New homes stuck on a sticky wicket

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Let's say you're a housebuilder with a site in the vicinity of a cricket pitch. Clearly, you need a fence, but how high should it be to ensure that purchasers won't have their windows smashed by the odd stray ball?

This is what risk assessments are for. You might start by considering who will use the pitch - the village team might threaten the boundary occasionally, but pros will be hitting shots 360 degrees from the crease. Either way, you'd probably cover the question as best you can and move on, safe in the knowledge that the issue won't derail an application for 140 homes in an area suffering from a housing shortage.

That would be an incorrect assumption. Sport England did intervene in Aire Valley House Ltd's application to build 139 apartments next to Crossflatts Cricket Club late last year, on the basis that the company's "ball strike assessment" wasn't "undertaken via a specialist qualified consultant". The developer missed the fact that the pitch was used in an ECB Premier League, which allowed tier five professionals, the body said.

The Crossflatts Cricket Club saga is no isolated case, either. The government last night highlighted the case as it announced a consultation on cutting the number of “statutory consultees” able to slow or block new housing developments. Sport England, the Theatres Trust, the Gardens Trust and others "will no longer be required to input on planning decisions," the release said. "The scope of other statutory consultees will be narrowed to focus on heritage, safety and environmental protection, speeding up the building process and preventing delays to homes being built."

Reviewing the scope

In the past three years, more than 300 applications have been pushed to the Secretary of State for a decision due to disagreements from consultees. Officials will look to review the scope of all statutory consultees, reduce "the type and number of applications on which they must be consulted, and make much better use of standing guidance in place of case-by-case responses," the release said

This is part of a broader push cut red tape. Deputy Prime Minister Angela Rayner also intends to curtail the powers of councillors to block development - an announcement is coming this week. From Saturday's Times:

"Rayner will promise to go significantly further than originally thought, setting a national rule that would stop committees of councillors playing a role in all but the biggest projects and those that most clearly go against local development plans.

"Exact details are still being finalised, but the threshold below which councillors cannot step in is expected to be set somewhere between ten and 100 houses. Once a project has outline permission, councillors will also not be given a say on details of housing style and layout."

Data from Glenigan published last week revealed that the number of homes given planning permission in England last year fell to the lowest since 2014. Permissions will need to rise by 53 percent to hit the 370,000 planning consents target that the government set under its national planning policy.

Overseas buyers

More than 6,100 US citizens applied for British citizenship last year, the most since records began two decades ago and a quarter more than in 2023. Overall applications for UK citizenships were up 6 per cent to 251,000, another record.

Immigration lawyers put the surge down to US president Trump’s re-election bid and subsequent victory, along with UK tax changes encouraging Americans to secure British passports before they exit.

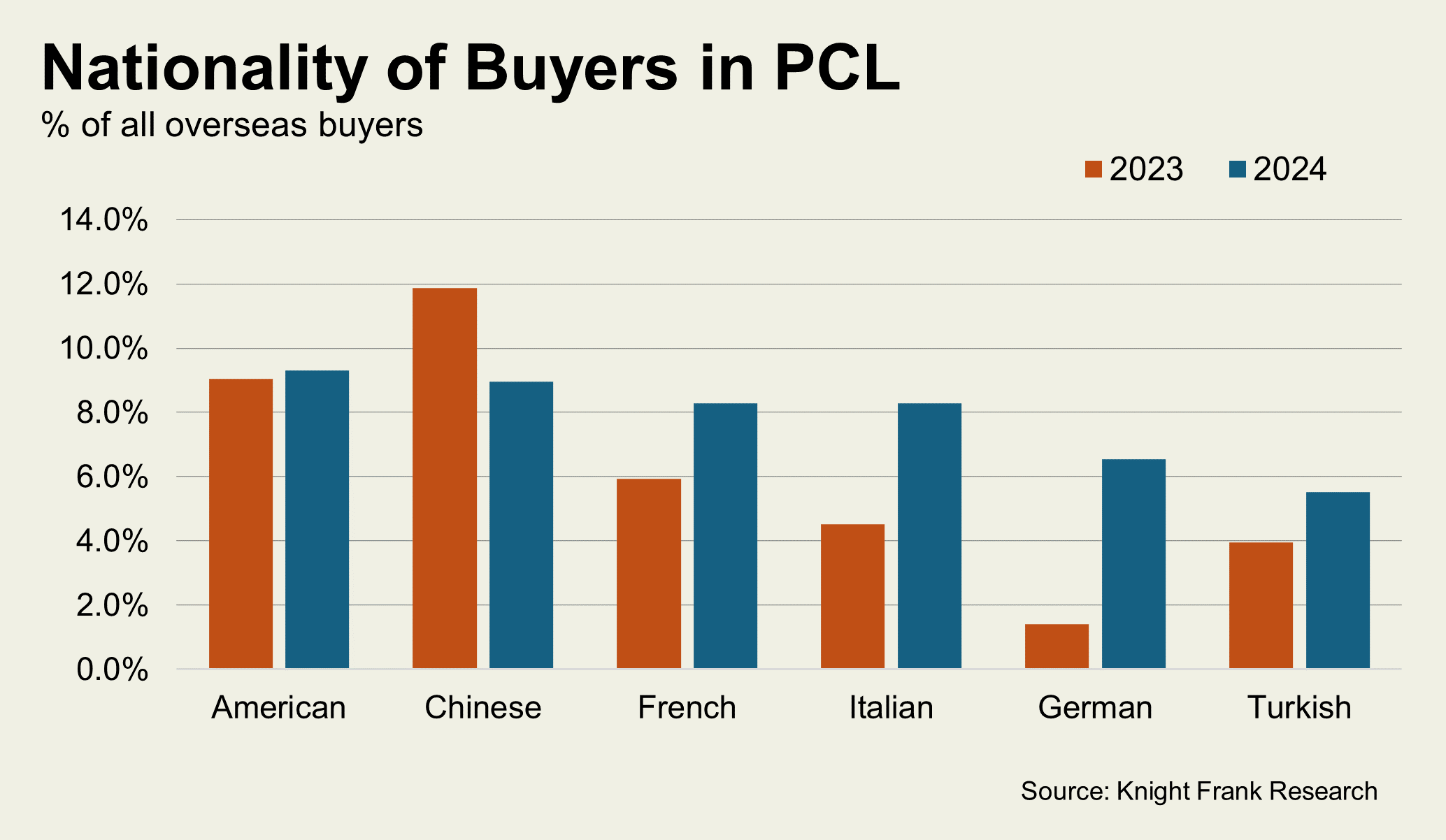

US nationals accounted for 11.6% of overseas buyers in prime central London (PCL) in the final quarter of 2024, which was the largest group ahead of the Chinese (8.1%), new Knight Frank data shows. Indeed, they overtook the Chinese to become the largest group last year in PCL, accounting for 9.3% of sales to overseas buyers compared to 5.6% in 2019. Tom Bill discusses this issue with The Telegraph here.

That analysis comes from our new Prime Central London Index, which you can read here. Average prices in prime central London fell 1.1% in the year to February, following the largest monthly dip (-0.4%) since December 2023. Meanwhile, prices increased 1.5% in prime outer London, as demand is supported by equity-rich, needs-driven buyers.

Meanwhile, average rents in prime central London (PCL) rose 0.7% in the year to February, while there was a 1% increase in prime outer London (POL).

In other news...

Flora Harley considers the takeaways from the UK's Seventh Carbon Budget. Buildings are expected to contribute almost 16% of emissions reductions in the 2023-37 budget period, rising to 25% during the 2038-42 timeframe.