UK rural property: Garnering investment in nature

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

10 minutes to read

Opinion

As Mark points out below, the government is putting a lot of faith in the private markets to bankroll its ambitious plans for nature restoration and climate change mitigation. I discuss some of the issues in more detail with Green Finance Minister Lord Benyon in the forthcoming issue of The Rural Report. And from people I’ve spoken to it won’t be a lack of cash from funds that believe natural capital is the asset class of the moment that is the problem. The big question will be whether the expectations of the funds for a tasty return, line up with those of the rural property owners and stewards actually supplying the natural capital AS

Do get in touch if we can help you navigate through these interesting times. You can sign up to receive this weekly update direct to your email here

Andrew Shirley Head of Rural Research; Mark Topliff, Rural Research Associate

In this week's update:

• Commodity markets – Grain estimates are pulled back

• Natural capital – Downing Street tries to lead on financing nature

• Waste charges – Will changes tackle fly tipping?

• Out and about – An inspirational story

• ELMs – Now pick and mix from expanded SFI actions

• Interest rates – Assess options now

• Survey – Win an F&M hamper

• Yorkshire opportunity – Barns with a view

• House prices – Country homes take a dip

• Farmland Index – Prices rise in quarter 1

• The Wealth Report – 2023 edition out now

• Farmland Index – Agri-land 2022's top-performing asset

Commodity markets

Grain estimates are pulled back

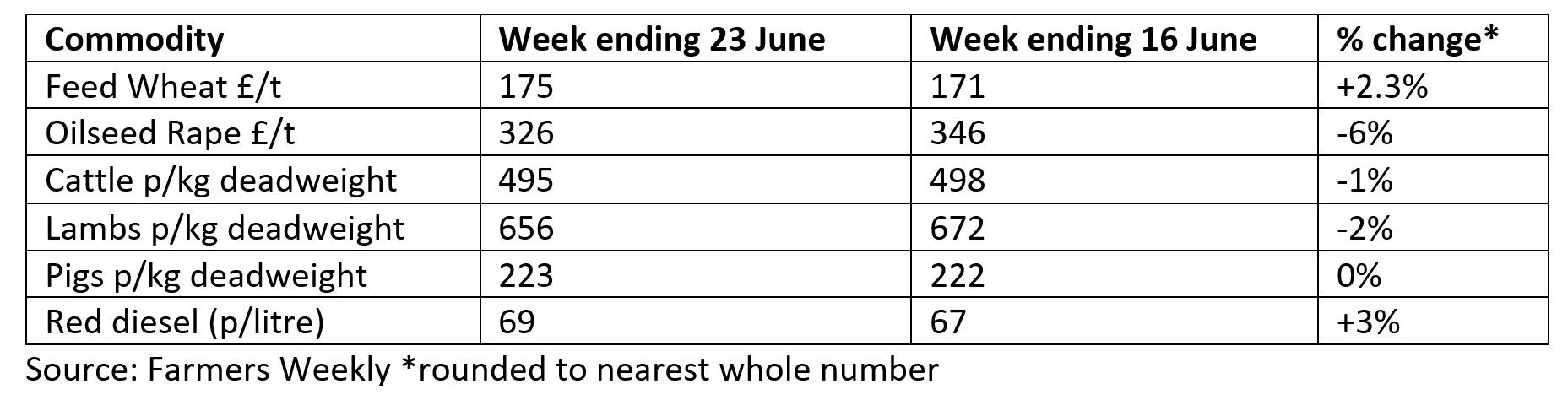

Reports from various markets around the world mention reduced crop expectations as hot dry weather is in part to blame. Germany’s 2023 wheat and rapeseed crops could be around 3% lower on last year. India’s wheat harvest is said to be back 10% on government estimates. Over in the US, corn and soy forecasts are also expected to be dropped due to drought conditions worsening in some states.

But uncertainty reins around what will happen to the Black Sea grain corridor with Russia seemingly standing its ground saying the initiative isn’t being properly implemented. Growers have been watching wheat market spot prices closely and hoping feed grain will return to above £200/t. Andrew Martin in Knight Frank’s Agri-consultancy team suggests “watch the November 2023 and 2024 feed wheat prices as well. They are currently above £200/t, which is a key price point for many to cover costs. Such is the uncertainty that we have experienced and likely volatility to come it’s as well worth locking some grain into both these levels.”

Meanwhile, the US Environmental Protection Agency has finally set out its biofuel mandate targets for the next three years. This is the level of vegetable and plant-based ethanol to be used in fuel blends. It wants the fuel industry to be using over 22 billion US gallons of biofuels by 2025. Despite an increase on previous years, these targets were lower than expected by a biofuel market that made heavy investments and oilseed prices weakened MT

Talking points

Natural capital – Downing Street tries to lead on financing nature

Earlier in the year, the government set a target of at least £500 million of private funding to finance investment in nature every year by 2027, rising to £1 billion by 2030. These are ambitious aims and its latest attempt to show leadership, was the Nature for Finance event held at 10 Downing Street. It brought together farmers, land managers, investors and conservation experts to ‘identify new investment opportunities’ to drive nature recovery and continue support for food production.

At the event it was announced that a little-known fund called the Natural Environment Investment Readiness Fund (NEIRF) will be launching its next round of applications later this year with a focus on farming. It will be the first time this fund will have been used for the farming sector. According to Defra “The NEIRF funds projects that have the potential to produce revenue from the benefits nature provides to attract and repay investment, as well as projects able to produce an investment model that can be scaled up and reproduced.”

The government hasn’t just been wooing UK investors to nature this last week. It also announced a joint initiative with the French government to step up global efforts in garnering investment in biodiversity. They outlined a strategy to create global biodiversity credits. The credits will document a project’s location, developer, and include measurement and verification processes for transparency MT

Waste charges – Will changes tackle fly tipping?

Discovering a load of dumped waste from a home improvement project sat in a gateway is an all too familiar sight for many landowners and land managers. Fly-tipping is estimated to cost the economy £924 million per year. Defra hopes that recently announced changes to waste disposal charges may just help alleviate the problem alongside other initiatives. The environment Minister Rebecca Pow plans to abolish charges to dispose of DIY waste at household waste recycling centres.

Apparently around a third of local authorities still apply a charge for household DIY waste, which can be up to £10 for an individual item such as plaster board. Farms and estates will welcome anything that might make it easier and cheaper for people to get rid of their waste and reduce that temptation to use cowboy firms.

This announcement is on the back of the Environment Agency’s planned consultation in Autumn 2023 that will consider bringing in charges for waste exemptions in England by April 2024. The NFU reports that there are a number of commonly used on farm exemptions that may be affected such as burning waste in the open. Farmers and estate managers will be hoping that the changes are joined up and won’t negate the efforts to reduce fly-tipping MT

Out and about – An inspirational story

Our out and about this week was one that was truly inspirational. Andrew and I visited David and Brenda Mwanaka who in January this year took on the tenancy of a county council farm in Cambridgeshire. But for the Mwanaka’s to get to this point we discovered the story of a farming couple who seemingly against the odds with little agricultural experience but with a huge amount of determination, refusal to take no for an answer, and a lot of hard work have managed to be successful at doing something different in British agriculture.

Watch out for Andrew’s article in Knight Frank's The Rural Report 2023/24 to find out more - coming out soon MT

Need to know

ELMs – Now pick and mix from expanded SFI actions

There will be more Sustainable Farming Incentive (SFI) actions and a pick-and-mix approach for choosing which actions land managers wish to sign up, from August 2023. Defra has said that there will be 19 new actions – twice as many as originally planned – plus the four carried over from 2022. The new actions that will be offered include hedgerows, integrated pest management, buffer strips, low-input grassland and payment for not using insecticides. Defra has also confirmed that Severely Disadvantaged Areas will receive the same payment amount for low-input grassland as in the upland and lowland areas.

Calls for better flexibility with SFI have seemed to lead to a change in the structure of the scheme. Instead of actions being grouped under standards, actions will now be able to be picked from a list of those that will work on your land. This approach means land managers can choose which actions they wish to include in their agreements. Another 30 actions are due to be available in 2024. Defra also says that despite the SFI structure changes, existing 2022 agreement holders won’t be disadvantaged and will be transitioned across to the SFI 2023.

Henry Clemons, a grants expert in our Agri-Consultancy team, says: “The changes that Defra have made will be taken as a positive step forward, introducing flexibility of choice and agreements that can be taken for the short term. But before considering entering into a new SFI agreement, also look at what Countryside Stewardship has to offer and how both schemes can help your income and objectives.”

The new 2023 SFI handbook published by Defra can be accessed here MT

Interest rates – Assess options now

As the news rolled in about the Bank of England increasing the base rate for the umpteenth time in a row, media coverage focused on the impact on household mortgages. But there is also an impact on rural businesses that are already trying to grapple with production costs that have risen significantly. Although some expenses have fallen recently, like fertiliser and fuel, it will add to finance transaction costs and hit those who use debt to make large purchases. It does seem though, that farming businesses have been reacting to higher rates with reports of ag borrowing levels falling in the last two years. However, as Bradley Smith of Knight Frank Finance says: “A lot of farmers will still be on variable interest rates, including their overdrafts, and a 0.5% increase is quite a hit at once. So now might be a good time to look to refinance any debt into longer-term loans.” MT

Survey – Win an F&M hamper

If you fancy a chance to win a “Teatime” picnic hamper from Fortnum & Mason why not take our short Summer Residential Sentiment Survey compiled by my colleague Chris Druce in our Residential Research team? AS

On the market

Yorkshire opportunity – Barns with a view

Our new Yorkshire office is selling a development project at Newby Cote, Clapham, North Yorkshire. The three barns with stunning views towards Keasden Moor and the Forest of Bowland AONB have planning consent for four semi-detached homes and one detached house. The guide price is offers over £700,000 AS

Contact Hannah Renwick for more information

Knight Frank Research

House prices – Country homes take a dip

The average value of country houses fell by 0.5% in the first quarter of the year as the cost of borrowing continued to rise, according to the latest findings from the Knight Frank Prime Country House Index. On an annual basis prices have dropped by 0.8%. Demand remains strong, but transaction numbers fell in the aftermath of Liz Truss's mini budget last autumn. "Ultimately, despite resilient demand, we expect the reduction in spending power caused by the increase in the cost of borrowing and improved supply to see prime regional prices decline by a few percentage points in 2023," predicts my colleague, Chris Druce.

Farmland Index – Prices rise in quarter 1

Agricultural land proved resilient in the first three months of 2023. While residential property values weakened, the average price of bare farmland rose by 2%, edging closer to £9,000/acre, according to the Knight Frank Farmland Index. The hike takes the annual rise to 11%, reinforcing farmland's reputation as a good hedge against inflation. Read the full report for more data and insight

You can also listen to the latest edition of our Intelligence Talks podcast where I discuss biodiversity net gain and nutrient neutrality schemes with my Rural Consultancy colleague Isabel Swift AS

The Wealth Report – 2023 edition is out now

Knight Frank's leading piece of thought leadership on property and wealth trends was launched recently and includes an interview by me with one of Scotland's pioneering rewilders, as well as some thoughts on why farmland could be one of this year's most in-demand property investments. Download your copy to find out more AS