Despite Brexit uncertainty opportunistic overseas investors dominated the UK hotel market in 2018

Despite the prolonged Brexit negotiations, in 2018 the UK continued to remain attractive to overseas hotel investors, with 78% of total hotel investment activity and 85% of all hotel portfolio activity exchanging hands with an overseas buyer.

3 minutes to read

Investment from overseas buyers totalled approximately £4.9 billion, more than doubling their investment compared to the previous year, with an even 50% split of the capital invested between London and regional UK.

The continued strength of the global economy at the start of 2018, the liquidity of the UK property market and the competitive value of the pound are all factors that have helped attract safe haven capital flows to the UK and, in particular, London, as a leading global city.

"Even if there is little or no currency movement as a result of Brexit, we envisage overseas capital inflows in the UK hotel market to remain buoyant, as greater strategic importance is placed on investing in alternative specialist sector businesses."

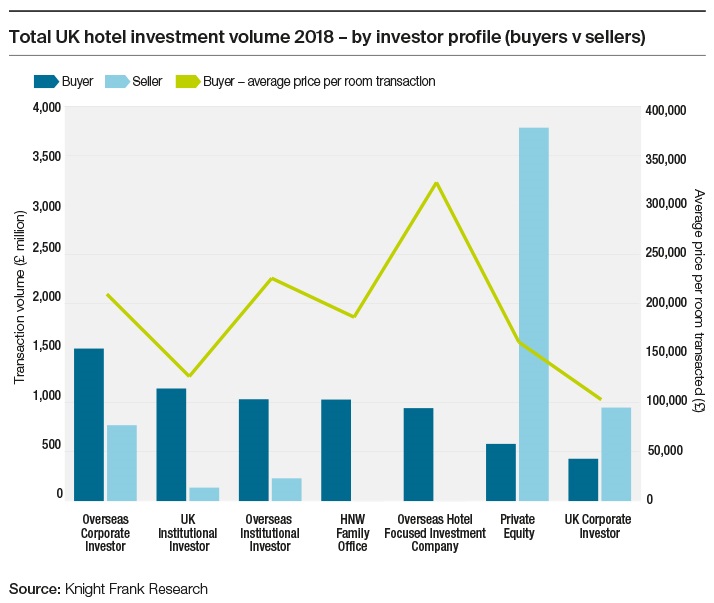

Overseas Corporate Investors were ranked overall as the top investor type into the UK Hotel property sector in 2018, with investment totalling £1.5 billion.

In London, this investor group was ranked as the highest spending investor by transaction volume, with a 25% share, closely followed by Overseas Instittutional Investors with a 21% share of the total volume. Together, the two groups invested £1.5 billion of capital into the London hotel sector, involving 11 separate deals.

LRC Group, secured the position as the lead Overseas Corporate Investor, with approximately £774 million of investment. Their acquisition of Lonestar’s Amaris Hospitality platform and owned assets, accounted for 50% of the total investment by overseas corporate investors, adding approximately over 4,700 rooms to its portfolio, with an average price of £164,000 per room.

"London’s position as one of the world’s most liquid and transparent real estate markets will remain alluring for global and domestic investors alike."

In total, international capital accounted for 75% of the total hotel investment in London. Transactions included:

• Four separate Travelodge investment transactions totalling over £130 million, with an average price of £193,000 per key;

• Cola Holdings acquisition of the Hilton London Kensington for £260 million (£431,000 per key);

• Katara Hospitality, the hotels division of Qatar Investment Authority acquiring Grosvenor House, a JW Marriott hotel;

• AXA Investment Management completing on its forward funding commitment of 250 City Road, a £90 million deal with an agreement in place with NH Hotels to operate the new 190-room nhow Hotel in Shoreditch.

In regional UK, no single investor group dominated the transaction market, albeit UK institutional investors were most active, with a 19% share of the market. A total of £2.4 billion of investment was made by overseas investors, accounting for 58% of total regional investment, whilst 75% of the overseas investment was deployed in eight portfolio transactions.

In 2018, inbound investment from Europe increased phenomenally, with investment exceeding £2 billion, representing 27% of the total transaction volume.

The French investor Covivio and LRC Group, together contributed 81% of total European investment. Israeli investment was also significant, representing 11% of total investment volume, largely due to HNW Dayan Family acquiring the Apollo portfolio.

Meanwhile, inbound capital from the USA increased by 77% to £1.5 billion in 2018, as a result of significant institutional interest which accounted for 75% of US investment. Brookfield’s £457 million acquisition of the SACO portfolio helped drive total US investment to 21% of the total UK investment volume.

In summary, the UK hotel market has seen no shortage of overseas capital investing in quality stock, as growing demand from the varied investor groups, diverse sources of capital available and a resilient trading performance have all contributed to a surge in UK hotel investment.

For further detailed insight, the latest edition of Knight Frank’s UK Hotel Capital Markets Investment Review 2019 is out now. Download: