Daily Economics Dashboard - 15 March 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 15 March 2021.

Lockdown: From today, 10 regions in Italy, including Rome, Milan and Venice will be under new COVID-19 restrictions until at least 6th April. In Germany, a ‘third wave’ of infections has been declared. Meanwhile, in Wales, restrictions have started to ease, with hairdressers reopening and households permitted to mix in gardens.

Equities: In Europe, stocks are higher. The STOXX 600 (+0.5%), FTSE 250 (+0.4%), CAC 40 (+0.4%) and DAX (+0.3%) are all up over the morning. In Asia, the TOPIX (+0.9%), Hang Seng (+0.3%) and S&P / ASX 200 (+0.1%) all closed higher, while the CSI 300 (-2.2%) and KOSPI (-0.3%) both closed down. In the US, futures for the S&P 500 and the Dow Jones Industrial Average are up +0.1% and +0.4%.

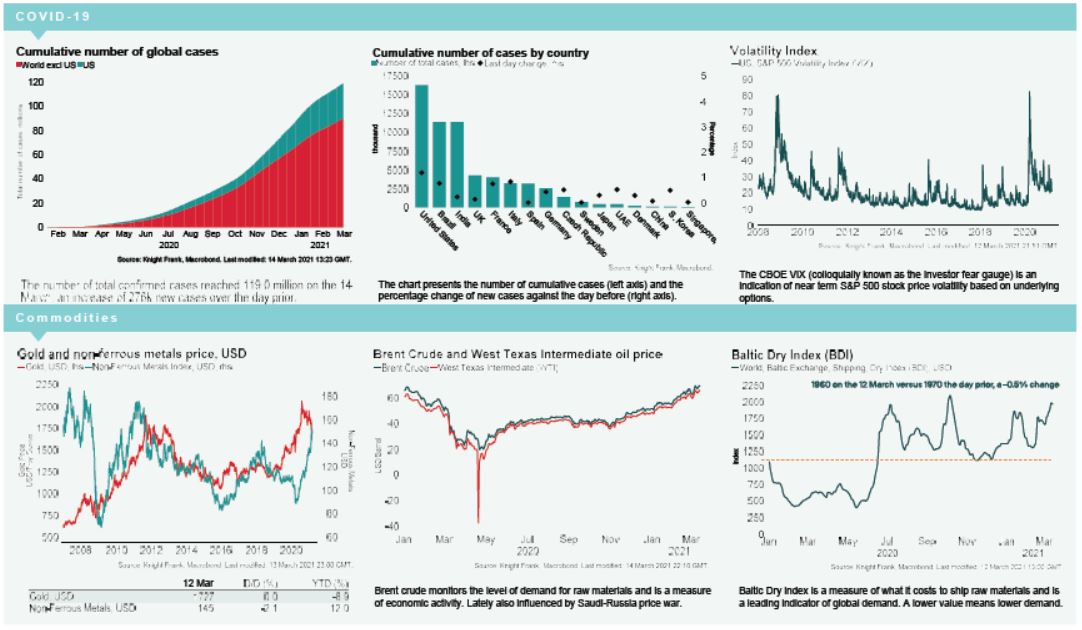

VIX: After decreasing -6% over Friday, the CBOE market volatility index has since increased +2.5% this morning to 21.2, above its long term average (LTA) of 19.9. Meanwhile, the Euro Stoxx 50 volatility index is lower this morning, down -1.6% to 18.4, remaining below its LTA of 23.9.

Bonds: The German 10-year bund yield has compressed -3bps to -0.33%, while both the UK 10-year gilt yield and US 10-year treasury yield are -1bp lower at 0.82% and 1.61%, respectively. The UK gilt yield and US treasury yield are currently at their highest levels since December 2019 and January 2020.

Currency: Sterling and the euro are currently $1.39 and $1.19, respectively. Hedging benefits into the UK and the Eurozone are 0.60% and 1.71% on a five-year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) have both increased +0.2% over the morning to $69.34 and $65.77 per barrel, their highest levels since March 2019 and October 2018, respectively.

Baltic Dry: The Baltic Dry decreased for the second consecutive session on Friday, down -0.5% to 1960. Over the week, the index increased +7.2%, with prices supported by capsize rates, which increased +13.2% last week.

China’s Industrial Output: China’s Industrial output increased +35.1% in January and February 2021, compared to the same months in 2020, when most of China’s factories were in lockdown. However, compared to the first two months of 2019, industrial output in January and February 2021 was up +16.9%.