How much space is needed to service the last-mile and where is consumer demand greatest?

The UK’s urban population has grown significantly over the past twenty years. Since the year 2000, the population of UK cities has risen by 10 million (Source: World Bank). Urban populations are forecast to continue growing. 56.3 million people or 83.9% of the UK population currently live in cities and Oxford Economics forecast to rise to 61.8 million, or 87.5% of the population by 2050. As urban populations grow, the need for logistics space in cities will rise.

3 minutes to read

How much space will we need?

The amount of space required to service last-mile delivery for e-commerce is a function of both the consumer demand (or, online spend), as well as the distribution model (including the delivery speed and vehicle fleet). Different fleet vehicles may have a different range for deliveries and some distribution models will have a greater focus on urban logistics space compared with large, centralised distribution centres. Based our analysis of e-commerce operators (utilising a hub and spoke distribution format) we found that 23.5% of their warehouse space was located in “spoke” facilities, that are servicing the last-mile delivery. However, this could change through the adoption of more micro fulfilment centres or through greater adoption of in-store fulfilment, etc.

"Based our analysis of e-commerce operators (utilising a hub and spoke distribution format) we found that 23.5% of total warehouse space was located in “spoke” facilities, that are servicing the last-mile delivery."

Our analysis last year found that, for each £billion of online retail sales, a total of 1.36 million sq ft of warehouse space is required. Therefore, based on a hub and spoke model and at current capacity utilisation rates, each £1 billion requires around 320,000 sq ft of last-mile logistics space (or space in “spoke” facilities).

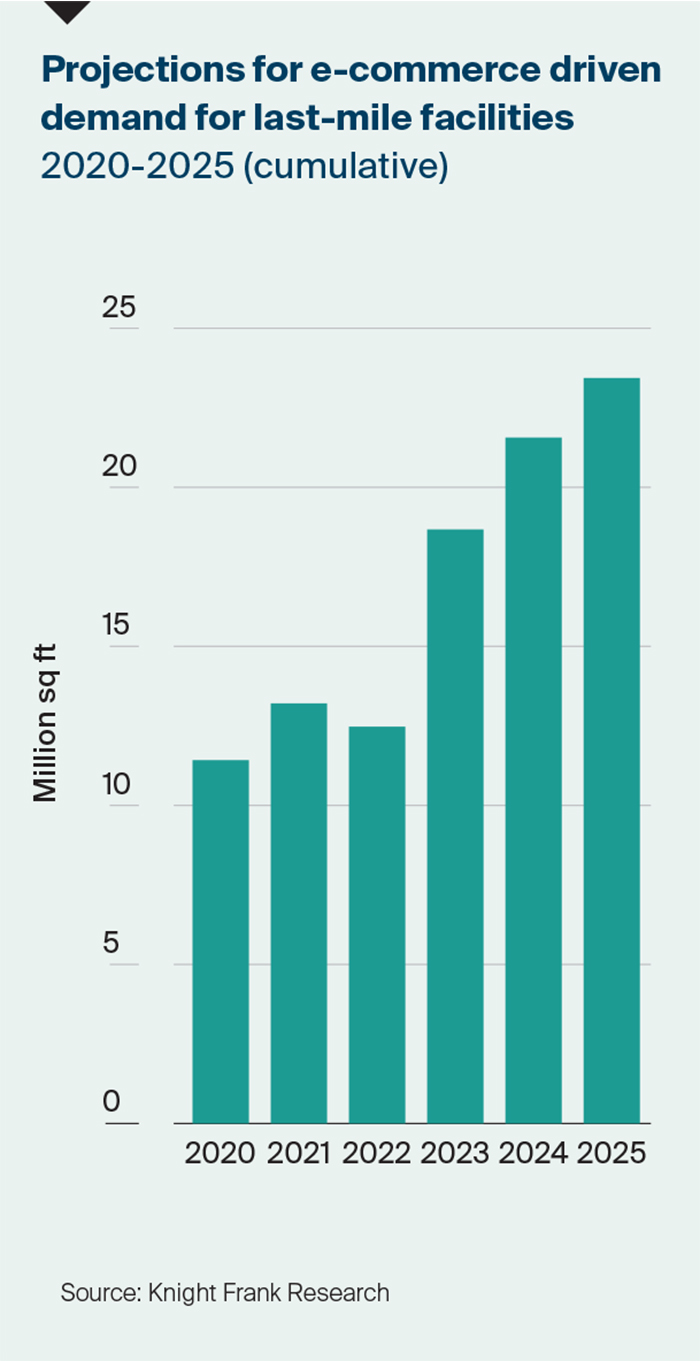

In 2020, e-commerce sales totalled £111 billion in the UK, and accounted for 27.6% of total retail sales, up from £75 billion (19.2% of retail sales) in 2019. An annual increase of £36 billion. This rapid growth in e-commerce and the above figures help to quantify the surge in demand for urban logistics space we have witnessed in 2020-2021. According to our analysis, the additional e-commerce sales in 2020, required an additional 11 million sq ft of last-mile logistics space, based on a hub and spoke model. It is important to note however, that much of this demand has, and will continue to be met through alternative fulfilment models, such as micro-fulfilment centres or in-store fulfilment. Vacancy rates in urban locations are at historic lows, and development remains highly constrained in these markets.

Click image to enlarge

Online retail sales are forecast to rise over the next five years (2021 – 2025), to account for 30% of retail sales by 2025 (Source: Mintel). This will result in an additional £37 billion worth of online spend. Based on the above stated assumptions, we could see additional requirements for urban or last-mile fulfilment space totalling 12 million sq ft (2021-2025).

"Online retail sales are forecast to rise over the next five years (2021 – 2025), to account for 30% of retail sales by 2025 (Source: Mintel)."

Click image to enlarge

Populations in urban areas are growing, consumers are getting more demanding, fulfilment models are evolving, and how efficiently operators use space is improving. These factors could impact the amount of space required to service last-mile deliveries. The most difficult factors to account for are improvements in the use of space, and shifts in distribution models. These factors are mainly driven by the adoption of new and emerging technologies.

Download Future Gazing 2021