A tale of two markets

Faisal Durrani, shares his observations on why we may be seeing two different markets in London; where office leasing activity has remained resilient, but activity has slowed on the investment side.

1 minute to read

London occupier market weathers Brexit storm, while investment activity slows

London office leasing activity has remained resilient once more, with take up during the first quarter falling just 4% shy of the Q1 long term average; a remarkable result given the Brexit linked political turmoil during February and March and a real vote of confidence for the capital.

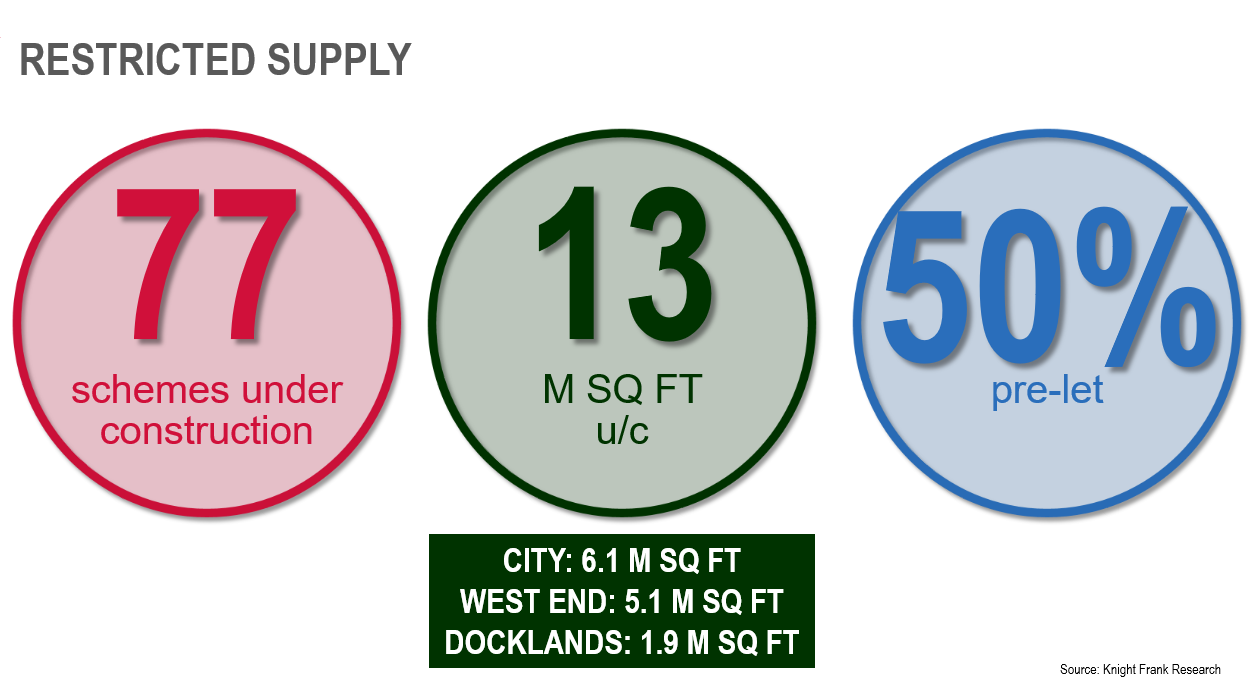

A relative shortage of new development remains a critical issue. 50% of all space under construction is now pre-let, highlighting the dearth of supply. Matters are even more severe in the West End, with nearly 70% of all space being built already having found a tenant.

On the investment side, activity has undoubtedly slowed, with many taking a 'wait and see' approach as the Brexit discussions continue. For some, it's not so much about Brexit itself, but the need to have closure on the issue that is stalling capital deployment. As a result of this dampened sentiment in what has otherwise been an active investment market, we have, for the first time since Q2 2016, increased our estimates of prime yields by 25bps, effectively signalling a slight decline in capital values. It should be stressed that this is a small fluctuation in values, and that we may see yields compress again once there is closure on the contentious issue of Brexit.