UK Property Market Outlook: Week Beginning 15 March

The combined effect of the Budget, the re-opening of schools, the vaccine rollout and the prospect of summer holidays all signal a return to normal patterns of activity for the UK property market

2 minutes to read

The government roadmap for relaxing lockdown restrictions signals a return to normality over the next several months.

At the same time, leading indicators in the property market point to the sort of seasonal uplift that is usually associated with spring.

It is unlikely to fully materialise until the second quarter of the year, but the property market appears on the verge of a robust period of activity as the impact of the pandemic slowly begins to fade.

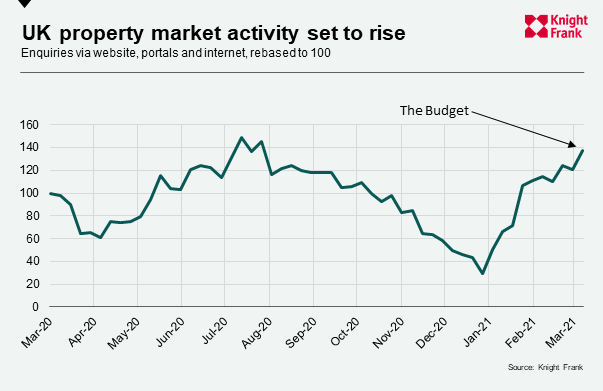

The number of enquiries via the internet, listings portals and social media reached its third highest level in more than a year in the first week of March, as the chart below shows. It is a mix of potential buyers and sellers and does not include contact with individual Knight Frank offices.

“Circumstances are conspiring to produce an active few months in the UK housing market,” said Tom Bill, head of UK residential research at Knight Frank. “While the stamp duty holiday extension, the re-opening of schools and vaccine rollout are driving supply and demand higher, the prospect of summer holidays will inject further urgency into the second quarter of the year.”

The Chancellor extended the stamp duty holiday to the end of June with a three-month taper in the Budget earlier this month. It will relieve pressure on the conveyancing system and may give some buyers and sellers pause for thought as the deadline is pushed back.

However, supply and demand are on the rise.

There was a spike in new supply in the week of the Budget, an analysis of OnTheMarket data shows. The number of new sales listings in England and Wales rose 18% week-on-week in the seven days to 6 March, the highest such rise since June 2020, a fortnight after the property market re-opened.

Supply had fallen in the first two months of the year as sellers were occupied with home-schooling and hesitated due to new Covid variants or the belief they would miss the March stamp duty deadline.

Meanwhile, demand was rising before the stamp duty extension was announced. The number of new prospective buyers in February was 8% higher than the same month last year. The start of 2020 was marked by particularly high levels of new demand following the general election in December 2019 and most of those registering last month would not have realistically expected to complete before the end of March. We explore the latest figures, including the rising number of offers accepted, in more detail here.

As a result of the improving data and the changed tax landscape, we have revised our house price forecasts for this year, as set out here.

While there are signs of a return to normality, what will be of longer-term importance for the economy and the strength of the housing market this year is a sense of finality in relation to the pandemic.

Photo by Brett Jordan on Unsplash