New inflation figures bring the end of rate hikes into view

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

The UK's headline rate of inflation slowed to 6.7% in the year to August 2023, down from 6.8% in July, according to official figures out this morning. While that's a small decline, economists had expected a rise to 7% due to fluctuations in fuel prices.

The underlying figures were very positive. Core CPI, which excludes volatile items like energy, food, alcohol and tobacco, slowed to 6.2%, down from 6.9% in July. The Services CPI, which is particularly susceptible to rising wages, slowed to 6.1% from 6.5%.

The figures raise the likelihood that a 25bps hike from the Bank of England tomorrow would be the last in this cycle and will strengthen the hands of Monetary Policy Committee members that say the base rate has already risen far enough. "Holding rates this week looks now a materially under-priced outcome," says Simon French, chief economist and head of research at Panmure Gordon.

Downside risks

The fact remains that UK wages are now rising faster than the rate of inflation. Services prices are coming down, but too slowly for comfort. These conditions are replicated to a greater or lesser extent across advanced economies, presenting central bankers with difficult choices as they seek to walk the line between avoiding recessions while ensuring momentum doesn't return to inflation.

That's the focus of the new OECD global economic outlook: "Uncertainty about the strength and speed of monetary policy transmission and the persistence of inflation are key concerns," the group says. "The adverse effects of higher interest rates could prove stronger than expected, and greater inflation persistence would require additional policy tightening that might expose financial vulnerabilities."

The group expects the global economy to grow by 3.0% in 2023, before slowing down to 2.7% in 2024. A disproportionate share of global growth in 2023-24 is expected to come from Asia, despite the weaker-than-expected recovery in China. Activity has already weakened in the euro area and the United Kingdom, "reflecting the lagged effect on incomes from the large energy price shock in 2022 and the comparative importance of bank-based finance in many European economies."

GDP growth in the euro area in 2023 and 2024 is projected to be 0.6% and 1.1% respectively, with the corresponding numbers for the United Kingdom being 0.3% and 0.8%.

Global housing markets

The OECD notes the falls in house prices from their peaks in some G20 countries, including Korea, Germany and the United Kingdom. Housing investment has declined, especially in the United States and Canada.

"Some signs of stabilisation have begun to appear in recent monthly data," the group added. That's been "supported by structural factors including robust population growth and a limited inventory of houses for sale. Prices have turned back up in a number of countries, including the United States, Canada, and Australia."

Nevertheless, most countries have seen a sharp reduction in the volume of transactions and lending for house purchases, which may presage further weakness. Across the major advanced economies as a whole, risks remain that falling house prices prompt households to curb consumption substantially or trigger a surge in mortgage defaults, though so far these have not materialised, the group concluded.

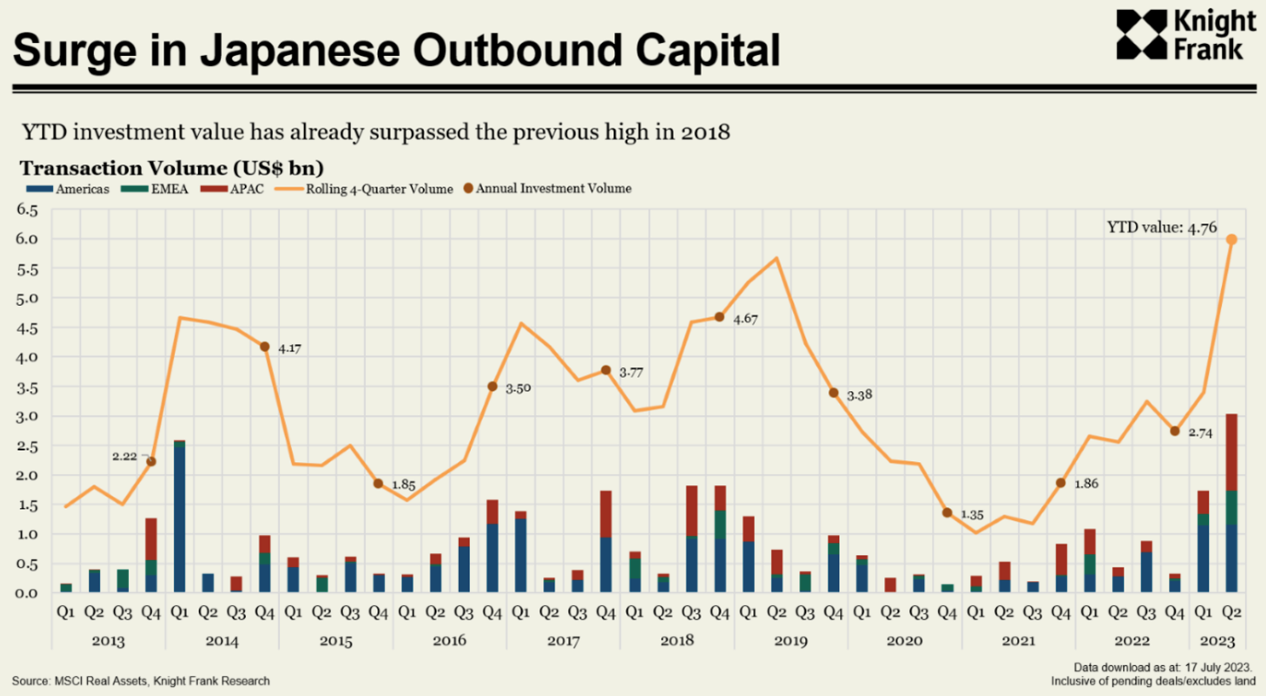

Japanese investing overseas

Japanese spending on commercial real estate overseas soared to US$4.76 billion in the first half of 2023, more than double over the same period a year ago and the highest half yearly total in two decades.

The investing surge is down to a mixture of factors spanning the end of two decades of deflation, economic outperformance, a dovish interest rate stance from the Bank of Japan and the yen's drop to 20-year low against the dollar.

The second quarter exhibited a near six-fold (593%) increase compared to a year earlier, almost 30% of which went into the Living Sectors.

In other news...

Slower hotel revenue growth amidst continued rising costs puts profit margins under pressure, writes Philippa Goldstein.

Elsewhere - Rishi Sunak prepares to water down UK green measures (FT), HS2 costs set to jump as inflation undermines rail project’s future (FT), better news on productivity and some genuine hope for the future (Times), the Fed is set to pause its rate hikes (Bloomberg).

Photo by Ryo Yoshitake on Unsplash