Covid-19 Daily Dashboard - 18 September 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 18 September 2020.

Equities: In Europe, the STOXX 600 (+0.2%) and the Dax (+0.3%) are up this morning, while the CAC 40 (-0.1%) and the FTSE 250 (-0.7%) are both trading lower. In Asia, stocks were mostly positive, with the CSI 300 +2.3%, followed by the Hang Seng and the Topix which both added +0.5% on close. However, the S&P / ASX 200 closed -0.3% lower. In the US, futures for the S&P 500 are down -0.2%.

VIX: The CBOE market volatility index is down -0.8% this morning to 26.3, which remains elevated compared to its long term average (LTA) of 19.8. The Euro Stoxx 50 vix is down -2.4% to 22.0, remaining below its LTA of 23.9.

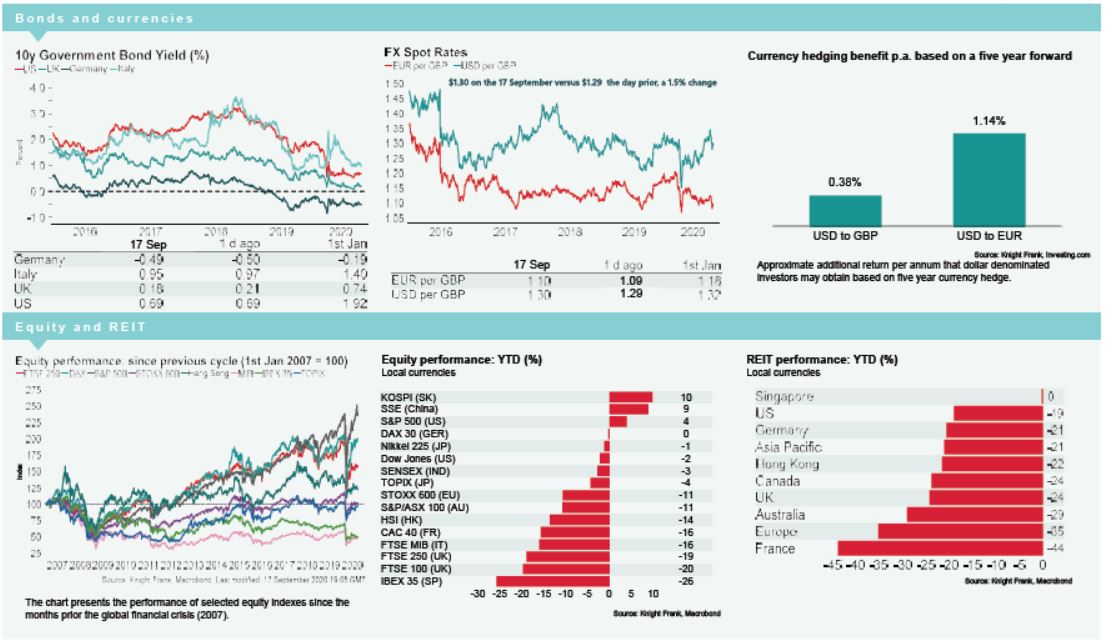

Bonds: The UK 10-year gilt yield and the German 10-year bund yield have both compressed -1bp to 0.18% and -0.50%, while both the US 10-year treasury yield and the Italian 10-year bond yield are flat at 0.68% and 0.96%.

Currency: The euro has appreciated to $1.19, while sterling is currently $1.30. Hedging benefits for US dollar denominated investors into the UK and the eurozone are 0.38% and 1.14% per annum on a five-year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) are up +0.4% and +0.3% to $43.48 and $41.11, respectively.

Baltic Dry: The Baltic Dry increased +1.0% yesterday to 1,294. The index is +19% higher than it was in January, while -34% down from the peak in July.

Gold: Gold depreciated -0.8% yesterday to $1,944 per troy ounce. The price of gold is down -6% from the record $2,063 recorded in early August, but still +27% higher than it was at the start of the year.

US Unemployment: There were 860k million new unemployment applications in the week to 12th September, above market expectations of 850k, albeit lower than the previous week’s reading of 893k.

UK Workforce: The proportion of adults commuting to work increased above 60% for the first time to 62%, according to the ONS Opinions and Lifestyle Survey. Furthermore, every region of the UK, except for Yorkshire and The Humber saw an increase in the volume of online job adverts in the week ending 11th September. The ONS estimate that 10% of the UK workforce remain on furlough leave.