Global Residential Outlook – 25 June 2020

A roundup of the latest data and insight on key global residential markets

5 minutes to read

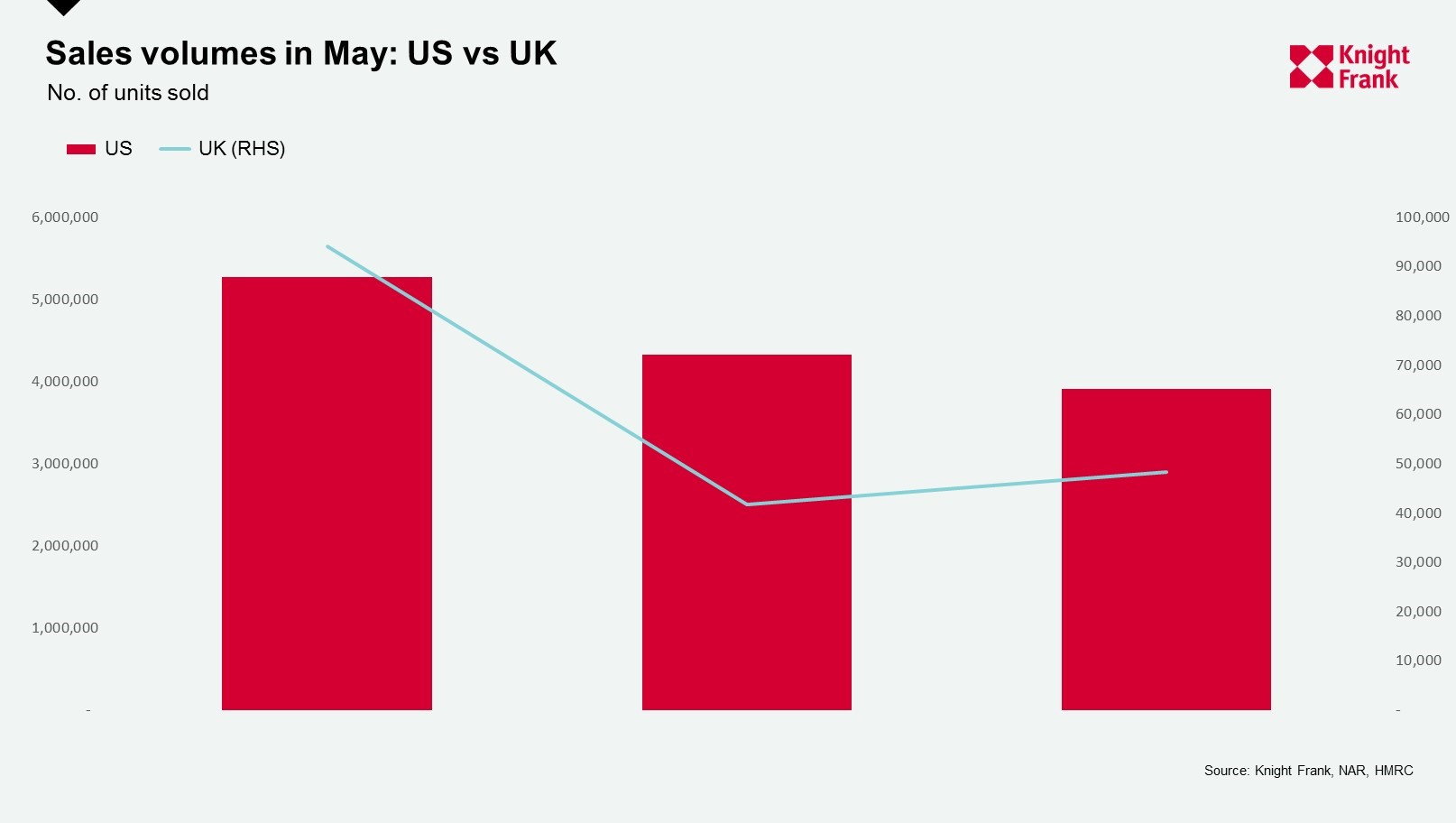

New sales data for the UK and US has been released for the month of May. This sits alongside the figures we have shared in previous weeks for New Zealand, Vancouver, Toronto and Hong Kong, strengthening the growing evidence base around the impact of Covid-19 on residential markets globally.

According to data from the US National Association of Realtors, sales were down 26.6% year-on-year in May and down 9.7% month-on-month. Similarly, UK sales (SA) declined 49.6% in May year-on-year but, in contrast to the US, sales increased 16% month-on-month according to HMRC, this is all the more surprising given it reflects only two weeks of activity - the UK housing market was closed for business until 13 May.

Residential digest

Need to know

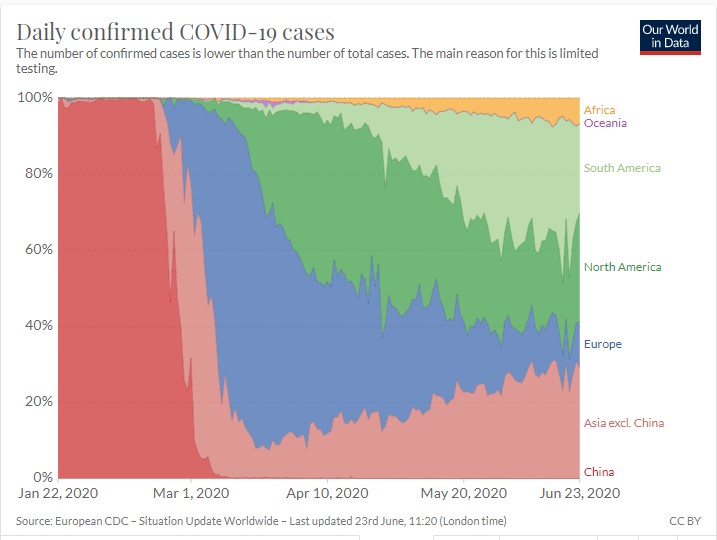

- France continues to lead the way in Europe with children up to 15 years of age returning to school and the country, so far, managing to keep Covid-19 in check. New York entered Phase 2 of its reopening with property viewings permitted as of Monday this week. Spain reopened its borders to EU and UK citizens on Sunday. New outbreaks were registered in Germany, Beijing and the Australian state of Victoria, whilst the US is increasing testing in a number of states that have seen a surge in cases including Florida, Texas and Arizona.

- Boris Johnson announced on Tuesday that he will reduce England’s two-metre social distancing rule to “one metre plus” guidance from 4 July with cinemas, galleries, pubs, restaurants, hotels and hairdressers able to open their doors from the same date. The PM is also evaluating European “travel corridors” to support summer tourism.

- My colleague Flora Harley’s weekly look at global real-time economic indicators reveals morning rush hour traffic across 20 major cities was just 25% below 2019 averages last week. Restaurant bookings still have some way to go, however.

- Brexit is back on the agenda with hopes rising that the EU and UK could find a compromise as soon as July. Plus, Japan has given the UK six weeks to strike a post-Brexit trade deal, according to the Financial Times, not only would this be Britain’s first in 40 years but equate to one of the fastest negotiations in history.

Europe

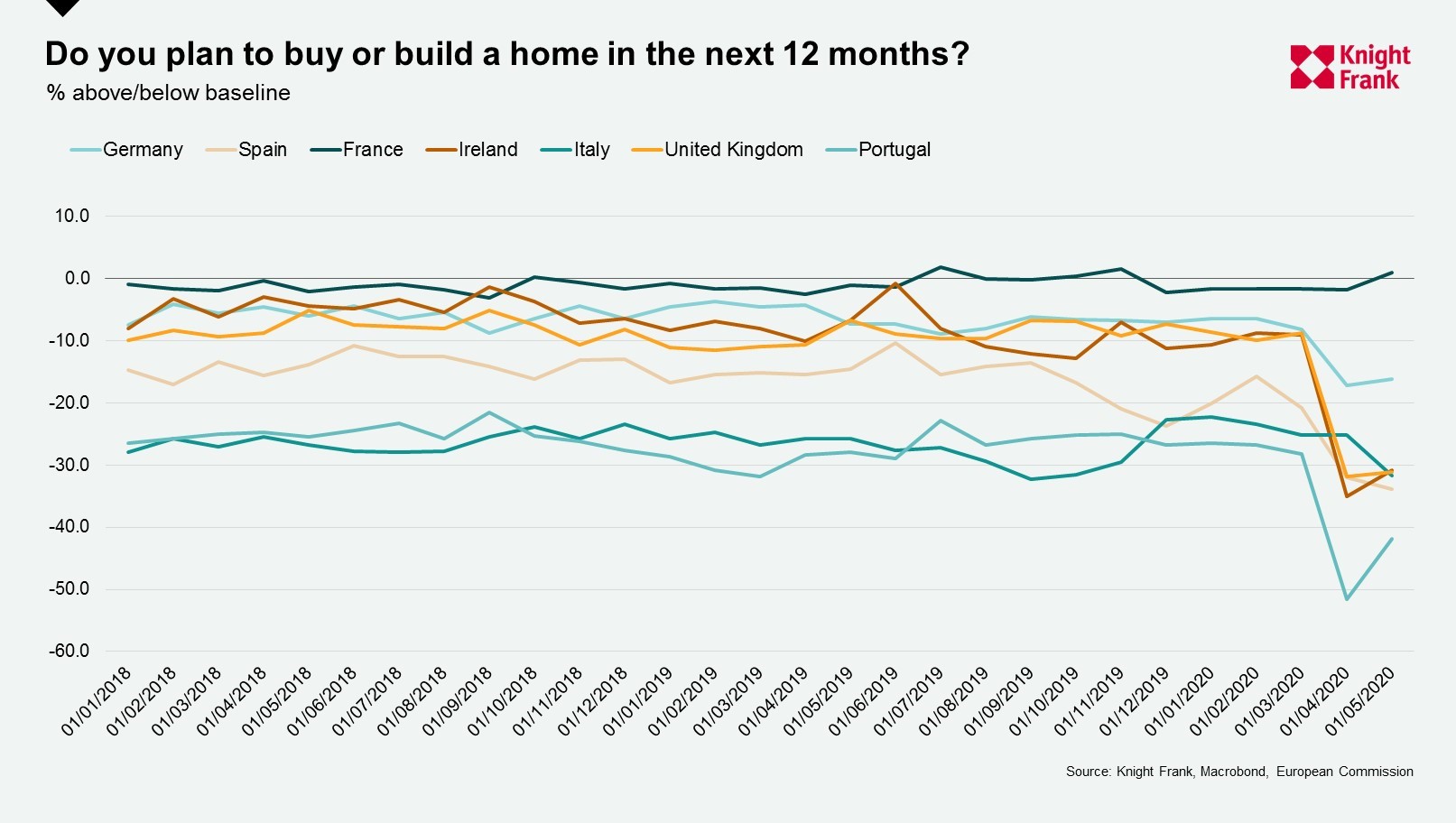

A survey by the European Commission confirms that French buyers are the most likely to buy or build a home in the next year, followed by those in Germany. The chart below shows the results for a selection of countries with most witnessing a marked improvement in sentiment between April and May.

The European economy is also staging a comeback, with the eurozone PMI climbing from 31.9 to 47.5.

In the UK, the number of new prospective buyers registering with Knight Frank in the second week of June was 45% above the five-year average, continuing the upwards trend of recent weeks. Furthermore, the number of offers accepted outside of London which had reached its highest ever level in the first week of June, was superseded the following week.

Asia Pacific

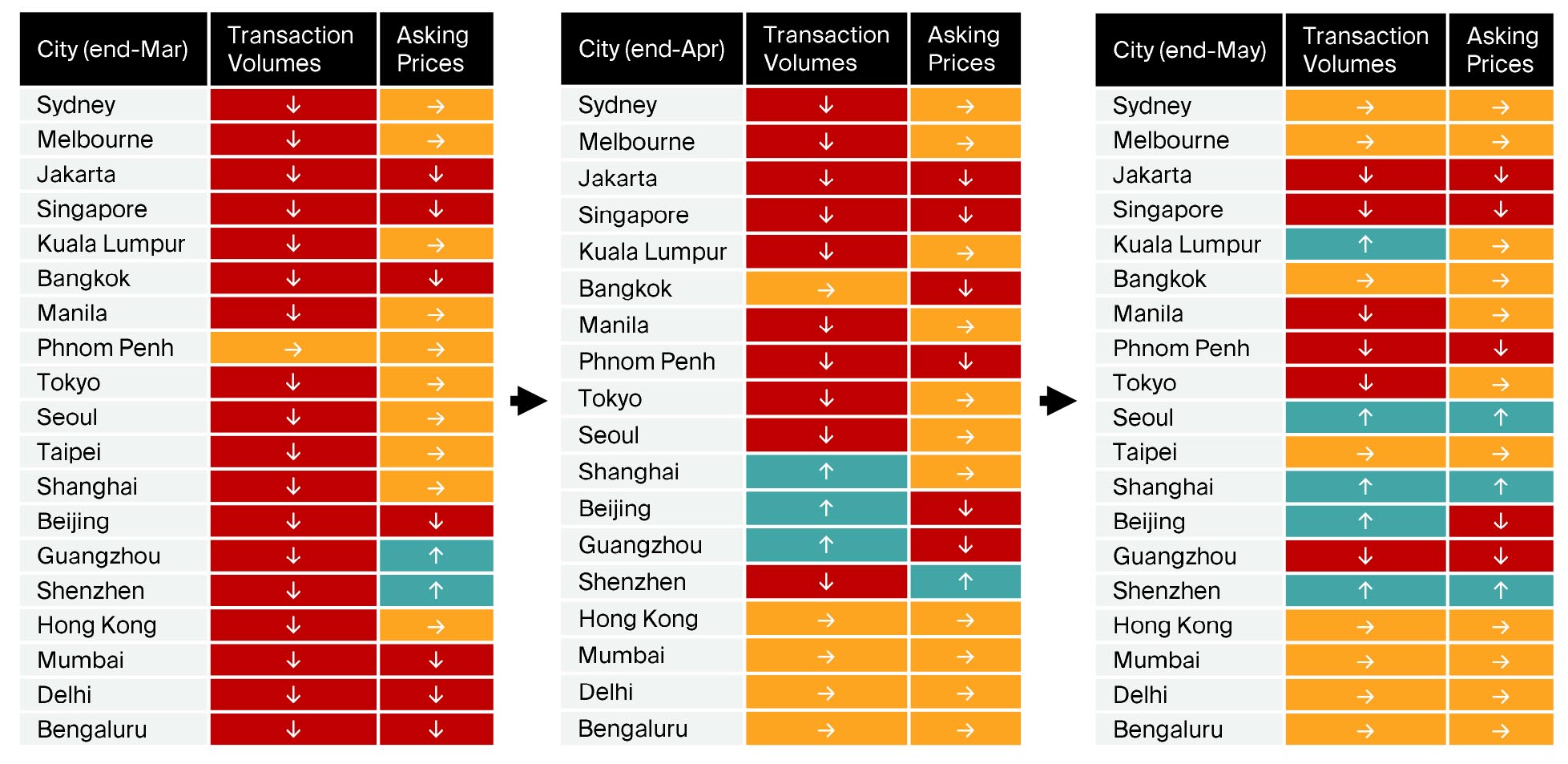

Residential markets are recovering faster than commercial markets across Asia, according to Knight Frank’s new Asia Pacific Bulletin. A mix of pent-up demand, low interest rates and some developer discounts are assisting markets in gaining traction.

A sentiment survey of our Asia Pacific network not only shows an improving picture for sales and asking prices between March, April and May but also highlights the extent to which sales volumes have to date, been affected more heavily than prices.

Our team’s take on the Hong Kong market is backed up by the RICS-Spacious Hong Kong Residential Market Survey which shows the city in holding state due to heightened macroeconomic uncertainty, although rents are stabilising with more respondents reporting no change or modest increases over the past three months.

Japan is considering visa waivers, tax advice, and free office space to entice financial services professionals and institutions based in Hong Kong to relocate to Tokyo according to the Financial Times as the Japanese capital looks to strengthen its status as a regional financial hub.

In Australia, Qantas has cancelled international flights until late October except for services to New Zealand following the Tourism Minister’s announcement that the borders will remain closed until the end of the year.

In New Zealand, The Reserve Bank left the policy rate unchanged this week. However, Capital Economics expect that the Bank will move rates into negative territory next year providing homeowners and potential buyers with access to lower mortgage rates.

US & Canada

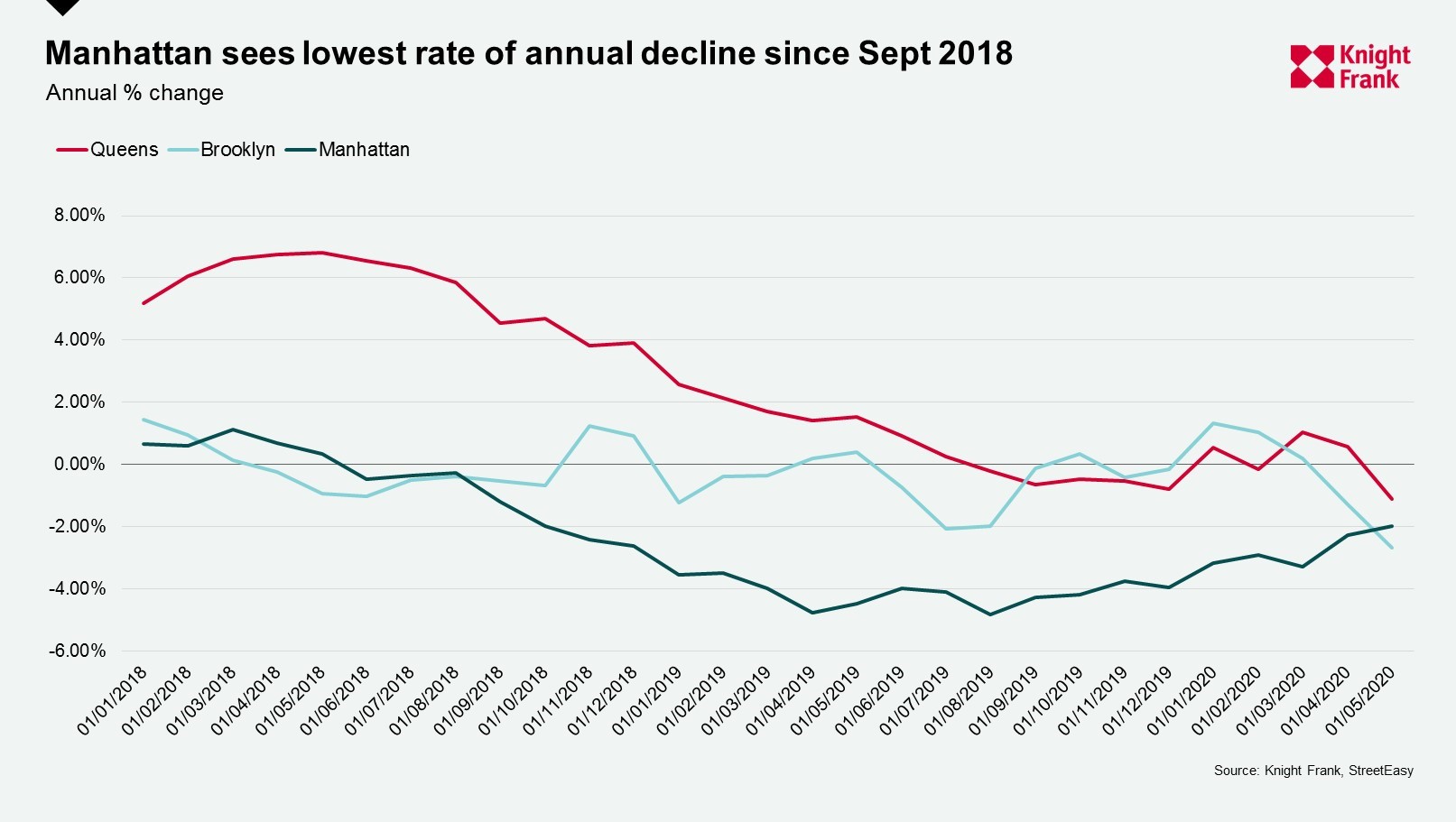

The StreetEasy price index reports a 2% fall in Manhattan in May – the smallest annual decline since October 2018. Brooklyn, by comparison, saw its largest annual price decline (-2.7%) in nine years.

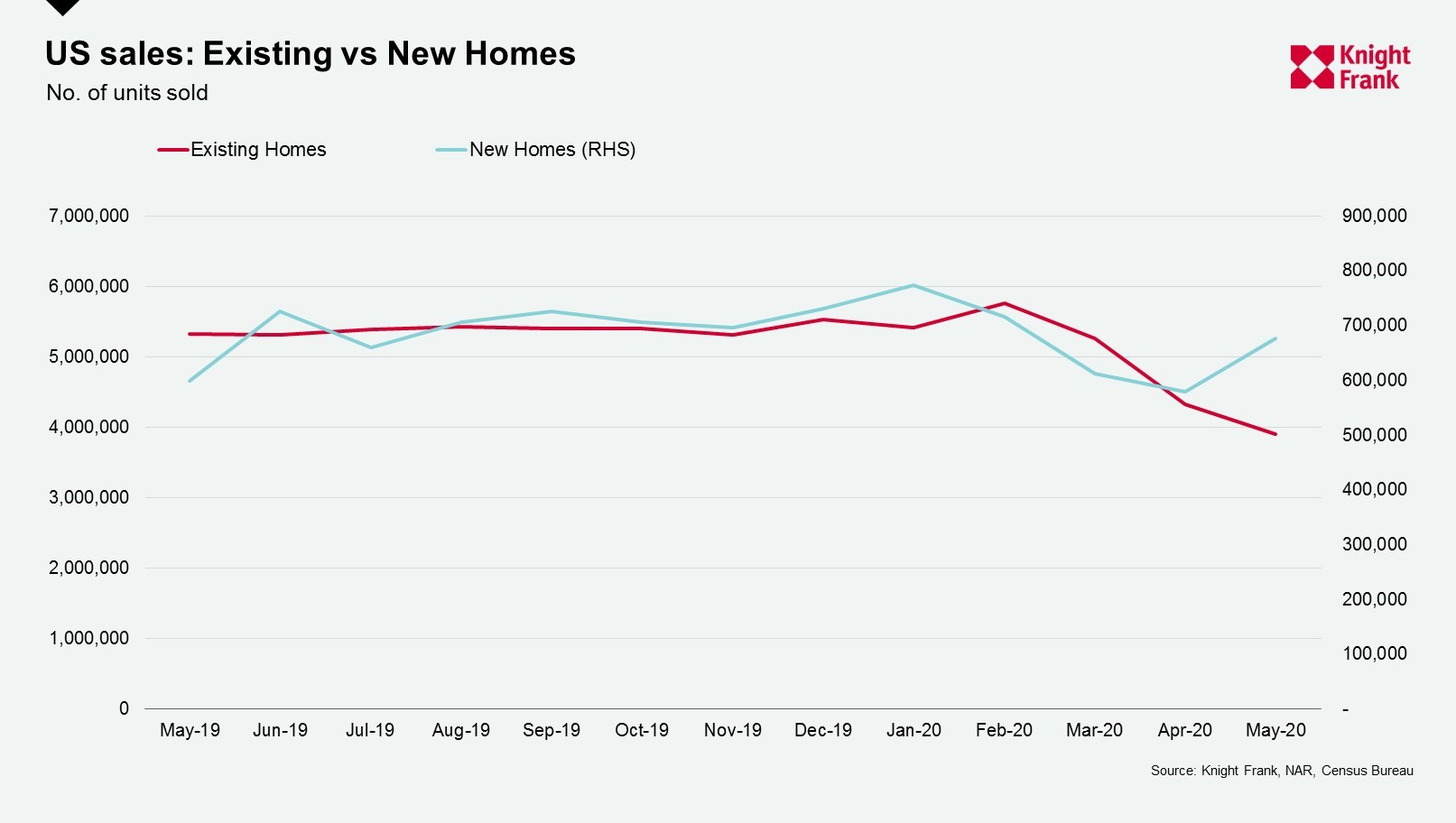

Nationally, new and existing home sales followed a divergent path in May. New homes sales increased 16.6% month-on-month whilst existing sales declined 9.7% over the same period.

In the new homes market, developers were able to stream virtual viewings and access mortgage financing for clients during lockdown and some offered attractive discounts at a time of record low mortgage rates.

In contrast, the existing homes market has faced reduced inventory levels and seen credit conditions tighten as the US started to ease out of lockdown. Existing home sales tend to lag mortgage applications by one to two months and with applications rising week-on-week since 10 April there was some optimism this would filter through to sales but new data for the week ending 19 June shows total mortgage applications fell 8.7%.

This week’s recommended listening:

Intelligence Talks podcast: In our latest Intelligence Talks global podcast, Victoria Garrett, Head of Residential in Asia Pacific, Shayne Harris, Head of Residential in Australia and myself talk to Anna Ward about the spike in expats looking for a foothold back home

Listen on Spotify, Apple and Acast. To view our full podcast series click here.