Will interest rates ever fall back to pre-pandemic levels?

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

Real interest rates

Will interest rates in major economies revert to pre-pandemic levels, or has the pandemic altered the global economy more meaningfully? Is it possible that inflation and interest rates will remain elevated for decades, as some economists have suggested?

The International Monetary Fund sought to tackle those questions in its World Economic Outlook this week.

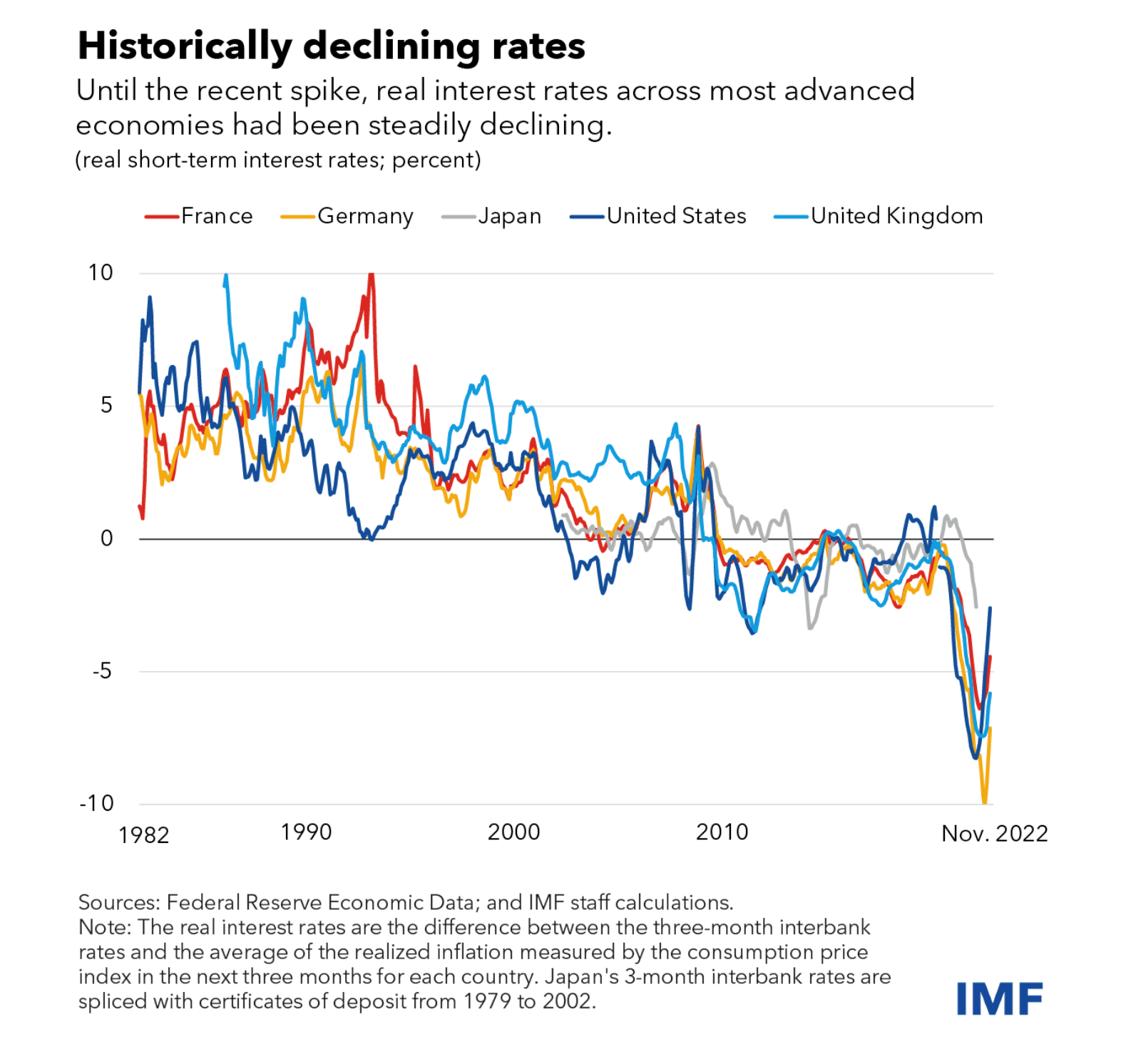

The answers will come as a relief to mortgage holders. While the pandemic fuelled a spike in real interest rates across major economies (see chart), trends that have dominated global economics since the mid-1980s - steadily declining real interest rates driven by sustained low productivity and ageing populations - will return, the IMF believes. Indeed, while those themes have so far been confined largely to advanced economies, they will increasingly spread through developing economies.

This will exert greater downwards pressure on global interest rates, though whether we'll see a return all the way to the ultra-loose monetary policy of the 2010s is still subject to considerable uncertainty. The energy transition and the potential for economic fragmentation could both exert considerable force in the other direction, the fund says. You can read a more detailed explanation in the full report.

The economic outlook

Granted, it's early days to be discussing falling interest rates. Inflation keeps proving stickier than anticipated. Core inflation, which excludes energy and food, has not yet peaked in many countries. The IMF expects core inflation will slow to 5.1% this calendar year, a sizable upward revision of 0.6% from its January update.

Higher interest rates will continue to throttle global growth, which will bottom out at 2.8% this year before rising to 3% next year, the group forecasts.

The economic slowdown will be concentrated in advanced economies, especially the euro area and the UK, where growth is expected to fall to 0.8% and -0.3% this year before rebounding to 1.4% and 1% respectively (see table).

The impacts of monetary policy tightening on the financial system offer considerable downside risks. "Following a prolonged period of muted inflation and low interest rates, the financial sector had become too complacent about maturity and liquidity mismatches," IMF director of research Pierre-Olivier Gourinchas says.

The fund explores a scenario where banks, faced with rising funding costs and the need to act more prudently, cut down lending further. That would lead to an additional 0.3% reduction in output this year.

Remortgaging

UK house prices climbed 0.8% in March, down from growth of 1.2% in February, Halifax said last week. That brings annual growth to 1.6%.

All-in-all, solid, but unspectacular. "Prices are broadly in a holding pattern but will be tested this spring as supply rises and higher mortgage rates cause a sharp intake of breath among a growing number of buyers and homeowners," Knight Frank's Tom Bill said on release of the figures.

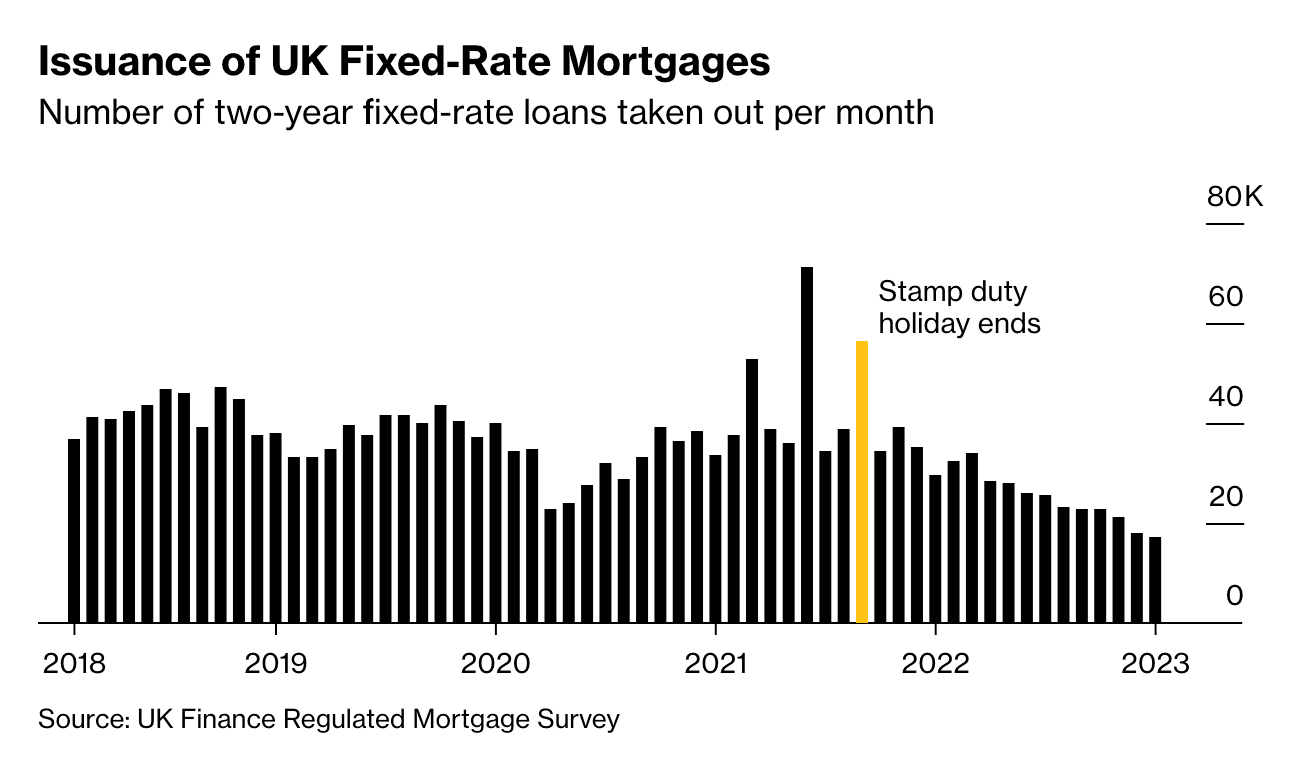

Indeed, spring and later this summer will be a difficult period for borrowers rolling off their old deals. Bloomberg pin points September as the moment as many as 56,220 two-year fixed-rate mortgages will expire following a flurry of sales in September 2021 ahead of the end of the stamp duty holiday (see chart). The average two-year fixed-rate mortgage was 5.32% on Apr. 11, according to Moneyfacts, more than two times higher than in September 2021.

In other news...

Flora Harley unpacks the government’s ‘Green Day’ announcements for the built environment.

We reveal the world's top 10 most connected cities.

Elsewhere - UK commercial rent collection dips for first time in two years (FT), US inflation expected to have eased to lowest level in two years (FT), workers are returning to the jobs market (Times), Bank of England MPC to grow more hawkish as Megan Greene replaces Silvana Tenreyro (Times), Blackstone raises more than $30 Billion for giant real estate fund (Bloomberg), and finally, South Korea plans to quadruple solar power from factory rooftops (Bloomberg).