From chalets to cities: charting post-pandemic property performance

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

The UK's annual rate of inflation climbed to 2.3% in the year to October, from 1.7% the previous month, the ONS said this morning. A rise back above target is in-line with Bank of England forecasts, though the reading is a little hotter than the 2.2% economists had expected.

Inflation is expected to remain above target for much of the final part of the year due to a 10% increase in the energy price cap, but that's only partly to blame. The rate of services prices inflation climbed to 5%, from 4.9%, which together with recent public sector pay rise settlements will continue to underpin caution at the Bank.

Governor Andrew Bailey appeared in front of the House of Commons Treasury select committee this week and reiterated his view that the Bank will adopt a "gradual" pace of easing through to the end of 2025 at least. Investors interpret that to mean four quarter point cuts over the course of the year.

Prime global rents

Global prime residential rents were flat in the third quarter, which is the weakest performance since the tumultuous final quarter of 2020, according to Knight Frank's Prime Global Rental Index. Markets are feeling the pressure of affordability constraints after a two-year period during which rental growth sharply outpaced wage inflation in most developed markets. The annual rate of growth has slowed to 1.9%, which is below the pre-Covid trend rate of 3.7%.

Toronto embodies these post-pandemic patterns. The city posted a 5.6% annual decline in rents, the largest of any city in our index. This follows a surge that began in 2021 and continued through 2022, culminating in a peak annual growth rate of 18%.

Sydney continues to lead our basket of cities, maintaining its position as the top market for the fifth consecutive quarter. Although its annual rental growth rate of 8.3% is lower than the 14% recorded last quarter and significantly below the 18% seen at the end of 2023, rents are rising far ahead of long-term trend levels due to a sharp imbalance between supply and demand.

Despite the broad slowdown, we believe that the structural under-supply of new accommodation in major cities means rents are likely to rise faster than trend levels during the next few years.

Alpine

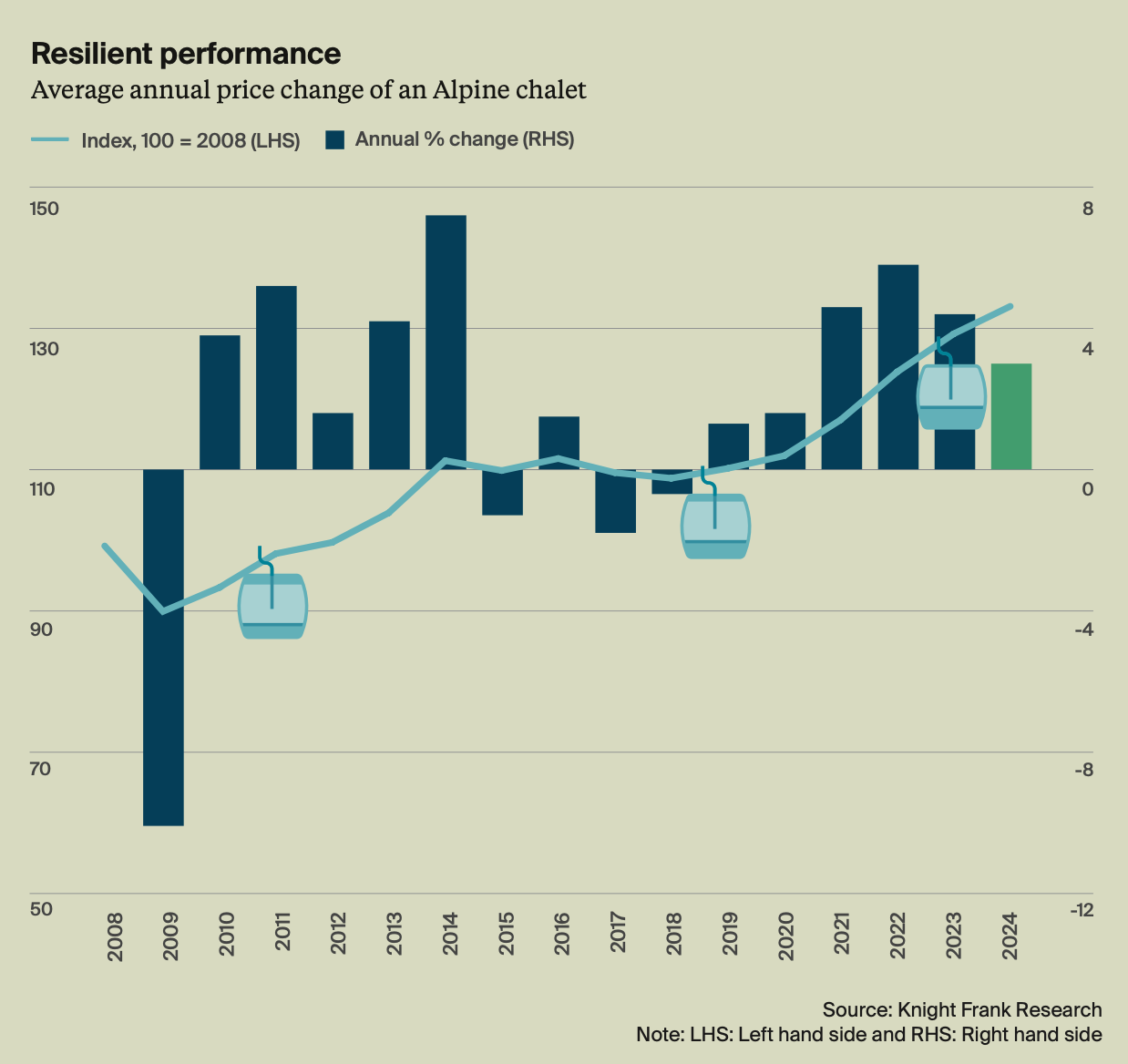

Property values in Alpine markets climbed 3% during the year to June 2024, according to new Knight Frank figures. While this is down from the recent peak, growth remains above the long-run trend rate of 1.9% (see chart).

The results form part of our new Alpine Property Report, in which we canvass our Alpine property experts and industry voices to explore topics such including climate adaptation, the reinvention of ski resorts as year-round adventure destinations, and ongoing investments in Alpine infrastructure.

Declining mortgage rates in France and Switzerland are starting to impact buyer sentiment, adding to demand from a very active pool of cash buyers. Record prices are being achieved – Chamonix recently surpassed €20,000 per square metre.

Property values

Leading the charge, Courchevel 1850 in France saw prices increase by 9% due to tight stock. Although a French resort held the top spot, Switzerland’s Alpine markets outperformed, with average growth of 3.5% across 12 key resorts, versus France’s 1.5%. The Swiss National Bank’s early rate cut in March bolstered buyer sentiment, highlighting Switzerland’s credentials as a stable, tax-friendly destination amid global policy changes.

Swiss resorts Gstaad and St. Moritz led in pricing, with Gstaad at €41,500 per square metre, reflecting 4% annual growth, while St. Moritz rose 5.6% to €33,250 per square metre. High international demand kept these markets competitive, backed by Switzerland’s unique winter offerings and stable economy.

In France, Val d’Isère followed Courchevel with a 7% growth rate, bolstered by demand for ski-in/ski-out properties. Priced at €31,600 per square metre, Courchevel remains a prime draw, while France’s broader price range and infrastructure appeal to diverse buyers. Austria also performed steadily, with Kitzbühel achieving an 8.5% price increase, attractive for its lower price point and accessibility.

See the report for more.

In other news...

Milan beats London and New York as home to most expensive shopping street (FT).