UK country market closes price gap with prime central London by a fifth during pandemic

Higher-value properties gained most ground since 2020

2 minutes to read

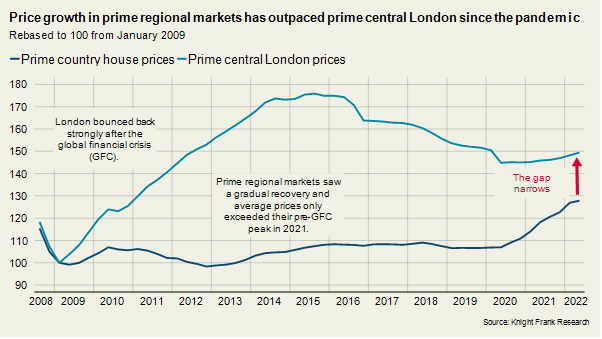

The price gap between the UK country house and prime central London (PCL) markets has narrowed by a fifth since the pandemic, according to Knight Frank data.

The surge in demand for properties offering more space and greenery transformed the fortunes of markets outside the capital, while it has been a more subdued picture in London for reasons that include less international travel.

In December 2022, the Prime Country House Index was 18.4% higher than before the first national lockdown. Meanwhile, in PCL there was an equivalent fall of 0.8%, meaning the gap between the two narrowed by almost 20% over the period (see chart).

“The revaluation of lifestyles that followed Covid-19 combined with a stamp duty holiday sparked a boom in the UK country market, as people recognised the relative affordability, extra space and greenery that it offered,” said Chris Druce, senior research analyst at Knight Frank.

London recovered strongly after the global financial crisis (GFC), with average prices in PCL exceeding their pre-GFC level in just over three years as global investors sought safe havens.

Measuring from January 2009, the gap between PCL and prime regional markets reached its widest point (69%) in Q3 2014.

However, pent-up international demand and the relative value on offer in the capital will see PCL erode some of the country market’s gains over the next five years, as we detail in our forecasts.

Gains since the pandemic have been particularly pronounced in the higher value bands in the country market, which had previously seen some of the weakest growth due to political uncertainty and a series of tax changes that disproportionately affected it.

Prime regional prices above £5m+ climbed 36% between March 2020 and December 2022, with a record period for the super-prime country market in 2022.

What’s next for the country house market?

While the escape to the country trend is relenting, demand is proving resilient and supply is building as we enter the spring market.

Permanent changes such as flexible working will continue to support demand outside of London and we expect annual price growth in prime regional markets to settle at 3% from 2025.

We also expect the levelling up of UK house prices that began before the pandemic to continue. This will be underpinned by economic sectors focused away from London, such as logistics and life sciences.