Our threats and opportunities for 2023

Making sense of the latest trends in property and economics from around the globe

2 minutes to read

The UK economy contracts

The UK economy contracted more than expected during the third quarter, according to a dismal set of official figures published yesterday. Business investment fell 2.5% - that was revised down from a provisional estimate of -0.5%.

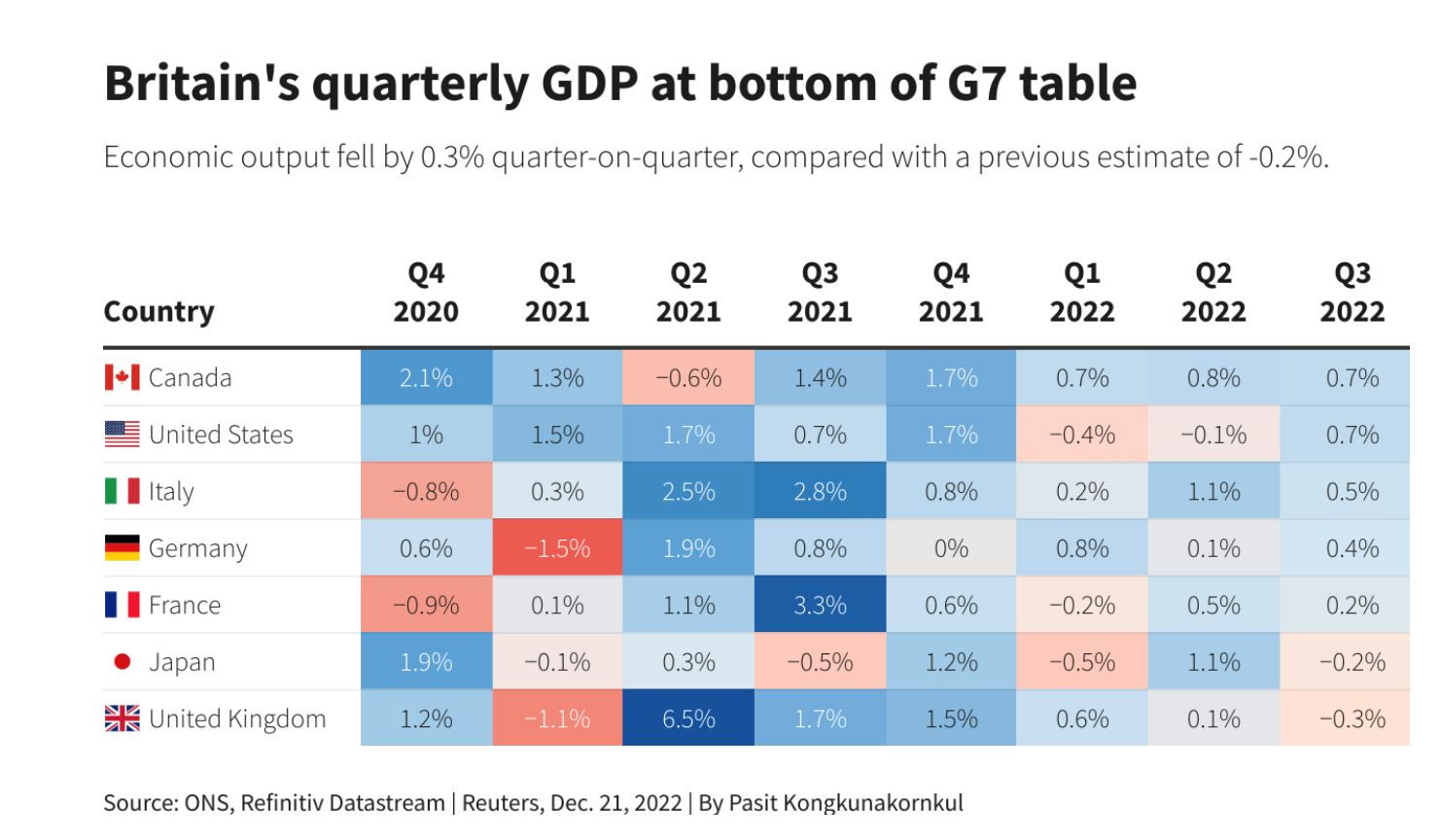

Reuters has a good round up here (chart below). The services sector continued to expand, but contractions in both construction and manufacturing dragged down the overall figure, putting Britain as the laggard among the G7 nations as we move into 2023. Sterling fell to its lowest level against the euro since mid-November.

All-in-all, not very festive. However, whether it's global residential, rural, retail or the office market, we see a range of opportunities emerging amid the turbulence in 2023. I gathered our sector experts this week for a final edition of our Intelligence Talks podcast. We discuss the biggest threats and opportunities in their markets, and squeeze it all into just 15 minutes - listen here, or wherever you get your podcasts.

US home sales fall

US mortgage rates have now fallen for six straight weeks, but it's unlikely to break the gloom for housebuilders.

Confidence among housebuilders has fallen for twelve consecutive months, according to the latest reading from the National Association of Home Builders. Many are now opting to pause new projects - permits issued for new construction fell to a two-and-a-half year low in November, according to the Commerce Department.

Sales have dropped sharply and, considering the uncertain outlook for interest rates, it's unclear at this stage how far that has to run. Nationally, sales fell 35% in November compared to the same period a year earlier, according to Redfin, capping the largest drop since the company began keeping records a decade ago.

Perhaps surprisingly, consumer confidence is rising amid signs inflation has now peaked. Nevertheless, fewer households plan to make big-ticket purchases over the next six months.

The Covid outbreak in China

The relaxation of Covid-19 restrictions in China has prompted a substantial outbreak in new cases - as many as 1 million new infections a day, according to Airfinity data cited by Bloomberg.

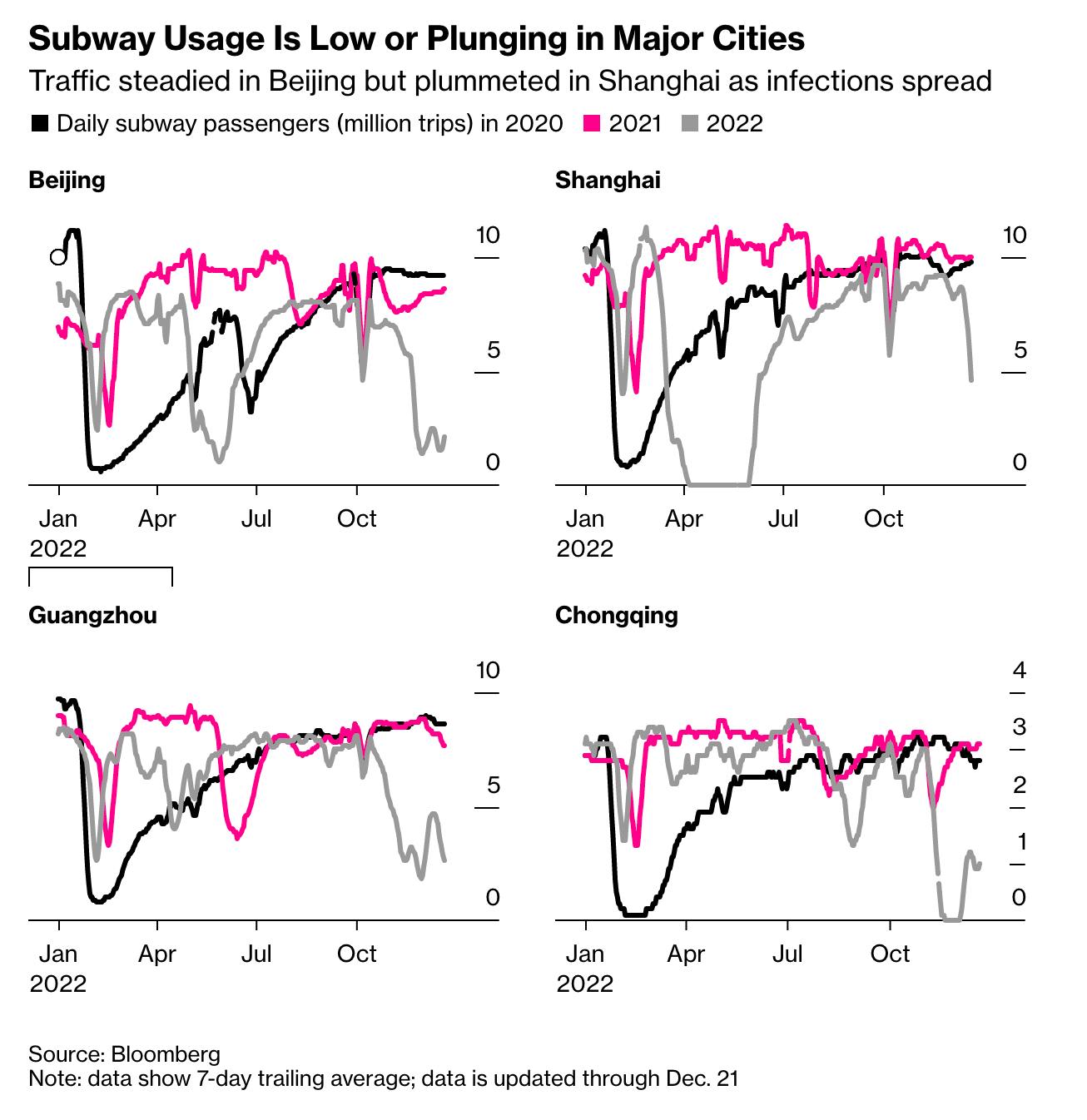

Economic activity is contracting rapidly. Travel data, also via Bloomberg (see chart), shows large numbers are choosing to remain home for fear of infection. The government intends to continue with reopening as things stand with a cut to quarantine requirements for overseas travelers starting in January.

In other news...

Market insight – what our most viewed content tells us about 2022 property trends.

Some rural reflections on 2022 as we look forward to the New Year.

UK Residential - the ‘great recalculation’ will have to wait until 2023.