Why New York’s firm fundamentals are helping it weather the economic headwinds

Against a backdrop of economic uncertainty and volatility in several asset classes, New York’s steady price growth, rising rents and low purchase costs are supporting demand.

1 minute to read

Manhattan’s luxury market is on a firm footing. While the S&P 500 fell 19% in 2022, and estimates suggest crypto plummeted 50%, luxury homes in New York registered 2.7% average growth, despite the Federal Reserve embarking on its fastest pace of rate hikes since the 1980s.

For a succinct summary of the New York insight report, see the 60-second round up from our international research analyst, George Stewart.

According to Miller Samuel, the average price of a luxury Manhattan home stood at US$1,948,603 at the end of 2021, a 2.7% increase equates to an average uplift of US$52,612 in 2022.

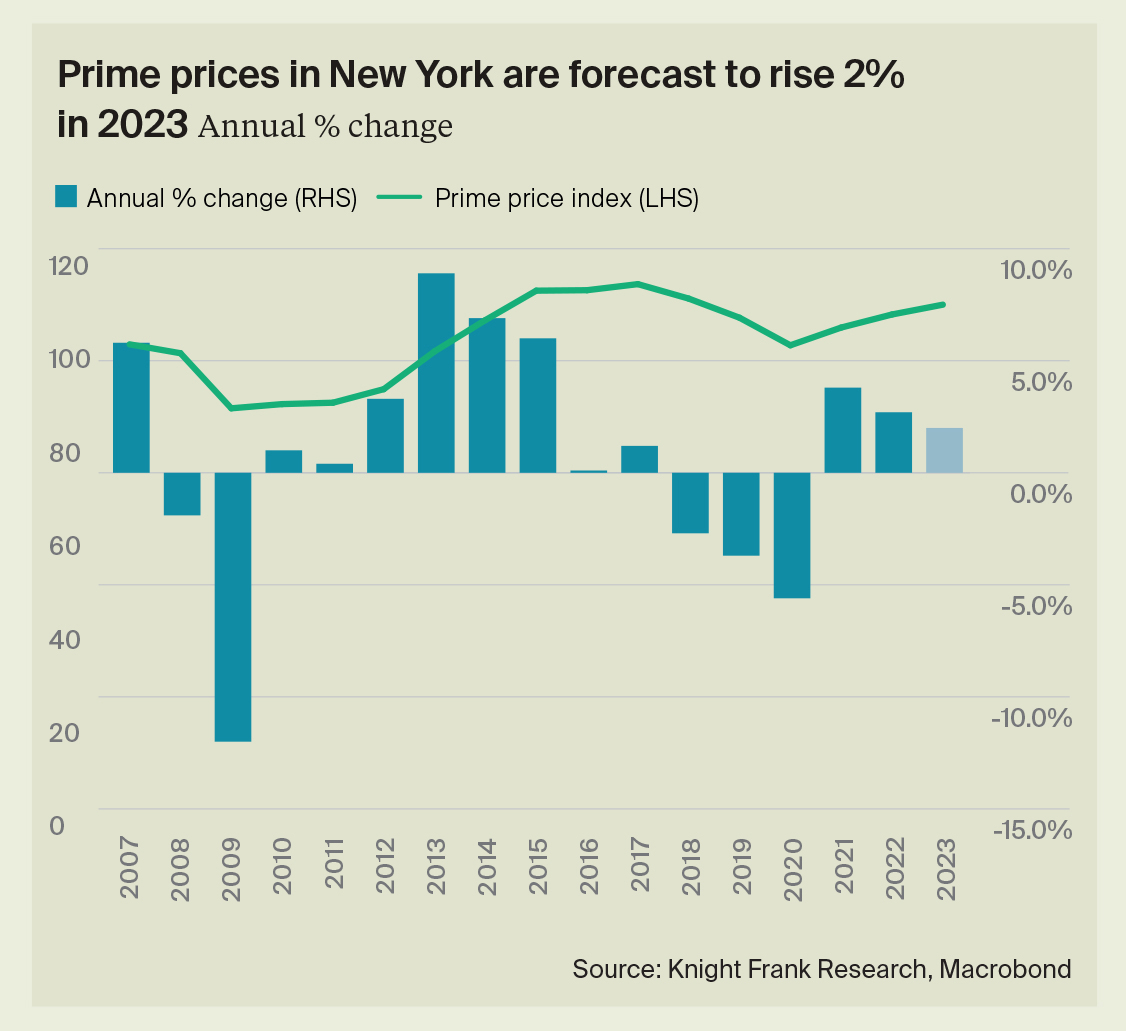

Knight Frank forecasts 2% growth in 2023, higher than the city’s 10-year average performance of 1.1%. Although interest rate rises, the Silicon Valley Bank’s collapse and recessionary fears will temper buyer sentiment, the unsettled financial and economic environment may favour prime property in tier one cities.

Safe haven inbound capital flight is evident in New York, not surprising, given more UHNWIs reside there than in any other global city. Data from The Wealth Report 2023 confirms 37% of wealthy individuals in the US are prioritising capital preservation, higher than the global average of 26%.

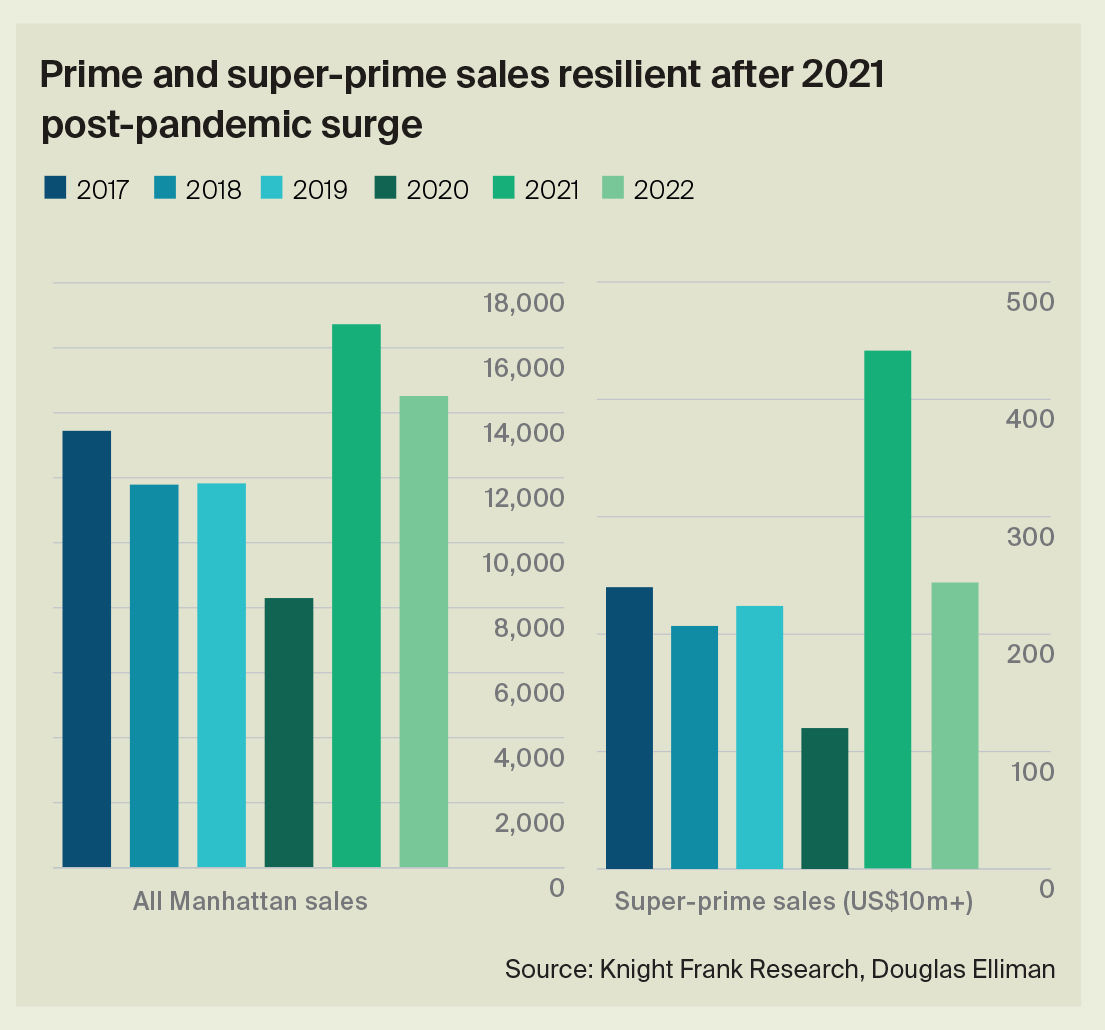

Sales rates remain robust. Over 14,500 properties changed hands in Manhattan in 2022, 23% above 2019 pre-pandemic levels, and the city posted 244 sales above US$10 million, more than any other global city in 2022.

With cash buyers accounting for 80% of new home purchases in Manhattan, the market is better insulated from rate hikes. Despite the wider economic uncertainty, there is a degree of optimism amongst US wealthy individuals. Some 21% saw their wealth increase in 2022, but 64% expect their wealth to increase in 2023, according to Knight Frank’s Attitudes Survey.

Discover more

Sign up here to receive future US research and analysis.