Daily Economics Dashboard - 6 April 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 6 April 2021.

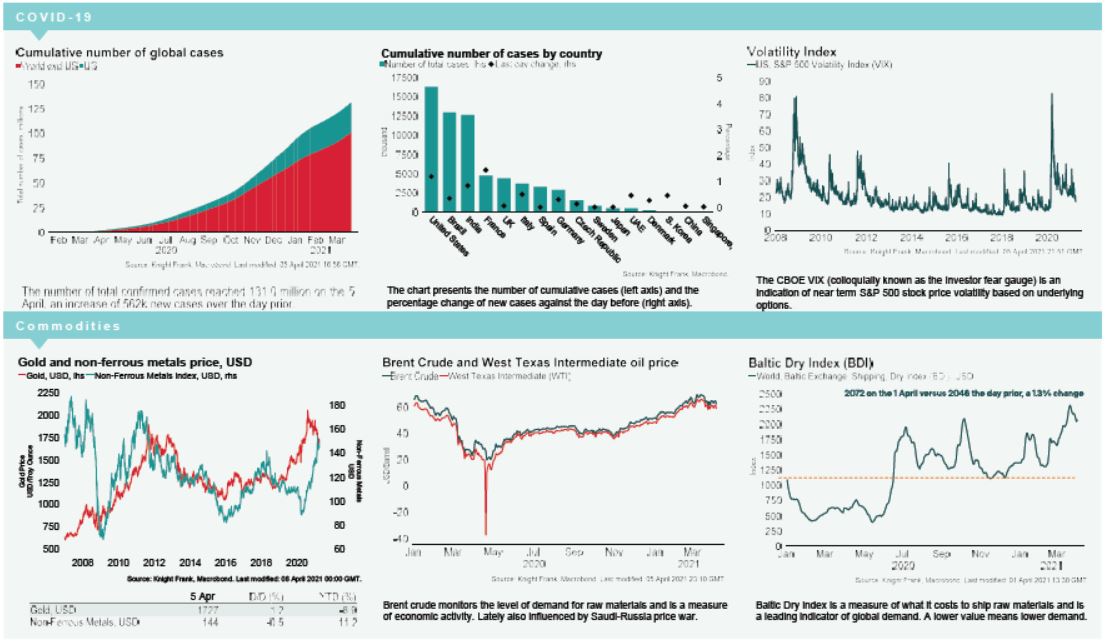

COVID-19: The total number of cases recorded globally has surpassed 131 million, according to Johns Hopkins University & Medicine. Circa 673 million doses of vaccine have been administered globally, at a latest rate of 6.2m doses a day. Reported deaths have reached circa 2.9 million.

Equities: Globally, stocks are broadly positive this morning. In Europe, the Stoxx 600 (+0.7%) reached a new record in early trading hours. The FTSE 100 (+1.2%), the DAX (+1.0%), and the CAC 40 (+0.3%) were also all positive. In the US, futures for the S&P 500 (-0.2%) and the Dow Jones Industrial Average (-0.1%) are marginally down, after the indexes closed at record highs on yesterday.

VIX: The CBOE market volatility index and the Euro Stoxx 50 volatility both increased by +0.8% and +1.0% today, up to 18.1 and 17.1 respectively, below their long term averages of 19.9 and 23.9.

Bonds: The UK 10-year gilt yield and the US 10-year treasury yield both remained stable at 0.83% and 1.71% respectively. The German 10-year bund yield increased +3bps to -0.3%.

Currency: Sterling and the euro are currently $1.38 and $1.18. Currency hedging benefits for US dollar denominated investors into the UK and Eurozone are 0.67% and 1.82% on a five year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) are up +1.3% and +1.5% this morning at $63.0 and $59.5.

Baltic Dry: The Baltic Dry declined increased by +1.3% to 2,072 on the 1st April. While this level is -11% below the March peak of 2,319, it remains +52% higher than the start of the year.

Gold: Gold increased by +0.3% this morning to $1,732 per troy ounce, the highest level in more than a week.

Eurozone Unemployment: The unemployment rate for the Eurozone stood at 8.3% in February for the second consecutive month. This level is higher than 7.3% recorded one year ago and above market expectations of 8.1%.

US service sector: The ISM Services PMI jumped to 63.7 in March from 55.3 a month earlier. Above 50 is considered expansionary. The reading points to the strongest growth in services activity ever recorded.