Knight Frank Alpine Index: How Prime Ski Resort Prices Have Shifted Over the Past Year

We assess prime prices across leading Alpine resorts, examining how they compare and their performance over the past year

2 minutes to read

This article is part of a series from the Alpine Property Report, previously known as the Ski Property Report, which evaluates current market trends in Europe’s top alpine destinations and highlights property conditions along with the growing year-round appeal of these locations.

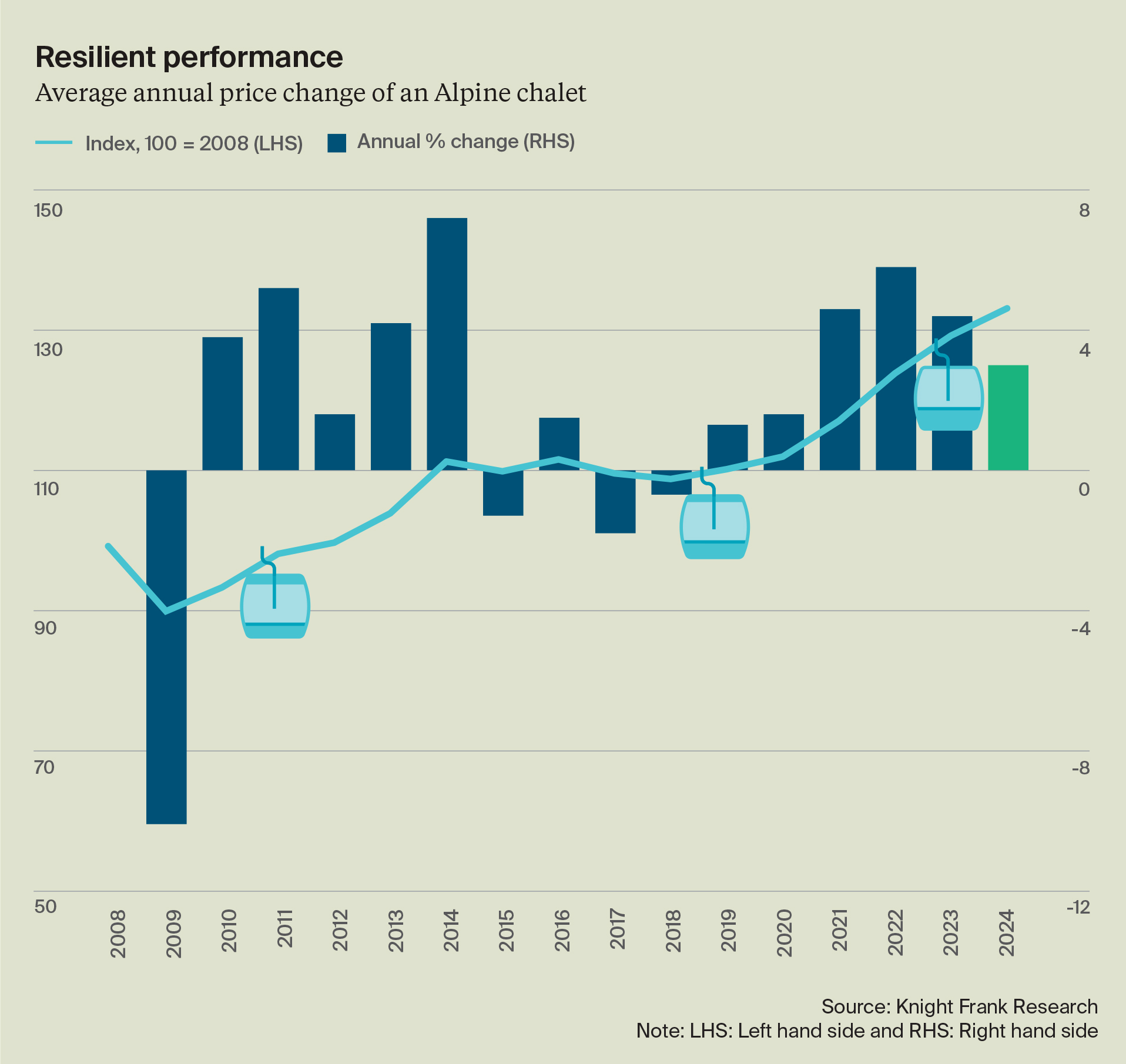

In 2024, Alpine property markets remained resilient, showing varied growth across top resorts in Switzerland, France, and Austria.

Despite economic headwinds, demand stayed strong, driven by both lifestyle buyers and investors.

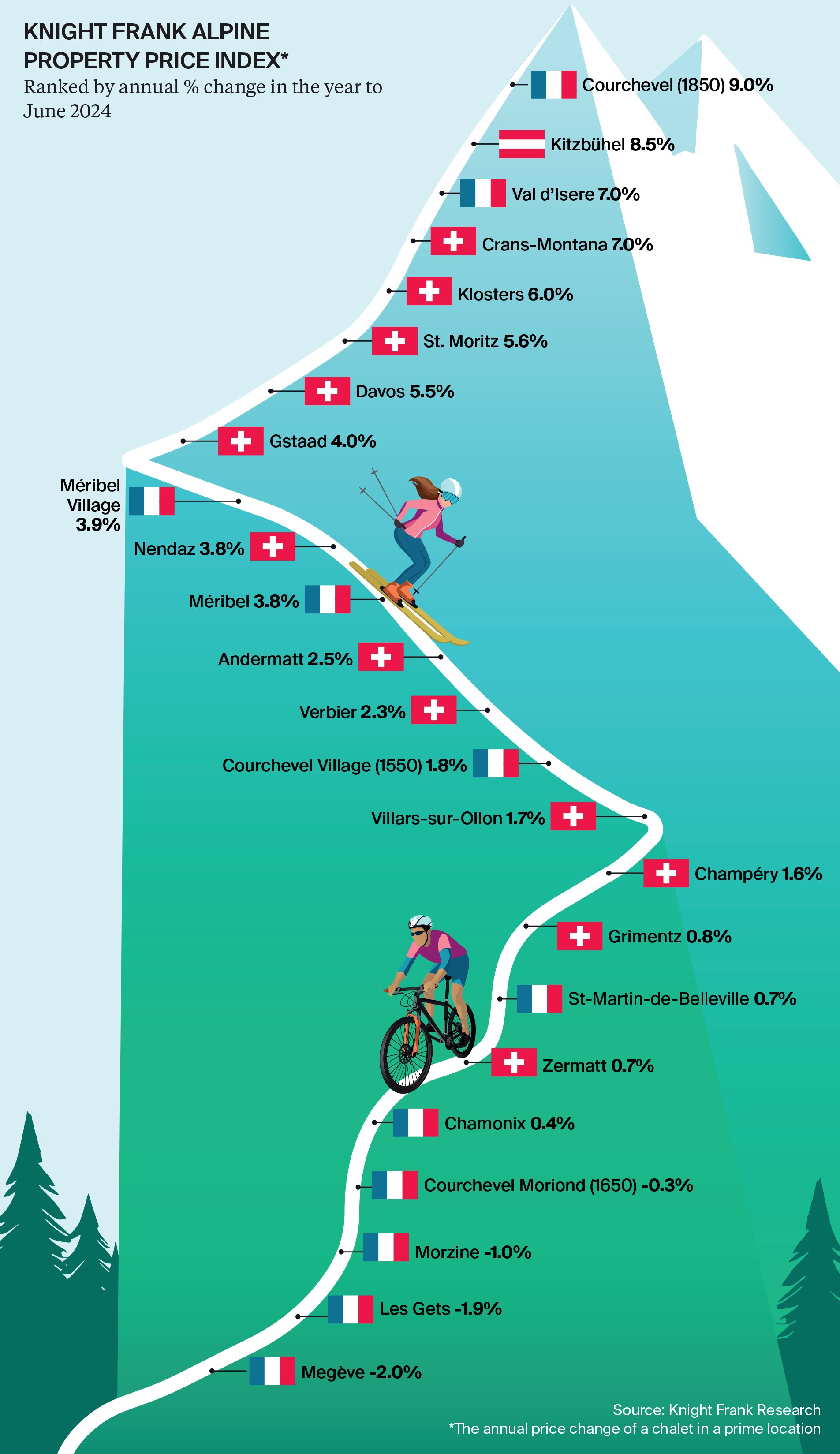

Leading the charge, Courchevel 1850 in France saw prices increase by 9% due to tight stock. Although a French resort held the top spot, Switzerland’s Alpine markets outperformed, with average growth of 3.5% across 12 key resorts, versus France’s 1.5%. The Swiss National Bank’s early rate cut in March bolstered buyer sentiment, highlighting Switzerland’s credentials as a stable, tax-friendly destination amid global policy changes.

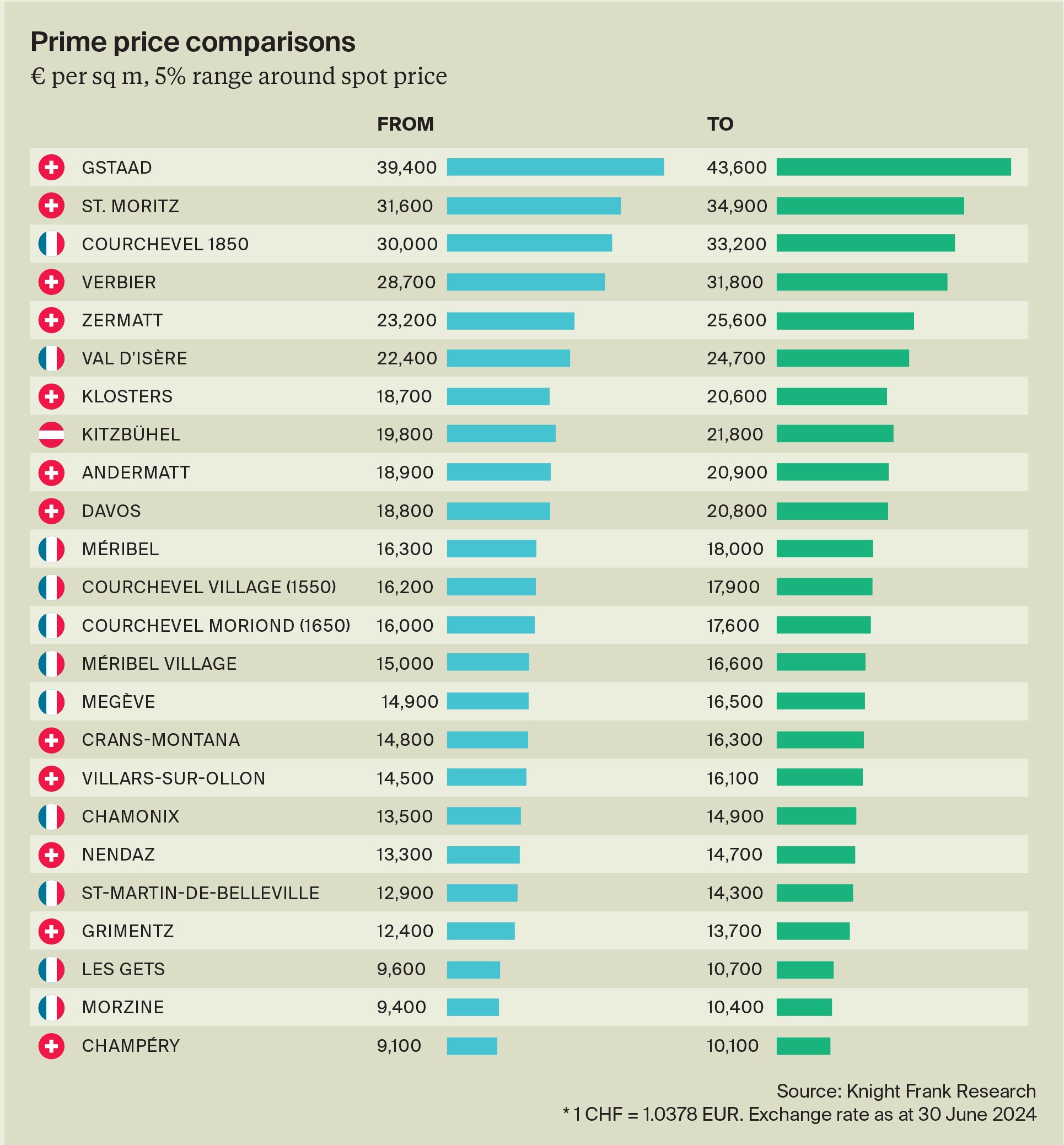

Swiss resorts Gstaad and St. Moritz led in pricing, with Gstaad at €41,500 per square metre, reflecting 4% annual growth, while St. Moritz rose 5.6% to €33,250 per square metre. High international demand kept these markets competitive, backed by Switzerland’s unique winter offerings and stable economy.

In France, Val d’Isère followed Courchevel with a 7% growth rate, bolstered by demand for ski-in/ski-out properties. Priced at €31,600 per square metre, Courchevel remains a prime draw, while France’s broader price range and infrastructure appeal to diverse buyers.

Austria also performed steadily, with Kitzbühel achieving an 8.5% price increase, attractive for its lower price point and accessibility.

Since 2009, Alpine property values have shown strong resilience, with an average annual growth rate of 1.9% over 13 years, accelerating to 4% in the post-pandemic period. In 2024, prices rose by an average of 3%, reflecting how the market has adapted to major challenges, including shifts in the economic and debt landscape as well as climate change concerns.