UK recovery begins to slow and labour shortages likely to remain

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

In this edition:

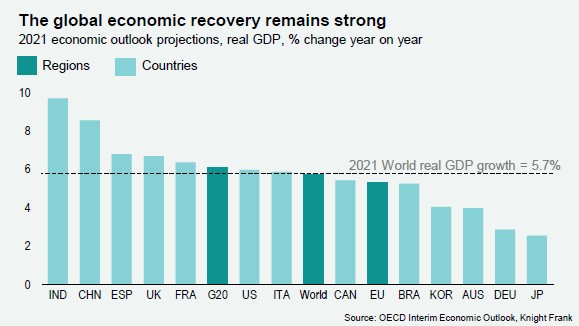

- UK output growth: still leading, even as the recovery slows. Amidst clear signs that the pace of the UK recovery is gradually easing, the OECD’s latest forecasts continue to show the UK as top economic performer in the G7, with an expansion of 6.7% predicted for 2021.

- Central banks begin to tighten. As expected, Norges Bank has become the first major Western central bank to increase interest rates, with a 25bps hike. Meanwhile, the Bank of England struck a more hawkish tone than expected in last week’s meeting, with two members voting to immediately halt the current bond buying programme. That said, market rates remain low, and globally $14.8tn worth of government bonds are still negatively yielding.

- The UK’s furlough scheme ends. Labour shortages will likely remain a key feature of the UK’s economic recovery, with very visible impacts on supply chains. The total volume of online job adverts grew by 133% in September compared to pre-pandemic levels, which could be intensified by around 50% of UK firms expecting to grow their workforce in the next year.

Download the latest dashboard here