Rural Update: Working together with farmers

Your weekly dose of news, views and insight from Knight Frank on the world of farming, food and landownership

8 minutes to read

Viewpoint

By the time you read this, thousands of angry farmers will have converged on Westminster. Ostensibly, they will be protesting against the government’s recent raid on Agricultural Property Relief (APR), but the anger goes far deeper.

As Defra’s own figures, discussed below, reveal, average farm incomes dropped sharply last year. Some of the other measures announced in the Budget, including the carbon border tax on imported fertiliser and National Insurance and minimum wage hikes, not to mention sharper cuts than expected to the Basic Payment Scheme (BPS) in 2025, will only pile on the pressure over the coming years.

Comments over the past few days from Defra ministers will further disillusion farmers, who feel let down by a government whose actions seem in stark contrast to its words. Daniel Zeichner claimed supporting farmers was an “absolute priority for this government”, while Emma Hardy said: “Farmers are the backbone of the nation, with their hard work helping to put food on the family tables across the country.”

The government has a lot of bridges to build if it wants to regain the trust of the rural community. If it won’t reconsider its inheritance tax reforms, it should at least offer some kind of transitional arrangements to family farms that may not have time to adjust to the new regime.

But rural businesses also need to take action. The EU subsidy safety net, which has propped up farm profitability for decades, is virtually gone. To prosper, farms and estates will need to adopt new cropping systems, boost productivity, look for new income streams and focus much harder on succession planning.

Please get in touch if we can help

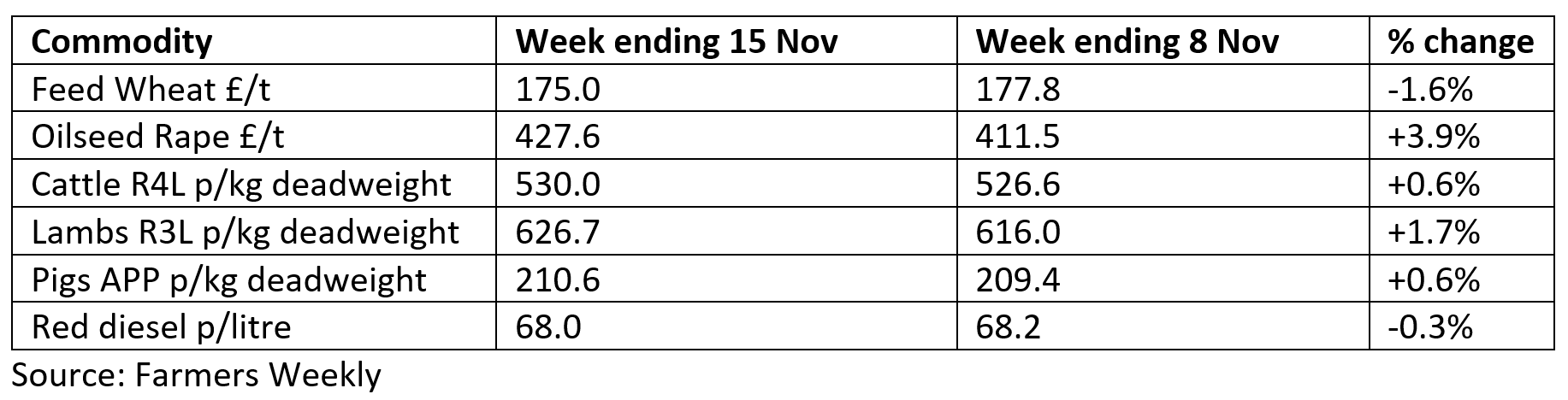

Commodity markets

OSR - price up, area down

Oilseed rape (OSR) prices continue to rise as food companies look for alternatives to higher-priced palm oil. Meanwhile, it is predicted that next year’s UK OSR crop could be the lowest in four decades. United Oilseeds predicts a harvest of around 664,000 tonnes, compared with 884,000 tonnes in 2024. This would leave the UK needing to import almost 1.3m tonnes to satisfy domestic demand.

Festive lamb fillip

Lamb prices are beginning to nudge back up again as processors start preparing for Christmas, according to Farmers Weekly. UK production has fallen by 8% during the year, while import volumes, mainly from New Zealand and Australia, were up 47% between January and August.

The headline

CLA disputes APR data

Figures compiled by the CLA suggest the government’s claim that most farms won’t be affected by its recent reform of inheritance tax (IHT) reliefs could be wide of the mark.

In last month’s Budget, Chancellor Rachel Reeves imposed a £1 million threshold on the value of agricultural property that qualifies for full Agricultural Property Relief (APR) and Business Property Relief (BPR) on IHT liabilities. After that, assets will be taxed at a rate of 20%.

Once any additional allowances are taken into account, the CLA calculates that a typical 100-acre farm owned by an individual will still incur an IHT liability of £109,000, rising to £2.5 million for a 1,000-acre unit. The calculations assume an average land value of £11,500.

Where the ownership of farming assets is split between a couple, extra allowances mean a 100-acre farm should have no IHT liabilities, but this rises to £92,000 for a 200-acre business, which is smaller than the average English farm size.

Although estates can spread IHT liabilities over 10 years, many farming businesses would still not generate enough profit to cover the payments and remain viable.

News in brief

Farm incomes fall

New figures from Defra reveal a sharp drop in most English farm business incomes (FBI) for the 2023/2024 season. Cereal farms were the hardest hit, with the average FBI slumping by almost three-quarters to £39,400. Lowland grazing livestock farms saw their incomes drop by around 25% to £17,300, while upland grazing farms experienced a 12% slide, taking incomes to just £23,500. Read the full report.

Cash for drainage boards

Floods Minister Emma Hardy announced last week that an additional £50 million will be distributed to internal drainage boards, the public bodies responsible for managing water levels for agricultural and environmental needs, as part of its flood management strategy.

The government also confirmed the £60 million of help for farmers impacted by last year’s severe weather would start to be paid from 21 November.

SFI claim change

Farmers and landowners looking to join the Sustainable Farming Incentive (SFI) scheme can now apply directly to the Rural Payments Agency instead of having to tender an “expression of interest” first. Mark Topliff of our Agri-consultancy team said: “This hopefully will make the SFI process easier and allow claimants to access nature-friendly farming funding more quickly.”

Labour’s carbon credit principles

The government unveiled its strategy for using voluntary carbon and nature markets to help cut emissions at the ongoing COP29 summit in Baku. It set out six principles that will be consulted on next year:

1. Use credits in addition to ambitious actions within value chains

2. Use high-integrity credits

3. Measure and disclose the planned use of credits as part of sustainability reporting

4. Plan ahead

5. Make accurate green claims using appropriate terminology

6. Co-operate with others to support the growth of high-integrity markets

Speaking at the summit, Keir Starmer also set out a more ambitious carbon-cutting target. He said the UK would cut emissions by 81% by 2035 compared with 1990 emissions.

The cost of unhealthy food

New analysis commissioned by the Food, Farming and Countryside Commission has found that the costs of Britain’s unhealthy food system amount to £268 billion every year – almost equivalent to the total annual UK healthcare spend. Professor Tim Jackson, economist and the Director of the Centre for the Understanding of Sustainable Prosperity at the University of Surrey, said: “Some of these hidden costs, like lost economic productivity, can be hard to see. But over a third — an astonishing £92 billion each year — is directly shouldered by governments and households to address the illnesses caused by a food system that's, quite literally, making us sick.”

US FTA has to be farmer-friendly

Britain has ruled out any future free trade agreement with the US that would undermine British food standards. “We have always been very clear that we will do nothing in trade deals that will undermine our important standards in this country,” Farming Minister Daniel Zeichner told MPs in a speech last week.

Bluetongue and bird flu update

The bluetongue restricted zone was extended on 16 November to include additional areas of Hampshire and part of Wiltshire. The zone now covers part or all of the counties and unitary authorities of Bedfordshire, Berkshire (part), Buckinghamshire, Cambridgeshire, City of Kingston upon Hull, City of York, East Riding of Yorkshire, East Sussex, Essex, Greater London, Hampshire (part), Hertfordshire, Isle of Wight, Kent, Leicestershire (part), Lincolnshire, Norfolk, North Yorkshire (part) Northamptonshire, Nottinghamshire, Oxfordshire (part), Suffolk, Surrey, Warwickshire (part), West Sussex and Wiltshire (part).

Read the latest updates and advice from Defra.

Avian flu has been confirmed in commercial poultry at premises near Rosudgeon, St. Ives, Cornwall. All poultry on the infected premises will be humanely culled. A 3km protection zone and 10km surveillance zone have been put in place surrounding the premises. Follow the latest Defra updates.

The Rural Report – Out now

The latest edition of The Rural Report, our flagship publication for farm and estate owners, looks at the numerous opportunities and challenges arising in the countryside following the election of the new government. Find out more or request a copy

Property markets

Country houses Q3 – Market waits

Discretionary buyers held back from a new country house purchase pending Labour’s first budget on 30 October. Offers from potential buyers were down 10% in the three months to August, according to the latest results from the Knight Frank Prime Country House Index. However, the slide in average values has slowed with prices dropping by just 1.2% in the 12 months to the end of September - the lowest annual fall since Q1 2023 - points out Head of UK Residential Research Tom Bill. He predicts a total average price slide of 2% this year, dependent on the outcome of the Budget.

Farmland Q3 – Prices flatline

The farmland market in England and Wales was also on budget alert, judging by the latest results from the Knight Frank Farmland Index. Average values for bare land nudged up by just 0.2% in the third quarter of the year to £9,351/acre. This was the smallest increase for several years. For more insight and data please download the full report.

Development land Q3 – Greenfield sites up

The average value of greenfield land values in England rose 3% in the third quarter of 2024, according to the latest instalment of our Residential Development Land Index. However, brownfield and prime central London prices stayed flat due to thin activity, with some market participants taking a “wait-and-see” approach ahead of the Budget, says the report’s author, Anna Ward. Housebuilders are also sceptical that it will be possible to deliver the 1.5 million new homes pledged by Labour over the next five years. Download the full report for more insight and data.

Property of the week

Unforgettable NZ vineyard

If Georgie Veale, a member of our Farms & Estates team who is currently visiting Knight Frank’s New Zealand real-estate partner Bayleys, hasn’t convinced you to head south yet, maybe this week’s property will be the one that swings it. The 129-acre Elephant Hill Estate on Hawkes Bay, south of Napier, North Island, offers premium wine produced from vines growing in three of the bay’s top sub-regions, a stunning lodge-style residence with three self-contained guest suites and a state-of-the-art winery and restaurant pavilion. Tenders close on 5 December. Please get in touch with Duncan Ross for more information. Read more from Georgie on the opportunities available for UK buyers in New Zealand.