Mortgage affordability, greener buildings, and US housing market

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

The most obvious way for central bankers to bring the annual rate of inflation back to 2% is to raise interest rates, but they have other methods to tighten financial conditions.

Investors are currently very worried about the prospect that inflation won't return to target for the foreseeable, and that interest rates will have to remain elevated for much longer than current forecasts suggest. Dropping the slightest hint that this might be the case, as Federal Reserve chair Jerome Powell and his colleagues have done on several occasions recently, prompts investors to sell off long duration government bonds, namely ten-year and 30-year US treasuries. Yields on the bonds rise as values fall - I explore this relationship in a little more detail here.

The yield on benchmark ten-year US treasuries touched 5% yesterday, the highest in 16 years after Powell said that interest rates were not "too tight" at present levels. The 30-year treasury hit 5.1%,a fresh 2007-era high.

This was not a hawkish speech, either. “Given the uncertainties and risks, and how far we have come, the committee is proceeding carefully,” Powell said, which is a reasonable hint that the Fed is inclined to hold rates steady at its next meeting that runs to November 1st.

Deteriorating affordability

Powell acknowledged that investors' shifting interpretations of the Fed's thinking is feeding through to the economy and adds a large dose of uncertainty to decision making moving forward:

"Actual and expected changes in the stance of monetary policy affect broader financial conditions, which in turn affect economic activity, employment and inflation. Financial conditions have tightened significantly in recent months, and longer-term bond yields have been an important driving factor in this tightening. We remain attentive to these developments because persistent changes in financial conditions can have implications for the path of monetary policy."

For an illustration of how all this impacts consumers, look no further than the housing market. The average US 30-year mortgage rate hit 8% on Wednesday morning, the highest level since mid-2000 and up from as low as 3% just two years ago. The impact on affordability has been huge - a $1,700 monthly mortgage payment on the average 30-year mortgage rate would have netted you a $515,829 home a couple of years ago. The surge in mortgage rates has pushed that down to $294,342, see chart below from Bloomberg chief economist Michael McDonough.

“When 30-year mortgages and car loans cost you 8 per cent it will impact consumer behaviour,” Jonathan Gray, president of Blackstone, said in an interview with the Financial Times yesterday. “Growth has been remarkably resilient, but if you keep policy this tight, this long, invariably you will cause the economy to slow down.”

The housing market standoff

The response from homeowners has been to sit tight. After all, refinancing to a much higher rate offers a significant disincentive to move house.

Existing home sales fell 2.0% in September to a seasonally adjusted annual rate of 3.96 million units, the lowest level since October 2010, the National Association of Realtors said yesterday. The number of homes for sale is down 8% compared to the same point a year ago. This has further to run, too. Applications for loans to buy a home fell 5.6% last week to the lowest level since February 1995, the Mortgage Bankers Association said earlier this week.

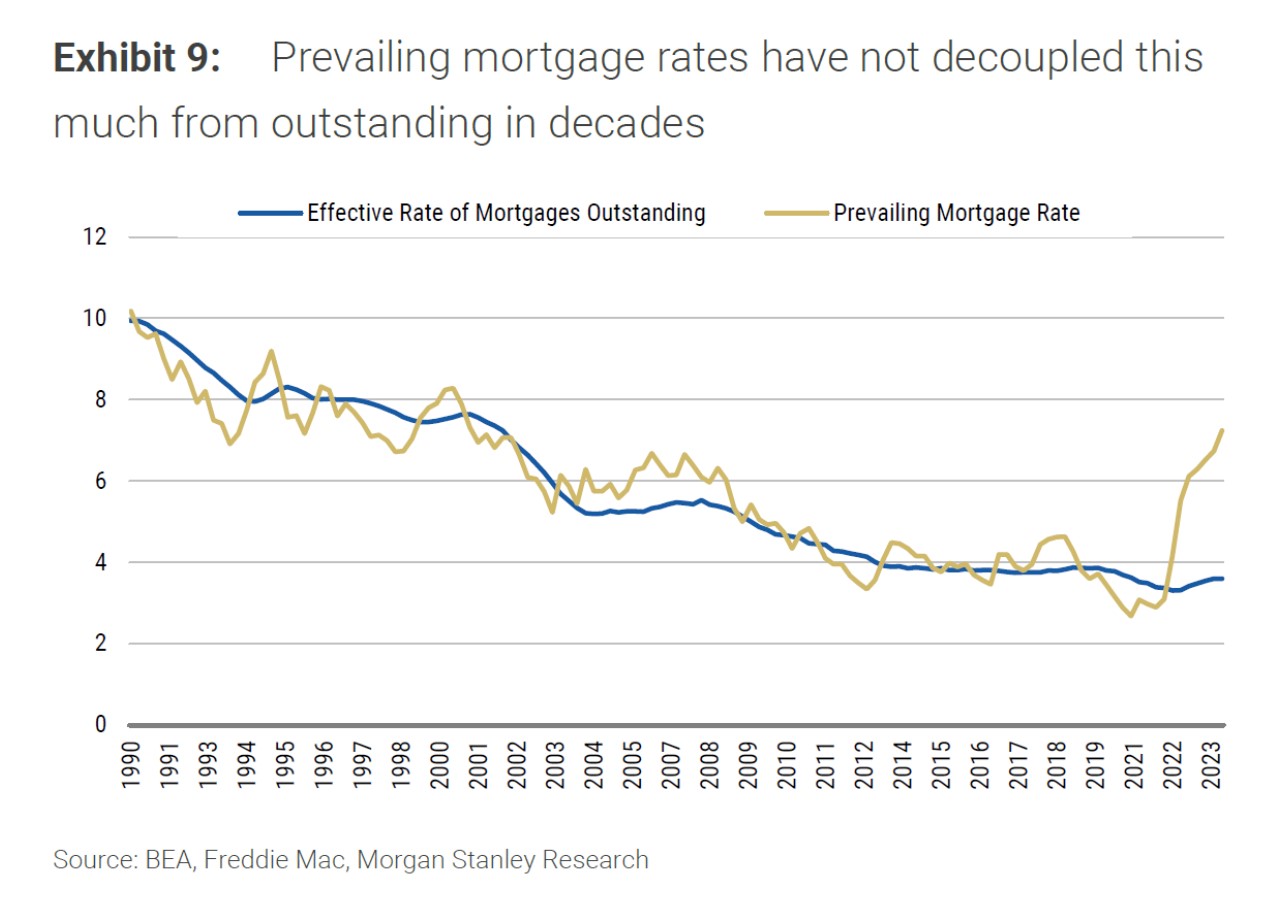

The chart below from Morgan Stanley, which was referenced in this very good Bloomberg podcast with the bank's housing strategist Jim Egan, tracks the effective rate on outstanding mortgages against the prevailing rate, and illustrates just how few people have been willing to give up their lower rate to move. It's unlikely that the standoff will ease to any great extent until long-term borrowing costs begin easing, which should start next year, but it's going to be a slow process.

The aging population complicates things further, due to the expanding cohort of older homeowners who are unlikely to sell for any reason. From 1980 to 2012, a steady 25% of all homes were owned by those 65 and older. Today that figure stands at 33%, and the team at Morgan Stanley only sees it going higher.

Greener buildings

I talked on Wednesday about the National Infrastructure Commission's (NIC) assessment of the government's long term infrastructure challenges, which focussed heavily on climate change and pleaded with ministers to back heat pumps in the residential sector after years of dilly dallying.

There were other important policy recommendations in the report worth keeping an eye on. Large commercial buildings (those over 1,000m2) account for 10% of emissions from buildings, despite making up less than 1% of the building stock. That imbalance makes those buildings a priority in the near term: "targeting regulation at this sector, which is most likely to be able to respond and take advantage of the changing relative prices of gas and electricity, would mean fewer buildings will need to switch in other parts of the building stock which are more challenging to decarbonise."

The NIC wants the government to introduce regulation by 2025 that would end the use of fossil fuel heating in large commercial buildings by 2035.

Finally, the NIC suggests allocating a decent chunk of funding to improve transport in cities between 2028 and 2045, to the tune of about £22 billion. "The initial focus for this funding should be on those cities that are likely to have the greatest need for increased capacity, justifying investment in rail or tram type projects – the Commission’s analysis indicates that these cities are Birmingham, Bristol, Leeds and Manchester."

Government needs to move faster in devolving powers and funding for local transport to local authorities, the NIC said. That would bring the UK model more in line with those that appear to work in continental Europe.

In other news...

Barratt flags 'uncertain' outlook amid tough mortgage market (Reuters), UK consumer confidence tumbles in October (Reuters), ‘holy grail’ bottle of whisky expected to fetch £1.2m at auction (Telegraph), stubborn UK inflation puts Bank of England in a bind (FT), sale of HS2 land to lose £100m of taxpayers’ money (Times), and finally, a mansion with Hong Kong's finest view goes on sale for $166 million (Bloomberg).