Land hikes down under, win wine, Rollercoaster profits

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership.

4 minutes to read

Some new numbers from respected farm business consultant Andersons highlight just how much volatility farmers have to cope with. The margin from production on its model arable farm surges in 2022 to £677/ha off the back of spiralling grain prices, but then crashes into the red by £7/ha in 2023 as input costs start to bite. Only the Basic Payment Scheme (BPS) stops the farm making an overall loss. Commodity price volatility is set to remain, but by 2027 BPS will be gone. If they want to enjoy a less gut-wrenching rollercoaster ride, policymakers and producers need to get their heads around the implications of this and also look at farming techniques that rely less on artificial fertilisers.

Please get in touch if we can help

Andrew Shirley, Head of Rural Research

In this week’s update:

• Commodity markets – Retailers react, at last

• Farm incomes – A rollercoaster ride

• Support payments – BPS payments to be split

• The Rural Sentiment Survey – Take part to win wine

• Vineyard opportunities – Listen to our new podcast

• Overseas news – Record growth for Australian farmland

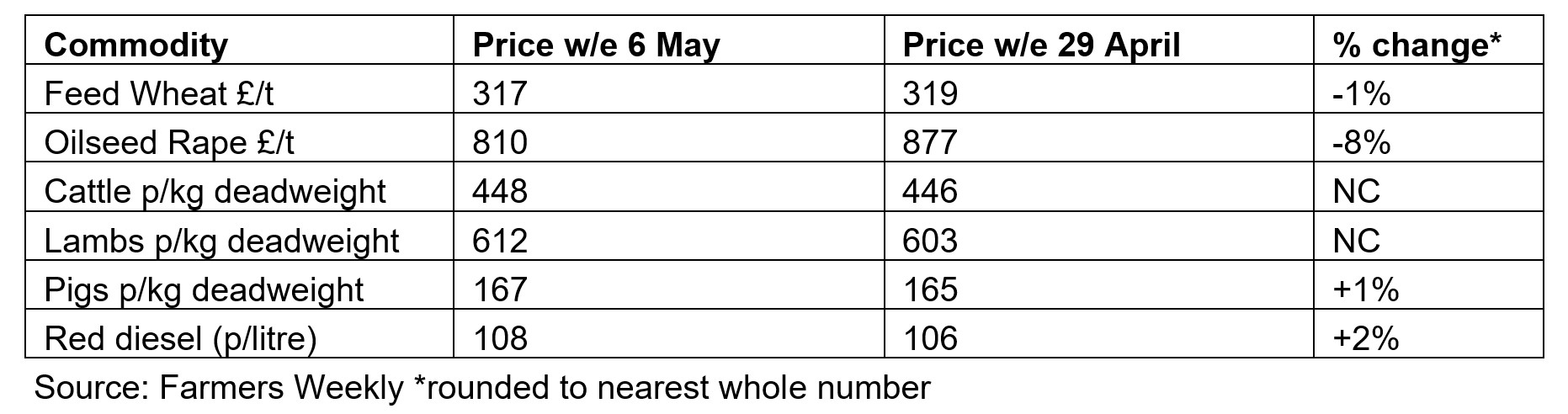

Commodity markets – Retailers react, at last

As discussed below arable farmers could be set for a bumper year in 2022 as grain and oilseed prices surge. But pork, dairy and poultry producers are set to feel the pain as their feed and energy costs rocket. Belatedly, some retailers are starting to recognise this. Sainsbury’s has just announced a £2.8 million package to help its pork suppliers cope with the crisis, while a number of supermarkets have recently boosted milk prices. Arla farmers with Tesco’s and Morrisons’ contracts will get around 43p/litre for their May milk, while Lidl has added 7p/litre to take its fixed-price milk contract for May to 40p/litre.

Farm incomes – A rollercoaster ride

The obvious question for those watching input and output prices soar over the past months is will the rise in grain prices cancel out the hike in fuel and fertiliser costs – i.e. will arable farmers be better or worse off?

A new update from consultant Andersons on the performance of its notional arable unit Loam Farm offers some clues. In 2022, given that the business bought its fertiliser requirements before prices spiked, a forecast business surplus of £840/ha will be generated, compared with £573/ha in 2021.

Great news. But fast forward to 2023 and the predicted surplus drops to just £161/ha. Only BPS keeps the farm in the black with a surge in variable costs leading to a margin from production of minus £7/ha.

For advice on how to cut your input costs please get in touch with Tom Heathcote, Head of our Agri-consultancy team.

Support payments – BPS payments to be split

Acknowledging how the volatility discussed above is making it hard for farmers to make decisions about what to grow and manage their cashflow, Defra minister George Eustice has announced that farmers will receive half of their Basic Payment Scheme (BPS) cash early.

The first tranche will be paid in July, with the balance handed over in December. Talking to Farmers Weekly, Mr Eustice said the split payment system would remain in place until 2027 when BPS will be phased out completely. The payment is being phased out with recipients taking a minimum hit of 20% to their claims this year. Higher value claims will be slashed harder.

The Rural Sentiment Survey – Take part to win wine

To help inform the next edition of The Rural Report all farmers, rural landowners and professional advisors are invited to take our annual Rural Sentiment Survey. Everybody who completes the survey will go into a draw to win a case of sparkling English wine from our client Chapel Down

Take the survey

Vineyard opportunities – Listen to our new podcast

Talking of wine, you can hear Ed Mansel Lewis, Knight Frank’s new Head of Viticulture, in a recent edition of our Intelligence Talks podcast. Ed looks at England’s wine boom and how it is impacting the land market.

English sparkling wine in particular has been portrayed as one of the wine world's big success stories. Overall, there are now over 700 vineyards in England and Wales.

Overseas news – Record growth for Australian farmland

Australian farmland values saw their biggest dollar hike in 27 years during 2021, according to the latest results from specialist lender Rural Bank’s Australian Farmland Values Survey. Median sales prices across the country rose 20% to Au$7,087/ha with positive growth in all states except the Northern Territories. Western Australia enjoyed the largest jump with values up over 36%.

The growth came despite the largest jump in transaction numbers - +22.5% - in 27 years. The survey recorded 10,032 deals last year covering almost 11 million hectares and worth Au$15.6 billion.