Your Leading Indicators | Recession Expectations | Robust Labour Markets | WFH

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators commodities, trade, equities and more. in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Recession avoided… for now

UK GDP contracted by -0.5% m-m in December, the first decline in three months. However, the UK avoided a technical recession (two consecutive quarters of falling GDP) in 2022, with flat growth in Q4. The Bank of England expects the UK economy to enter into a recession in Q2 2023, following a forecast -0.30% contraction in Q1 and a -0.75% decline in Q2. Overall, the UK economy is expected to contract by -0.50% in 2023, albeit this was upwardly revised from a -1.50% forecast contraction in November. This improved sentiment has been echoed overseas. The European Commission now expects the EU to avoid a recession altogether in 2023 and has improved its GDP outlook by 60bps to +0.9% in 2023. A stronger outlook and improving sentiment is naturally supportive of leasing demand and investor appetite, something we are seeing reflected in a generally more positive real estate narrative.

Robust UK labour market

The UK unemployment rate rose slightly by 0.1ppt to 3.7% over the three months to December 2022, remaining close to 40-year lows. Meanwhile, the number of people in employment increased by 74k over the quarter (the largest increase since the summer), lifting the UK employment rate by 0.2ppts to 75.6% in Q4. Subsequently, the economic inactivity rate fell by 0.3ppts to 21.4%. The BoE will pay close attention to average weekly earnings data released today, which saw private sector regular pay growth rise by +7.3% in Q4, a record high outside the pandemic period. For context, the central bank expects earnings to level off in H1. Despite robust labour markets, Lee Elliott notes that recent job loss announcements in certain sectors may cause some employees to increase their office presence, which could support office demand.

Is WFH here to stay?

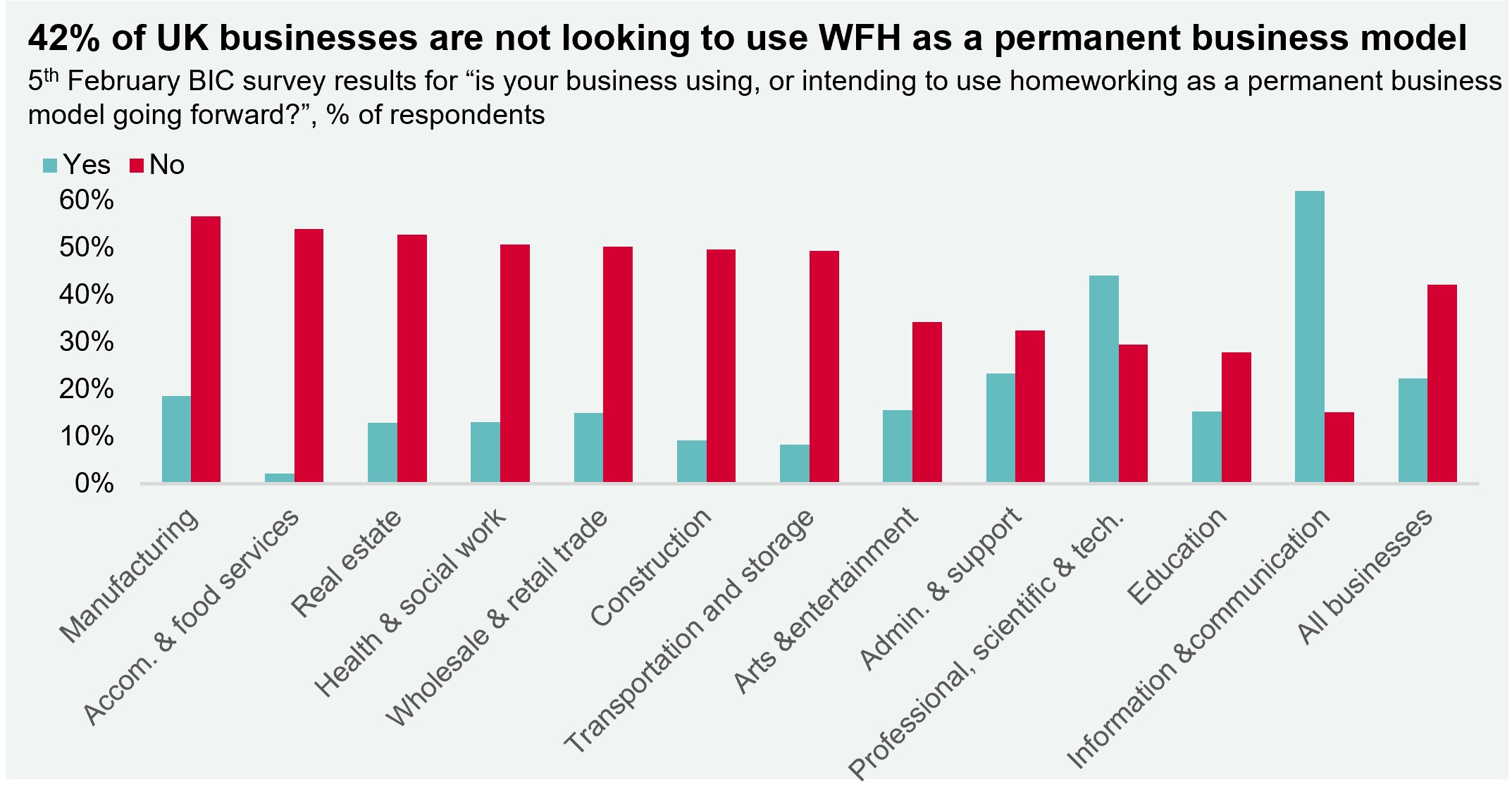

The latest ONS BIC survey found that 42% of UK businesses are not intending to use homeworking as a permanent business model, and only 22% of businesses were actively looking to do so. Manufacturing businesses had the least interest in homeworking as a business model, while Information & Communication businesses had the strongest interest. Similarly, 56% of workers surveyed in the 2023 ONS Characteristics of Homeworkers Report do not currently work from home in any capacity, while 44% engage in some form of hybrid or home working. The findings of these surveys are reflected in our latest Sentiment Index, which saw improving sentiment around increasing the density of office occupation. Here, more occupiers are adopting an “office first” stance, whereby some flexibility is afforded to staff, but the dominant place of work is the office.

Download the latest dashboard