UK Hotel Investment - Transaction Trends 2021

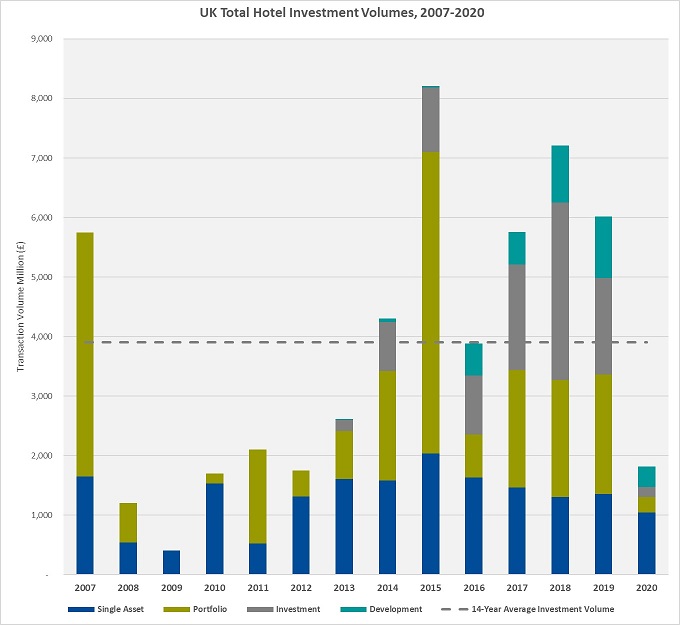

The landscape for the UK hotel market has been vastly altered by the pandemic and it’s far from business as usual. UK hotel investment declined by 70% for the full year 2020, with total transaction volume exceeding just over £1.8 billion.

5 minutes to read

At this time one year ago, the coronavirus was just emerging, causing havoc in China, but with very little regard to the potential damage it could cause on a global scale. Today, the world is still contending with the pandemic and with increased tightening of restrictions and newly imposed national lockdowns, it’s far from business as usual.

At the start of January 2020, the outlook for revenue and EBITDA growth was modest, with the absorption of new supply a key concern for certain markets and the rising cost of labour above inflation, anticipated to limit EBITDA growth. The capital markets were strong, with an abundance of debt and equity available, whilst interest rates remained low and hotel values stable. A year on, the landscape for the UK hotel market is vastly altered and finds itself at the bottom of the deepest economic decline in its history – the only way is up.

Following a tumultuous year in terms of hotel trading performance, UK hotel investment declined by 70% for the full year 2020, with total transaction volume exceeding just over £1.8 billion recorded, of which 81% of the transaction volume occurred in Q1-2020. London witnessed a decline of 49%, with the sale of The Ritz contributing £750m to London’s total investment volume of £1.4 billion. Knight Frank’s Hotel Transaction Trends 2021, outlines in greater detail this recent activity and the likely investment trends for 2021.

Source: Knight Frank Research

The financial impact of Covid-19 on hotel assets has been severe, with lenders forced to be flexible towards their borrowers, as such they have been acutely focused on supporting their existing clients, resulting in many hotel properties being refinanced or their existing financing being restructured and/or extended. Government financial stimulus and the overwhelming support of lenders, in terms of their flexibility and leniency over covenants, capital repayments and interest holidays has prevented significant distress and allowed many hotel businesses to survive.

Nevertheless, difficulties in obtaining debt has acted as a significant barrier to entry. The complete lack of visibility in forecasting future trading performance and the uncertainty over the ability to curtail the virus prior to widespread vaccination, thwarted all sizeable portfolio and corporate transactions after declaration of the pandemic, with the exception of The Ritz transaction. Nevertheless, selective new debt made available from certain banks, enabled these finance providers the opportunity to pick up new business from committed operators, with a proven track record and holding assets with a history of strong cashflow.

The Canongate Hotel, Edinburgh. Knight Frank represented the vendor, sold as a turnkey development to a UK-based investor.

Retirement sales, hotels sold for alternative use, non-core assets sold to bolster equity and non-alignment of shareholder interests have been the main drivers for the majority of UK hotel transactions. These single asset hotel sales have been predominantly independently owner-operated, significantly smaller in size and lower in value, than the traditional branded and well-capitalised hotel assets which would transact under normal trading conditions.

The bitter company voluntary arrangement of Travelodge, was undoubtedly the highest profile dispute for the sector of 2020 and whilst Travelodge appears to have retained the vast majority of its landlords, it has paved the way for strategic change in the leased model, with a hybrid lease model being offered by newcomer ‘AGO’, offering greater transparency and alignment of goals between the owner and operator. Yet with continued strong interest by institutional funds in the sector, many of which are restricted from taking on operational risk, the 100% fixed lease model will continue to prevail.

Despite the short-term, profound volatility in the sector, the long-term fundamentals remain strong. Similar to previous downturns, the UK hotel industry will adapt and survive. Not being a homogeneous sector and diversifying through investment in a varied portfolio is only set to increase in a post pandemic world. From the price-point and strong brand recognition of the budget sector, to the proven resilience of the serviced apartment sector, wide variation exists.

Restoring consumer confidence will be key to boosting hotel investment. Whilst the MICE segment will take longer to recover, the domestic leisure market has proven its strength during 2020 and will continue to lead the recovery. Furthermore, with the pandemic driving a flight to quality, leveraging well-established branding and future proofing hotels in strategic locations, can offer unique upside potential for investors.

Once the mass vaccination campaign advances, the second half of 2021 is set to drive a strong recovery. However, for many hotels this recovery may come too late, given the extended time in a national lockdown and the likely continued localised and sector restrictions thereafter. As such, an increasing number of quality distressed assets and consensual sales are anticipated, due to the lack of cash reserves.

Navigating the emerging and unique opportunities presented by this crisis and the period following Brexit transition, may serve to strengthen investor appetite from across the globe to invest in the UK hotel sector. Skilfully acquiring and asset managing hotels at a time before a return to pre-COVID valuations, could ultimately offer attractive long-term investment prospects. In this current climate, having an experienced and trusted partner in property, with a proven track record, is vital for a committed investor to achieve their objectives and ensure a successful and timely outcome.

Knight Frank’s Hotel Transaction Trends 2021

"Despite the extreme challenges that the UK hotel sector is enduring, the long-term fundamentals remain positive and the sector will recover as the economic landscape starts to revive and travel and social restrictions are lifted

We envisage an increase in Covid-induced investment activity from Q2 and thereafter, driven by pressure exerted from stakeholders. With softer pricing available, this period immediately following the Brexit transition, may serve to further strengthen investor appetite, attracted by long-term investment prospects.

Nevertheless, investors are set to become increasingly focused on undertaking detailed, differentiated, robust and smarter due diligence - and uncompromising on their investment criteria."

Henry Jackson MRICS, Knight Frank, Partner - Head of Hotel Agency

Contacts: