Manila's strong rental growth drives Asia-Pacific logistics market upward in H2 2023

10 minutes to read

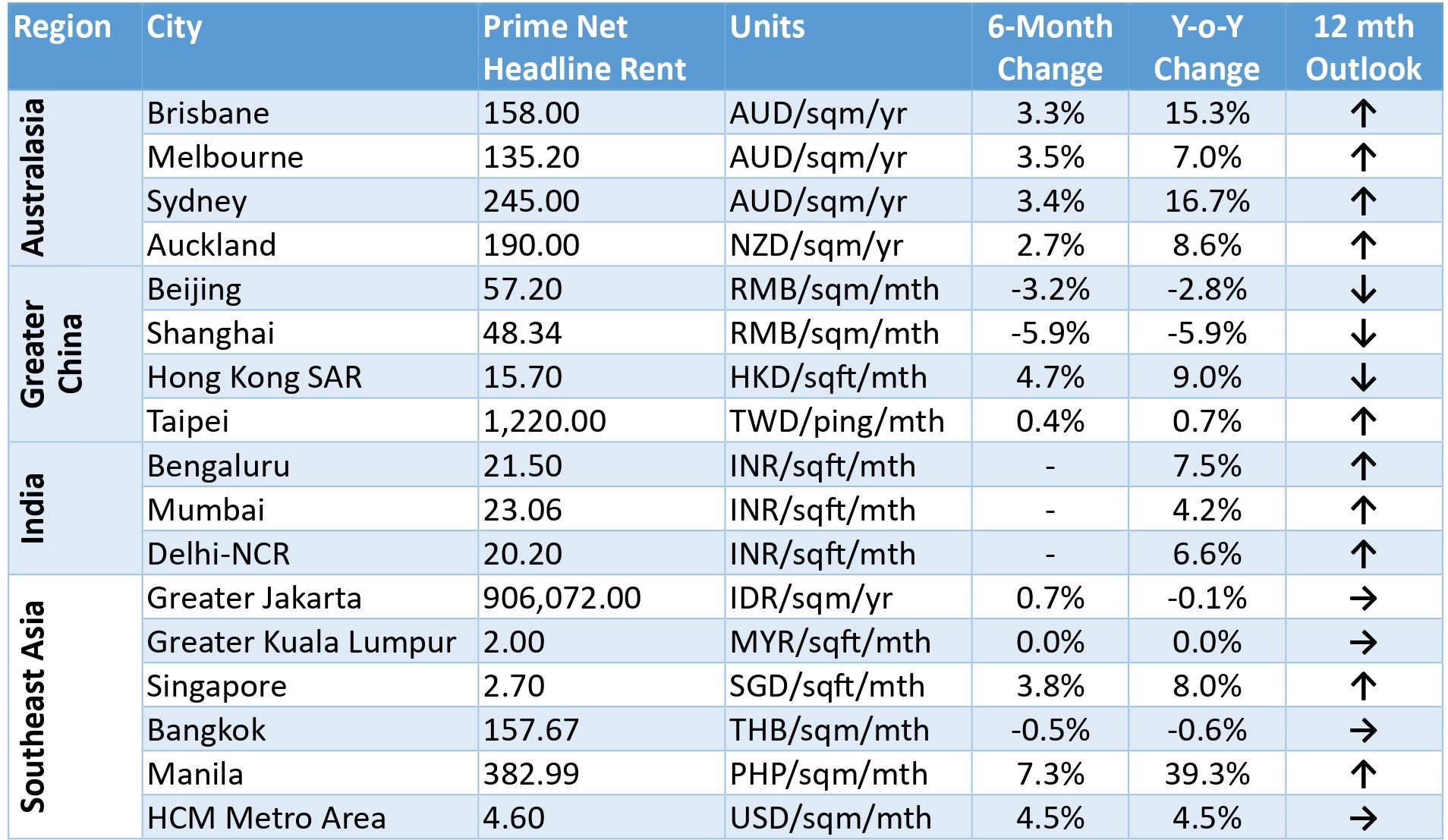

The strong rental growth observed in Manila's logistics market played a key role in strengthening Asia-Pacific's overall performance in the second half of 2023, with an average year-on-year growth of 6.5% across the region.

Manila’s logistics property rents surged 39.3% annually and 7.3% from 6 months ago, catapulting the Philippines’ capital over Sydney as the best-performing city in Asia-Pacific. The rise helped to maintain an overall positive trend in rental growth for H2 2023.

However, a closer look at the near-term momentum reveals a half-yearly rental growth rate deceleration. While the rate was 4.6% in the previous six months, it slowed to 1.5% in the latter half of the year, indicating a potential shift in market dynamics and a moderating pace of office rental increase across office markets in Asia-Pacific.

The Australian cities of Sydney and Brisbane rounded off the top three cities in Asia-Pacific, with year-on-year rents for industrial space gaining 16.7% and 15.3%, respectively, in 2023.

Hong Kong ranked fourth in this category with year-on-year rental growth of 9%. In the second half of 2023, the city had the second-best rental growth at 4.7%.

The rental growth for industrial space, however, could not be replicated in the Chinese mainland. Shanghai and Beijing ranked at the bottom of the rankings, with rents retreating 5.9% and 2.8%, respectively. Leasing fundamentals in the Chinese mainland continued to drag against a backdrop of a weak economy and substantial completions in and around Beijing and Shanghai. Total trade, which slowed significantly in 2023, substantially reduced the demand for logistics warehousing.

The region’s development pipeline will remain significant in 2024, adding 43.7% to existing stock, which will continue to ease tight supply conditions. The bulk of new supply will be delivered in Chinese mainland markets, where over 17 million sqm completing in Beijing and Shanghai will continue to weigh on market conditions for most of 2024.

With the outlook turning conservative, occupiers in the region will remain cautious, impacted by economic uncertainty, inflationary pressures and higher interest rates. Rents will remain on an uptrend, but with the structural shortage of quality spaces narrowing, growth will moderate sharply to 1-3% in 2024, down from the over 6% rise in 2023.

PMI data points to a strengthening of economic activity

Despite inflationary pressures dampening consumption and leading to a 9% decline in total trade in Asia-Pacific during the first nine months of 2023, recent data points to a strengthening economic activity and a pick-up in exports emerging as inflation subsides and interest rate hikes pause.

Surveys compiled by S&P Global show Purchasing Managers' Index (PMI) averages across the region rose above 50 in January 2024 for the first time in seven months, signalling improving sentiment. Although shipping diversions from the Red Sea and droughts in the Panama Canal have caused some delays, their impact remains limited compared to the disruptions experienced during the pandemic.

As the region's economy continues to recover and adapt to global challenges, these positive indicators suggest a more optimistic outlook for the Asia-Pacific trade and economic growth in the coming months.

Geopolitical tensions reshape tech supply chains

As geopolitical rivalries intensify, significant shifts occur in the global technology supply chain. India's efforts to build its tech supply chain come at a time when the Chinese mainland's dominance as the world's manufacturing hub is being challenged due to its trade war with the United States.

Southeast Asian countries such as Vietnam and Thailand have benefited from the diversification of consumer electronics supply chains. Malaysia is re-emerging as a critical hub for chip packaging and testing. Given their perceived neutrality in the geopolitical landscape, South and Southeast Asia are expected to play an increasingly important role in the semiconductor supply chain.

Major semiconductor players, such as Intel and Qualcomm, are establishing research and development centers and production facilities in India. Meanwhile, chipmakers are looking to set up new production facilities in Southeast Asia to mitigate supply chain risks and ensure a stable flow of components to customers worldwide.

Outlook: Positive amid looming US elections

The outlook for trade in the region remains largely positive. This is supported by growing consumption, a bottoming electronics cycle, 5G rollouts and a transition to electric vehicles. The region’s trade liberalisation architecture will further facilitate this growth. An agreement to reinforce supply chains will enter into force in February 2024. The U.S.-led Indo-Pacific Economic Framework deal will enable most countries in the region, excluding Chinese mainland, to foster collaboration in dealing with disruptions.

However, 2024 will culminate in the US presidential elections. While a return to the White House for former president Donald Trump could disrupt trade dynamics in the region, demand for logistic spaces could heighten as companies fast forward plans to shore up their supply chains in the run-up to the election.

Markets Round-up

Australasia

Australia – Eastern Seaboard

Leasing activity in Australia’s Eastern Seaboard markets eased in the second half of 2023, although it was coming off record highs. As a result, rental growth slowed, with all markets recording increases of less than 4% from six months ago. However, annual growth remains high, with Sydney and Brisbane recording double-digit increases as incentives remained at historical lows across all capital cities. While a strong pipeline of about 3 million sqm is expected to be delivered in 2024 across the East Coast, most of this new supply has been pre-committed. Rental growth is expected to be sustained albeit slower, with growth expected to revert to an annual pace of 4-8% over the next 12 months.

Auckland

The rapid growth of e-commerce and its related fulfilment and delivery operations led to an unprecedented increase in demand for warehousing, logistics, and distribution spaces during the pandemic. However, as pandemic-related supply chain constraints have eased and sentiment has weakened, the market is now showing signs of tapering off, with resistance to higher rents emerging.

Landlords still need to offer lease incentives, maintaining high rent expectations. While the supply of industrial properties for lease is expected to remain tight in strategic and desirable locations, the frenzied rental activity observed during the pandemic may begin to ease. Occupiers can cautiously anticipate moderate supply constraints and escalating rents as the market adjusts to changing demand dynamics in 2024.

Greater China

Beijing/Shanghai

Escalating trade protectionism and geopolitical conflicts have resulted in trade disruptions, weakening external demand and mounting challenges for the domestic economy. The Chinese mainland's export growth slowed considerably in 2023, and imports also experienced a slight decline, which led to decreased demand for logistics warehousing.

Substantial new warehouse supply in the areas surrounding Shanghai and Beijing has prompted landlords to accelerate the leasing process by implementing significant rent reductions. Additionally, highly competitive rental rates in nearby cities have further diminished demand within Shanghai and Beijing. As a result, rents for logistics and warehousing in Beijing and Shanghai are expected to continue their downward trend in 2024, accompanied by persistently high vacancy rates.

Hong Kong

Supported by significant leasing deals in the logistics sector, rental levels in Hong Kong continued to experience moderate growth during the second half of 2023. However, the substantial addition of 4 million square feet of new supply from the Cainiao Smart Gateway at Hong Kong International Airport, which became operational in Q3 2023, has led to an increase in vacancy rates. Currently, only 30% of the available space in the development has been leased or occupied.

The absorption of space in this development is expected to take time, as there is a growing trend of air freight demand for logistics shifting from Hong Kong to the Chinese mainland, particularly to cities such as Zhuhai and Dongguan. Additionally, weak external demand for goods is anticipated to impact Hong Kong's export performance in the near term. As a result, industrial rents are likely to face pressure in 2024, contributing to higher vacancy rates in the market.

Taipei

Domestic consumption in the territory hit a record high in 2023, resulting in a growth in the demand for logistics from traditional retail and e-commerce. Korean e-commerce company Coupang completed its second logistics center in November 2023, with a third planned to commence operations in 2024. Homegrown semiconductor companies are also reshoring their factories due to the reshaping of global supply chains. The demand for raw material storage and bonded warehousing facilities for semi-finished products is expected to increase in 2024.

Southeast Asia

Bangkok

The average rent for logistics properties in Bangkok has been quite stable over the past decade, showing only minimal fluctuations within an approximate range of 1%. The slight adjustment in rent in the second half of 2023, approximately -0.6%, is in line with typical market trends and is mainly due to the launch of several new projects that have introduced marginally lower asking rents.

Jakarta

The demand for logistics warehousing in Jakarta continues to experience stable growth, fueled by strong demographics and expansionary demand from retail and e-commerce sectors. In addition, the increased focus on locating warehousing facilities closer to Jakarta has strengthened growth.

In 2023, new deliveries as a proportion of existing stock reached about 37% in the Bekasi submarket. However, the occupancy rate has remained resilient, marginally increasing as demand grows, which kept rents largely stable in the second half of 2023. These conditions will likely persist in 2024, with rents expected to remain unchanged despite the influx of additional stock.

Manila

Rent growth has been erratic, with Manila's industrial facility rents ranging from US$4.87-6.78 per sqm during the second half of 2023. The rapid expansion of the e-commerce sector largely influences this volatility. However, rental growth is anticipated to turn more gradual in 2024, reflecting a market that is returning to normalcy.

Kuala Lumpur

Despite the delivery of 1.8 million sq ft of new supply, no significant changes in the asking rentals of detached warehouses in the major localities of Shah Alam, Kapar, Sepang, Port Klang, Bukit Raja and Petaling Jaya were noted. Warehouse absorption in Greater Kuala Lumpur remained healthy, supported by strong pre-commitment levels from occupiers, with changes in the supply chain and implementation of the China Plus One strategy continuing to drive demand for high-quality logistics space. Following encouraging trends in demand, rental rates and market sentiment in 2023, demand for logistic warehouses will remain positive in 2024.

HCM Metropolitan Area

Due to increasing supply, rents have historically increased as new supply tends to command higher asking rents. However, with an ample supply pipeline, the market will require more time to absorb remaining availabilities and incoming spaces, which is expected to erode the premiums charged by newer developments. The higher competitive pressures are likely to restrain further growth, with rents expected to remain stable in 2024. However, strong occupier demand is likely to keep vacancy rates stable.

Singapore

Island-wide unit rents for warehouse facilities grew in 2023 as demand for quality logistics space remained strong. Rental transaction volume increased by 0.8% to 1,953 units in 2023, with momentum gaining in the second half of 2023. PMI figures improved for the fourth consecutive month in December, with the electronics sector finally breaking a streak of contractions to show expansion in the final two months of 2023. Large international manufacturers such as semiconductor firms are keen to commence operations at new facilities or expansion spaces to catch the global rebound in 2024. With a relatively positive outlook, warehouse rents are expected to rise 5% in 2024 as demand for high-quality storage spaces remains intact amid tight occupancy levels.

India

Bengaluru/Mumbai/Delhi-NCR

The Indian warehousing market continued to reflect the strength of the Indian economy as demand remained steady in the volatile global economic environment, with 0.9 million sq m being transacted in Bengaluru, NCR, and Mumbai in the first half of FY 2024 (April to September 2023). While e-commerce companies remained focused on curbing costs, demand continued to be driven by the manufacturing and 3PL sectors. India has benefitted from the sustained move towards the decentralisation of manufacturing capacity from China. Demand for logistics spaces in the country is expected to remain robust for the rest of the fiscal year, boosted by the government's focus on ‘Make in India’ and the Production Linked Incentive scheme.

The full report can be found here.