Updated prediction

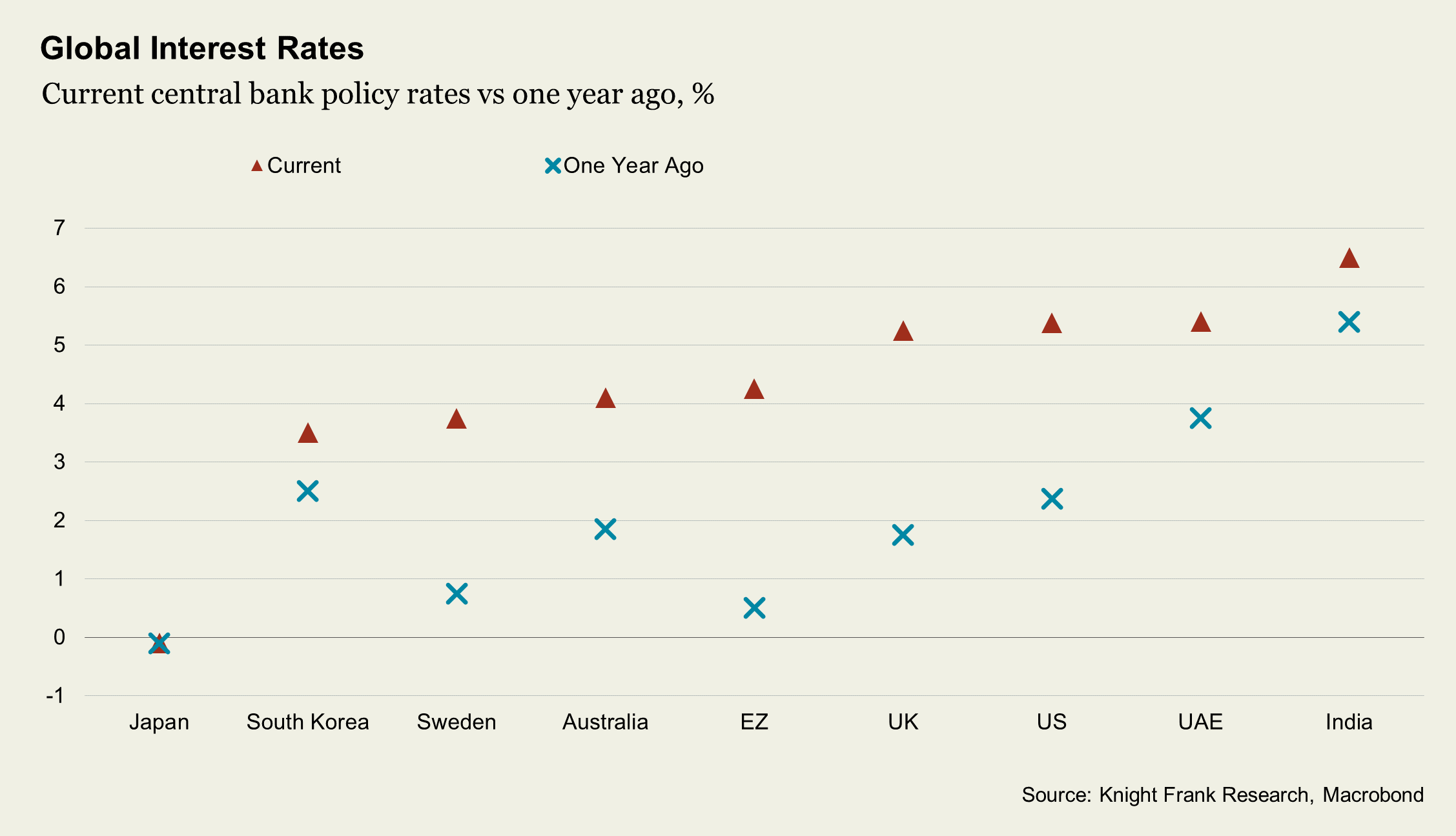

The year has seen nose-bleed rate hikes in many locations. The moves have been even swifter than our Active Capital predictions. In many locations, what is notable is not necessarily just the level of interest rates but the speed of change, although indications are that we may be coming to the end of the hiking cycle, with both the US Federal Reserve and the Bank of England both taking a rate hike pause at the time of writing (September 2023).

The bell-weather rate to track is the US Federal Funds Rate. The US Federal Reserve Rate is key because historically, the central bank rates of major trading economies across the globe have tended to track the US fed rate, albeit with more or less of a lag – and with the notable exception of Japan, which continues to experience relative immunity to rate pressures – for now at least.

At the time of writing, the Federal Funds rate is 5.50% versus a long-term average of 4.85%.

So, what is the outlook for rates?

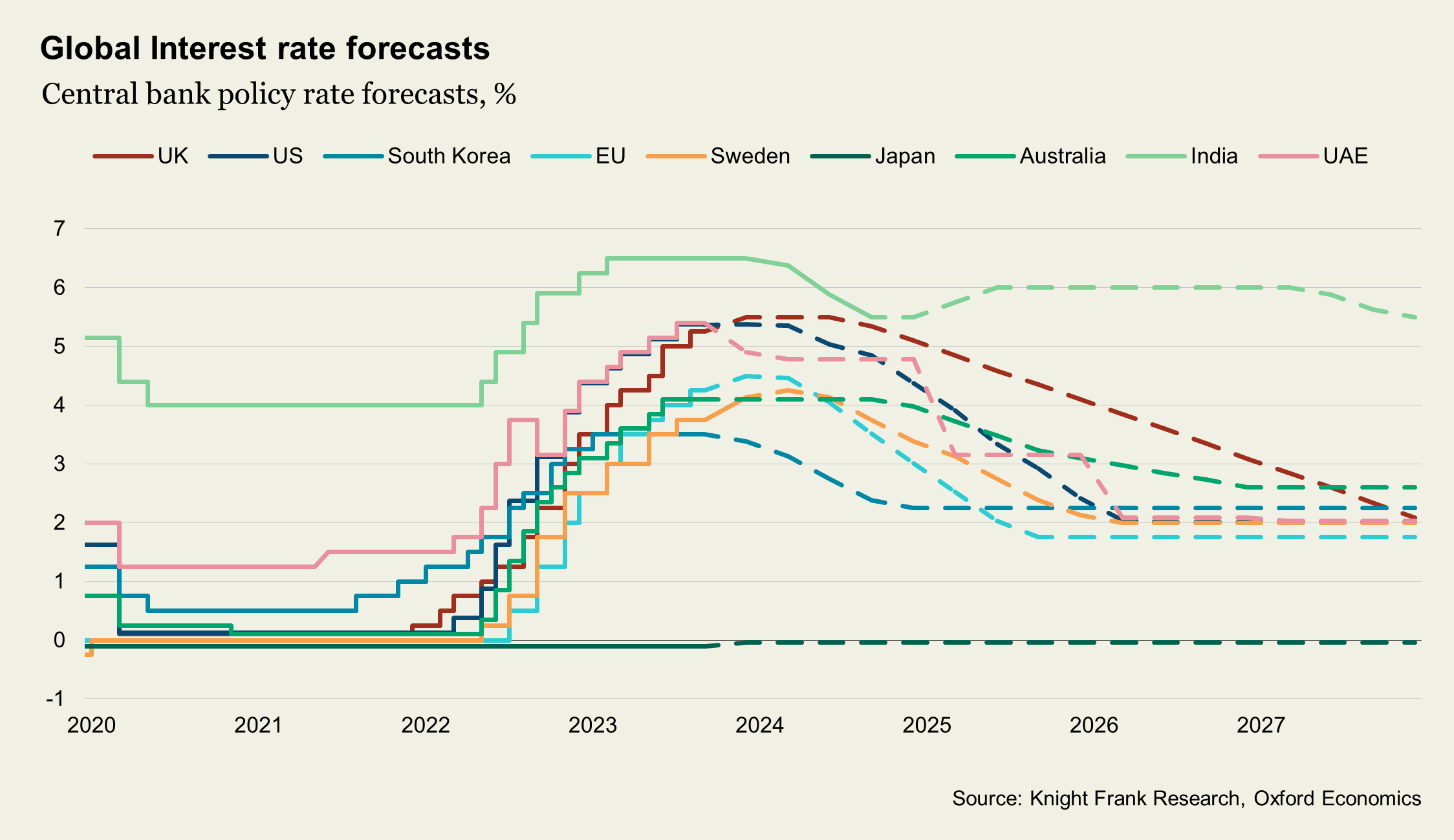

Base rate forecasts globally are typically looking at peaking over the end of 2023 and into the first quarter of next year, with the question then becoming when and how steeply will they reverse?

Divergence of views remains, keeping things tricky for investors. To provide one example however, Oxford Economics are currently forecasting a relatively steep US base rate reversal, to reach a stabilised 2% by the end of 2027. They expect European Central Bank rates to peak by the end of the year reaching a stabilised 1.75% over Q3 2025. The UK is currently expected to similarly peak towards the end of this year but then have a longer drift back to a stabilised rate of 1.75% - but only by mid-2028.

Over in Australia, rates are expected to peak lower and sooner – potentially Q3 2023, drifting down to 2.6% by the end of 2026. Meanwhile, South Korea could see rate cutting sooner, stabilising at a rate around 2.25% by the end of next year.

However, there are conflicting interpretations around health of economies, inflation, lending and general risks which do lead to divergences in economists’ views, but also in scenario probabilities. Oxford Economics themselves assign a 40% probability to the base case economic view and a 20% global chance of an excess savings run-down – i.e., the ‘accidental savers’ as a result of covid, use up these excess savings, driving growth and meaning that rates globally peak higher than expected and take longer to unwind.

Oxford Economics apply a 20% chance to tighter credit conditions spreading to the wider economy and dampening growth for a longer period, and a 10% probability to a global asset price crash triggered by continued rate. For the former, this means the US would start reversing rates from Q2 next year, seeing rates potentially dip below 1.90% by mid-2027 before stabilising at 2%. Similarly, elsewhere this is forecast to mean a steeper rate cut sooner (for example, Australia, UK) and / or an ‘overshooting’ of interest rate cuts to a lower level, before stabilising (for example, Eurozone, South Korea).

In the case of the lower probability asset price crash, in most of Oxford Economics scenarios this is predicated by rates continuing to hike typically 1-2% higher than the base case depending on country, leading to a fast reversal to much lower rates as central banks use interest rates as a tool to pump start their economies. Ironically (or rather – exactly what it is meant to do) in the event of this scenario leading to a quicker shift in rates, this may reduce the degree of refinancing stresses and re-pricing.

While we are likely to see a rush of investors breathing a sigh of relief and coming back to the market as sentiment improves, this scenario also leads to less opportunity for those investors looking for significant repricing to make, for example, refurbishment and repurposing strategies work in an era of higher costs, but also higher sustainability requirements, which many global commercial real estate assets don’t currently meet. In this scenario we are likely to see a swathe of investment managers, private equity, insurers and pension funds returning to market, albeit with a refocus on sector weighting towards those with the most structural tail winds – beds and sheds.

As we continue our Active Capital Q4 Outlook, we take a deep-dive into what this economic outlook means for investment flows and where the opportunities lie.

If you would like to read more from our Active Capital programme, visit www.knightfrank.com/active-capital.