1 minute to read

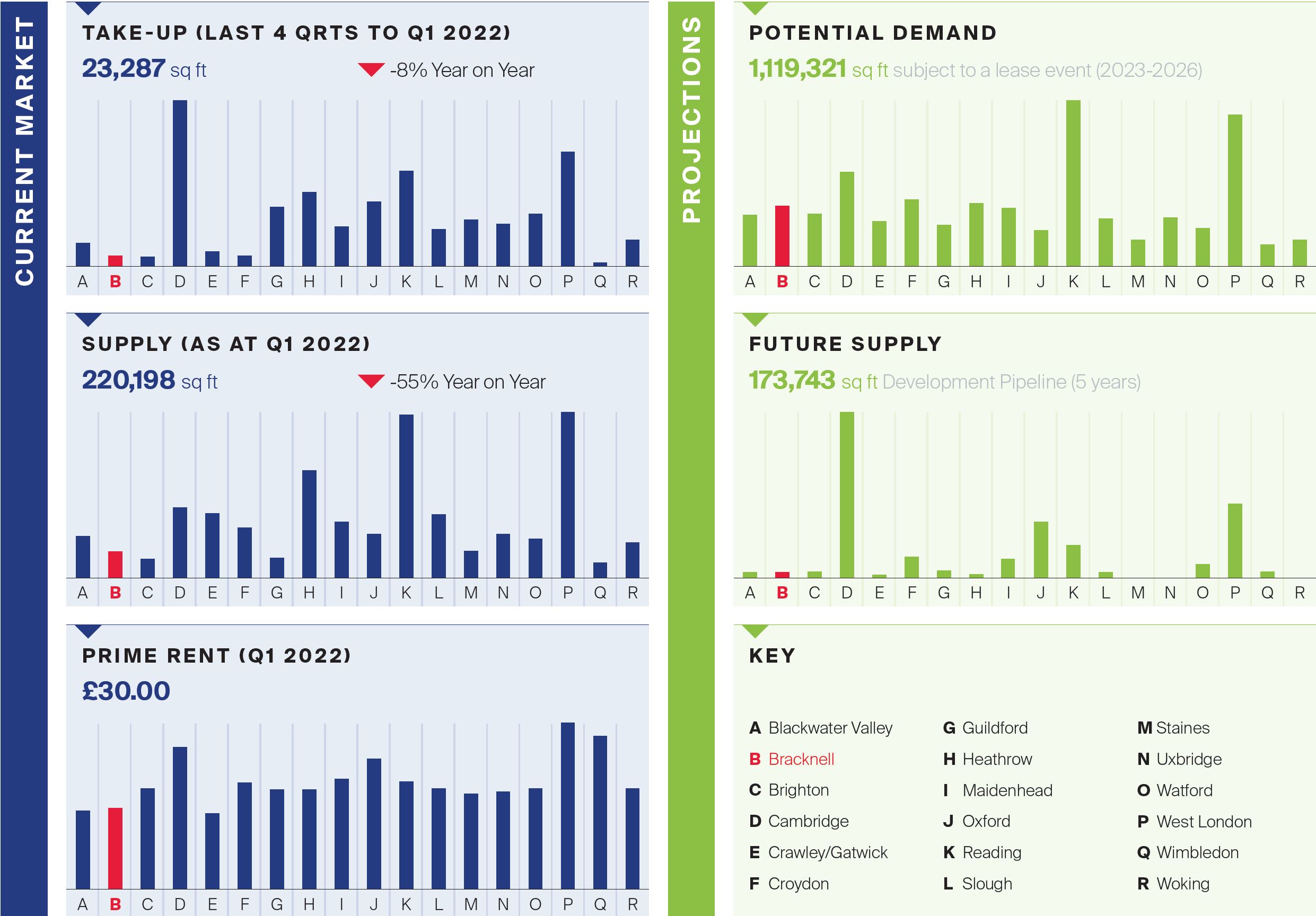

Lease analysis predicted an active 2021/22 with large occupiers in the town expected to seize opportunities to upgrade their accommodation. However, uncertainty surrounding the return to the office witnessed greater regear activity, with landlords placing greater emphasis on retaining their existing tenants.

Landlords continue to have success with offering occupiers ‘plug and play’ fitted solutions, particularly sub 3,000 sq ft, with greater demands for flexibility and convenience. The average deal size continues to reduce to below 10,000 sq ft. Given Bracknell’s history of attracting large tech occupiers, this downsizing provides clear evidence of the shift to flex across the sector. For these occupiers, the flight to quality remains central, with 100% of deals made for new / Grade A buildings in the last year.

Headline rents have remained at £30 psf over the past 12 months. Given Bracknell has a limited development pipeline (ca. 173,000 sq ft) which is not expected to be speculatively developed, genuine ‘best-in-class’ opportunities in the market are few and far between.

Click to enlarge image

Download the Key Markets report 2022