Daily Economics Dashboard - 16 February 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 16 February 2021 2020.

Equities: In Europe, stocks are mixed this morning, with the STOXX 600 (+0.3%) and the CAC 40 (+0.1%) both up, while the FTSE 250 is down (-0.1%) and the DAX is flat. In Asia, stocks were up on close, with the CSI 300 (+2.1%), Hang Seng (+1.9%), KOSPI (+0.5%), S&P / ASX 200 (+0.5%) and TOPIX (+0.3%) all recording gains. Futures for the S&P 500 and Dow Jones Industrial Average (DJIA) are both currently +0.3%.

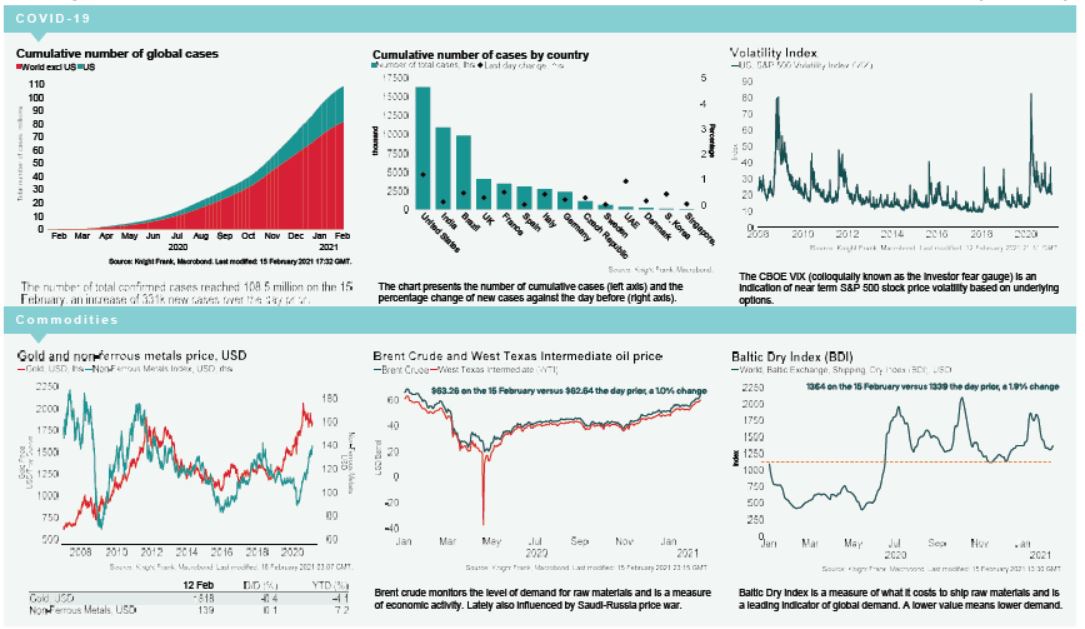

COVID-19:The total number of cases recorded globally has surpassed 109 million, according to Johns Hopkins University & Medicine. Circa 177.7 million people globally have been vaccinated, an increase of +31% over the week. Reported deaths have reached 2.4 million.

Equities: In Europe, stocks are mixed this morning, with gains recorded by the FTSE 250 (+0.3%) and the STOXX 600 (+0.1%), while the DAX and CAC 40 are both down -0.1%. In Asia, the Nikkei 225 (+1.3%), S&P / ASX 200 (+0.7%), TOPIX (+0.6%) and KOSPI (+0.5%) were all up on close. In the US, futures for the S&P 500 are +0.5% this morning.

VIX: The CBOE market volatility index is up +6.0% this morning to 21.2, remaining above its long term average (LTA) of 19.9. The Euro Stoxx 50 volatility index is also higher, up +1.2% to 20.4, remaining below its LTA of 23.9.

Bonds: The US 10-year treasury yield has compressed -2bps to 1.23%, meanwhile the German 10-year bund yield is down -1bp to -0.39% and the UK 10-year gilt yield has held steady at 0.57%.

Currency: Sterling and the euro are currently $1.39 and $1.21, respectively. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.51% and 1.40% per annum on a five-year basis.

Baltic Dry: The Baltic Dry increased for the third consecutive session on Monday, up +1.9% to 1364, the highest it has been since 2nd February 2021. The index is currently -27% below the four-month high seen in mid January 2021. On Monday, capesize rates ended their 17 session rout, increasing +1.5%, while panamax rates grew +2.7% to their highest level since mid September 2019.

Oil: WTI has declined back below $60 per barrel this morning, down -0.6% to $59.72. Brent Crude is also lower, down -0.33% to $63.09.

Eurozone GDP: The preliminary estimate for Q4 eurozone GDP was revised up to -0.6% from the initial flash estimate of -0.7% q/q to show a slightly smaller quarterly decline of -0.6%. This leaves eurozone economy 5.0% smaller than one year ago.