4 minutes to read

A key strength of West London is the lifestyle offer, which provides a wealth of amenities. Westfield, for example, has a wide range of offerings, including over 400 shops, 80 food and beverage establishments, and various leisure facilities from which workers and locals can benefit. Similarly, Chiswick High Road and Ealing Broadway provide amenities, with the mixed-use developments of Filmworks and Dickens Yard demonstrating investor and developer confidence in the market.

Connectivity in West London is superior to other South East markets. The markets are serviced by multiple London underground lines and bus routes and are accessible via the M4 corridor. Most recently, the opening of the Elizabeth Line has made Ealing far more accessible, whilst the London Overground links Kensington Olympia and Shepherds Bush to South London. Additionally, with much of the office stock providing end-of-trip facilities, West London is easily accessible by bike to those in the neighbouring residential suburbs and Central London.

What is the shape of the office market?

The four principal submarkets comprising the West London office market are Hammersmith, White City, Chiswick, and Ealing. Each market has a unique offering; however, occupiers consider all four before focusing searches on just one or two submarkets.

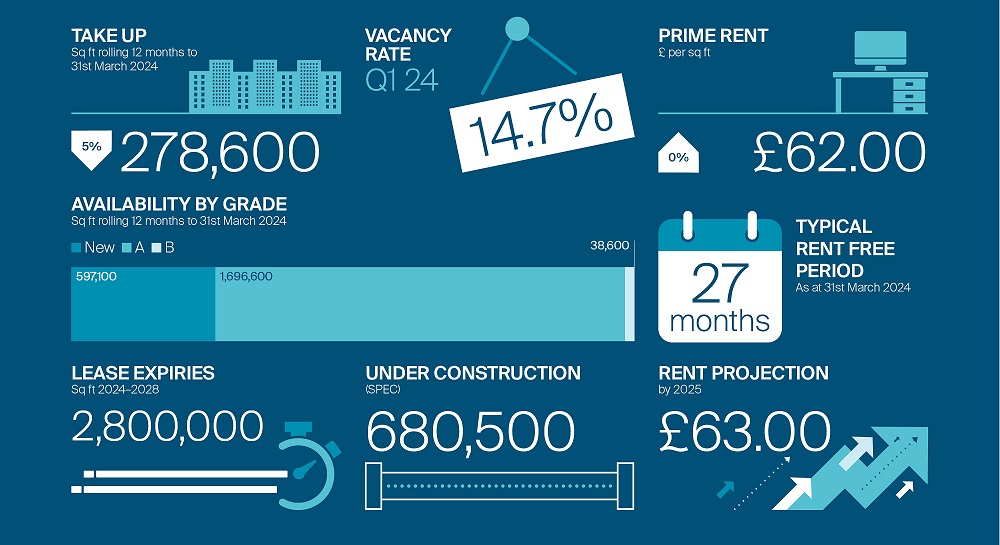

2023 proved challenging for the West London office market. Total take-up finalised 176,747 sq ft, reflecting a fall of 36% year-on-year and is just above 50% of the 5-year annual average. However, 2024 has seen a promising start, with takeup in the first quarter reaching 129,928 sq ft. This is 54% above the 5-year quarterly average and the highest quarterly take-up for 2 years.

The increasing occupier preference for the best quality space is evident in West London. Over the past 5 years, 93% of occupier activity involved new or grade A space. So far this year, the figure is 95%, owing mainly to the pre-let of 72,192 sq ft of brand-new space at One Olympia to serviced office provider IWG/Spaces.

There is a clear preference for being located near amenities, transport connectivity, and Central London. Across the last 5 years, 80% of take-up has been within a market core, owing to the unrivalled amenity offering and connectivity it provides.

Who is taking space?

Occupier activity in West London is underpinned by three dominant sectors: TMT, Pharmaceutical and Healthcare, and Retail.

Retailers account for the highest amount of take-up since 2019, at 29%. Most activity has centred on Hammersmith and White City, with the most significant deal being 120,217 sq ft at Gateway Central, White City, to L’Oreal.

Pharmaceutical and Healthcare have been responsible for a fifth of all deals over the last 5 years. West London has been established as a hub for Life Sciences due to its proximity to the Imperial College London White City Campus and the nearby Hammersmith and Charing Cross hospitals. Quell Therapeutics and Engitix have expanded in the market.

Across all submarkets, TMT occupiers remain active, representing 18% of take-up over the last 5 years. Deals include the letting of 125,157 sq ft of grade A space at the BBC Broadcast Centre to ITV in 2021, the largest transaction in West London since Q3 2018.

What does future demand look like?

At the time of writing, there was 790,000 sq ft of named demand in the West London office market, 57% derived from the TMT sector.

Significantly, 2.8m sq ft of space is subject to a lease event before the end of 2028.

What factors will challenge growth?

West London is experiencing a relative oversupply of new and grade A office space. Availability stands at a historic high of 2.3m sq ft, a year-on-year increase of 47% and is 65% above the 5-year average. As a result, rents have been largely flat.

Even so, West London has a strong pipeline of future demand, with current high-profile suitors including Disney, McDermott and Imperial College.

Is office supply to grow?

With 680,500 sq ft of development underway, there will be a further increase in availability in the near term.

What will underpin longer-term growth?

With the occupier’s focus on the best quality, well-located and amenity-rich offices, the West London market looks like a favourable occupier choice. In particular, White City Place and One Wood Crescent in White City and Chiswick Park can offer a healthy supply of high-quality buildings with large floorplates of 20,000 sq ft and above. This means West London caters to future and current occupiers needing more extensive space and those with upcoming lease events. Other competing markets cannot offer such space due to limited availability and inflated build costs, making construction unviable.