Natural capital and biodiversity opportunities for land owners, businesses and developers

The Rural Report 2023/24 explores how businesses can use natural capital and biodiversity opportunities from carbon credits to nutrient neutrality to support their environmental and economic targets.

6 minutes to read

We have cherry-picked the key highlights from the report from our researchers on the ground, Flora Harley, head of ESG research, and Mark Topliff, rural research.

We explore the options available for land owners, businesses and developers and hear from Knight Frank's rural team in the South Eastern Region to see how they are connecting developers with natural capital custodians.

The Rural Report 2023/24 offers rural property owners and businesses the latest news, guidance, advice and key insights in rural markets.

Download The Rural Report 2023/24

Natural capital opportunities

In her article focussing on natural capital markets, Flora Harley, head of ESG research, asks whether nature-based markets will be as profitable as we think.

Flora lays out the main opportunities and schemes open to UK farms and estates, detailing the latest research into these areas, and crucially the potential returns available.

Carbon credits

What do carbon credits consist of?

Despite lobbying from farming organisations, there are still only two government-backed nature-based carbon markets, the WCC and the PCC, covering woodland and peatland respectively.

These provide the mechanism for landowners to attract carbon funding to support woodland creation and peat restoration projects on their land. This funding support can come from commercial businesses looking to offset their targets or developers meeting legislative criteria for their projects.

What's the potential monetary yield?

Companies are paying between £7 and £20 per tonne of CO2 equivalent (tCO2e) under the WCC and £15 to £25/tCO2e under the PCC. Soil and hedgerow-based carbon codes are being developed, but release dates are yet to be confirmed.

The private soil carbon market is quoted as currently paying around £20 to £40/ tCO2e, and there are several private companies operating in this marketplace.

Biodiversity net gain

What is Biodiversity net gain (BNG)?

The BNG market is still in its early stages, but it has the potential to be a major tool for biodiversity conservation. The market is expected to grow rapidly in the coming years as more and more developers are required to demonstrate a measurable increase in biodiversity – on and/or offsite.

Landowners can provide the necessary gains for developers by committing their land for 30 years and either leasing it to a third party or managing it themselves on behalf of developers.

Read our latest guide to Biodiversity net gain here.

Find out how our rural team can support your business in this area.

What is the potential monetary yield?

The price of the biodiversity units is reported to be between £10,000 and £40,000 each.

Nutrient neutrality

What is nutrient neutrality?

Nutrient neutrality affects sensitive water catchment areas that are deemed to be at risk from excess nutrient pollution. New residential developments need to show how the added “nutrient load” from wastewater generated by the increase in population will be mitigated.

Farms and estates can provide a solution for developers looking for mitigation options by providing nitrogen or phosphate credits. Options may include changing agricultural practices or a wholesale shift to a business, such as ceasing operation altogether.

Phosphate credits in the private market can fetch between £50,000 and £70,000 per kg, while nitrogen credits are typically less than £10,000 per kg.

Find out more about how our Rural team can support with nutrient neutrality.

Water neutrality

What is water neutrality?

Water neutrality is a concept that aims to ensure that the amount of water used does not exceed existing supply levels in an area.

Developments in parts of southern England must demonstrate how increased water use will be mitigated.

A variety of methods can achieve this, one being offsetting water use. This involves developers entering into agreements with farmers with high water usage, such as dairy farmers, and agreeing to pay for works undertaken to catch and store water to be used on farm, instead of using water from the mains.

What is the potential monetary yield?

Developers have been paying around £10,000 to £15,000 per new dwelling on a development to fund offsite water offsetting.

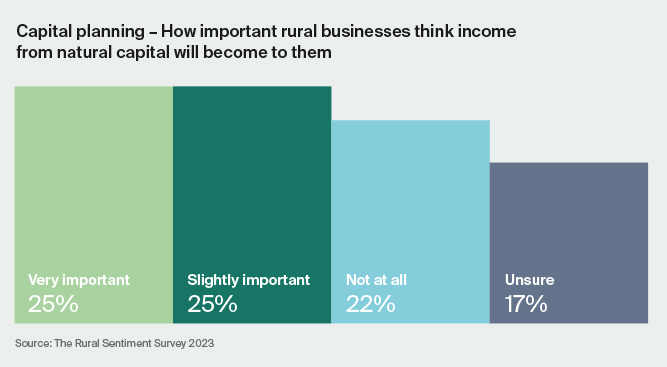

How important is natural capital to businesses?

Read more from Flora on the profitability of nature-based markets on page 20 of the report

Unblocking the housing pipeline

Mark Topliff, rural research, speaks with Knight Frank’s new rural team in Horsham, covering the South Eastern Region that are bringing together developers and custodians of natural capital to help deliver much-needed housing in the south of England.

Below are some of the key insights from our rural team in Horsham.

Jamie Evans-Freke, Rural Consultancy, South Eastern Region

Demand for nutrient credits primarily arises from developers who have set their sights on constructing residential properties that will discharge into a river.

River catchments designated as a special area of conservation can serve as a sanctuary for crucial species like spawning salmon and red shank. Faced with the need to minimise their environmental footprint, developers must offset the nutrients released through sewage outlets.

Jamie says that they are approached by a growing number of developers seeking credits to trade with.

Steph Small, who works alongside Jamie, explains that “this is achieved by partnering with polluters upstream in the same water catchment area and offsetting an equivalent amount of nutrients.” She adds that “through collaborative efforts with statutory authorities, we assist our clients in devising a comprehensive management plan.”

Rachel Patch, Rural Consultancy, South Eastern Region

“The crux of our approach lies in delivering biodiversity improvements that surpass a minimum threshold of 10% enhancement.” In effect, this means that the negative impact of development is counterbalanced by an even greater biodiversity gain elsewhere.

Rachel cites a prime example where a developer was seeking to mitigate their impact by reverting five acres of lowgrade arable ground into a thriving habitat of species-rich grasslands and wildflower meadows.

What may sound like a straightforward transformation in fact requires careful planning and management, as Rachel explains.

“The team diligently prepares a comprehensive management plan, outlining precise guidelines for land stewardship,” she says. “It can be likened to a private stewardship scheme. This plan then ensures that the land is managed in a manner that maximises biodiversity and conservation efforts.”

Isabel Swift, Rural Consultancy, South Eastern Region

“Water offsetting may seem like a distant concern for many, but for a handful of local authorities in the Sussex North Water Resource Zone, including Horsham, parts of the South Downs National Park, West Sussex, Crawley and Chichester, it has become an urgent issue,” says Isabel.

The Environment Agency has identified these areas as being under significant water stress. In 2021, Natural England issued a position statement to the authorities, highlighting the detrimental impact of water abstraction on wildlife sites. Consequently, any new development within the catchment must not worsen the situation. As a result, a large number of units have become “stuck” in the planning system.

Read about how the Horsham team are connecting developers and custodians of natural capital on page 68