Markit.

A score over 50 represents strengthening sentiment and both scores remain significantly ahead of the pre-pandemic levels (see chart).

However, while sentiment remains strong, the residential property market continues to suffer its own supply crisis, specifically the amount of properties available to buy (or lack thereof).

According RICS, the recent decline in new listings coming onto the market shows little signs of abating, despite the end of the stamp duty holiday. Its September sentiment survey recorded a net balance of -35% for new instructions (compared to -36% in August). This reading has been in negative territory in each of the last six months.

While tight supply continues to support prices, growth is moderating as the market moves back to normality. Nationwide reported annual house price growth had eased back to 10% in September from 11% in August. Halifax, which had reported three months of declining price growth, recorded an increase in September, with average prices up 7.4% compared with 7.2% in August.

However, on a three-month rolling basis, growth is down from 3% in June to 1.5% in September across the two indices, showing that once monthly volatility is stripped out, prices are softening.

Price declines are not however uniform across the UK, with Nationwide’s regional house price data for Q3 showing the strongest annual growth in Wales (15.3%), Northern Ireland (14.3%) and Yorkshire & the Humber (12.3%), while most English regions saw a slowdown in Q3 year-on-year. At the bottom of the growth table in Q3, as it has been throughout the pandemic, was London with 4.2%.

Mortgage approvals for home purchase declined for the third month in a row, with 74,453 in August. This is 28% below November 2020’s peak of 103,565 but remains ahead of the pre-pandemic average (66,058 in the 12 Months to January 2020), underlining the demand that remains in the system despite the tentative return to seasonal rhythms that is now underway.

Prime London Sales

Supply shortages have become a feature of the global economy as the pandemic hesitantly enters exit mode in the UK. It is no different in the UK property market, where a vicious circle of low supply has affected prices and transaction volumes this year.

In London, demand continues to surge this autumn as supply plays catch up. Excluding 2020, the number of new prospective buyers registering in London was 27% above the five-year average in the third quarter. Other metrics were equally positive given the potential for a post-stamp duty holiday lull. The number of offers accepted was 51% higher and total exchanges were up 10%, Knight Frank data shows.

However, on the supply side, the number of new sales instructions was 21% down.

Prime London Sales Report: September

Prime London Lettings

The bounce back in the prime London lettings market gathered pace in September.

Average rental values rose on a quarterly basis by the largest amount in a decade in prime central (+2.8%) and prime outer London (+2.6%) The number of tenancies started in September was also the highest monthly total in the last ten years.

We have explored how a “sprint for stock” has driven activity in the lettings market as universities return, offices re-open and overseas tenants begin to arrive in greater numbers. As a result, the biggest increases in rents over the three months to September included Canary Wharf (+6.1%), Wapping (+5.6%), Aldgate (+7%) and Islington (+6.9%).

Prime London Lettings Report: September 2021

Country Market

Annual price growth in the English and Scottish country markets hit decade-long highs in September, up 10.8% and 5.9% respectively.

This was despite a moderation in the third quarter, with average prices in the three months to September climbing by 2.1% in the Prime Country House Index (compared to 3.7% the second quarter) and by 1% in the Prime Scottish Index (compared with 5.5% in the second quarter).

In Edinburgh, which continues to perform strongly and to benefit as an option for people looking for an alternative to London and other big cities due to its scale and ease of access to the countryside, average prices increased by 2% in the third quarter. This compared with 2.3% in the previous three-month period.

Prime County House Index Q3

Prime Scottish Index Q3 2021

Edinburgh City Index Q3