Covid-19 Daily Dashboard - 16 September 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 16 September 2020.

Equities: In Europe, the STOXX 600 is +0.5% higher, while both the DAX and the CAC 40 are up +0.4%. However, the FTSE 250 is -0.2% lower. In Asia, the S&P / ASX 200 (+1.0%) and the Topix (+0.2%) closed higher, whilst the CSI 300 (-0.7%) and Kospi (-0.3%) were down on close. In the US, futures for the S&P 500 are up +0.2%.

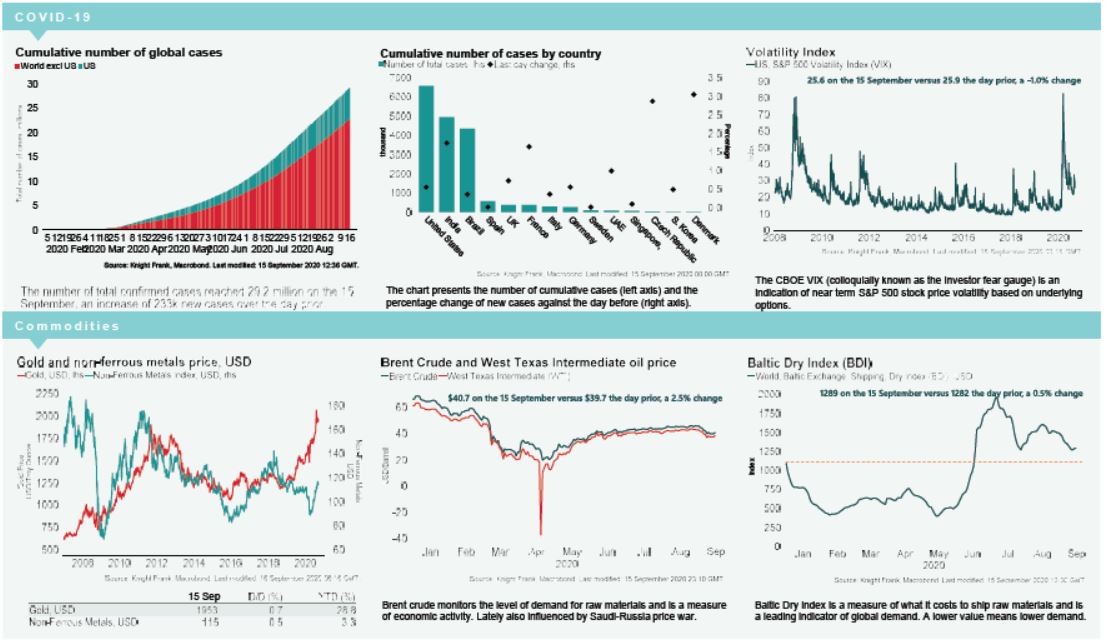

VIX: The CBOE market volatility index is down -1.5% this morning to 25.2, which remains elevated compared to its long term average (LTA) of 19.8. The Euro Stoxx 50 vix is down -3.7% to 21.3, below its LTA of 23.9.

Bonds: The UK 10-year gilt yield, US 10-year treasury yield and the German 10-year bund yield are all flat at 0.21%, 0.68% and -0.48%. The Italian 10-year bond yield has compressed -2bps to 0.98%, its lowest level in a month.

Currency: Sterling and the euro are currently $1.29 and $1.19, respectively. Hedging benefits for US dollar denominated investors into the UK and the eurozone are 0.31% and 1.14% per annum on a five-year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) are up +2.0% and +2.3% to $41.35 and $39.16. This comes as the American Petroleum Institute (API) reported a crude inventory draw of 9.5 million barrels in the week ending 11th September, above expectations of 1.3 million barrels and the 3.0 million barrel inventory draw recorded the week prior.

Baltic Dry: The Baltic Dry increased for the second consecutive day yesterday, following a 13 session rout, up 0.5% to 1,289. The index remains +18% higher than it was in January, while -34% down from the peak in July.

Gold: The price of gold remains relatively stable at $1,953. Compared to the record high of $2,063 on 6th August, prices for gold are down -5%, however prices are up +28% compared to the beginning of January.

UK Inflation: Inflation fell from 1.0% in July to 0.2% in August, higher than expectations of 0.1% but the lowest reading since December 2015. Declining prices in restaurants and cafes, predominantly driven by the government’s ‘Eat Out to Help Out’ scheme, had the largest downward contribution to prices, according to the ONS.