Three scenarios for the global economy

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Three ways this could all pan out

Central banks across the world are raising interest rates "with a degree of synchronicity not seen in five decades", yet the current pace of tightening lacks the urgency to restore low inflation "in a timely fashion".

That's according to a baseline scenario published by the World Bank yesterday - report here (but short press release here). Should central banks raise interest rates to the degree markets believe they will - with the Fed hiking to 3.7% in Q1 2023, for example - the global economy would experience a slowdown next year comparable to the downturns of 1998 and 2012. That pace of tightening, however, would be insufficient to return global core inflation to a rate compatible with central bank targets within the usual time horizon of about two years.

With that in mind, the World Bank publishes two alternative scenarios. The first, a "sharp downturn", sees inflation expectations continue to drift upwards, prompting central banks to hike interest rates 100 basis points above the baseline scenario in Q4 2023 and Q1 2024. The global economy would still escape a recession, but would experience a downturn on par with 2001. Global activity in this scenario recovers in 2024, but the projected GDP growth rate of 2.7% remains 0.3% below the baseline rate.

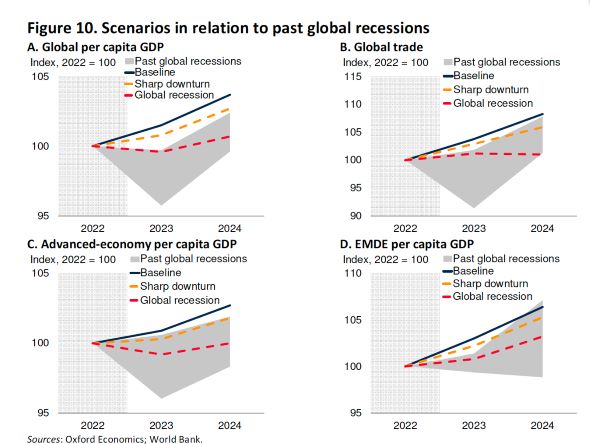

Secondly, the bank sees the potential for a global recession, defined as a contraction in annual global real per capita GDP. In this scenario, central banks may need to raise interest rates by an additional 2%, potentially causing GDP growth to slow to 0.5% in 2023—a 0.4% contraction in per–capita terms that would meet the technical definition of a global recession. This level of tightening could still avoid recession, however, if central banks manage to implement it in a manner that minimises financial system stress. You can see how the potential scenarios compare to previous downturns in the charts below.

The squeeze continues

Tuesday's hotter-than-expected US inflation reading set off a rout in global stock markets on fears the Fed would be strong-armed into a prolonged period of aggressive interest rate hikes, as we discussed on Wednesday. A surprise rise in retail sales during August, revealed in data published yesterday, will do little to alleviate those concerns.

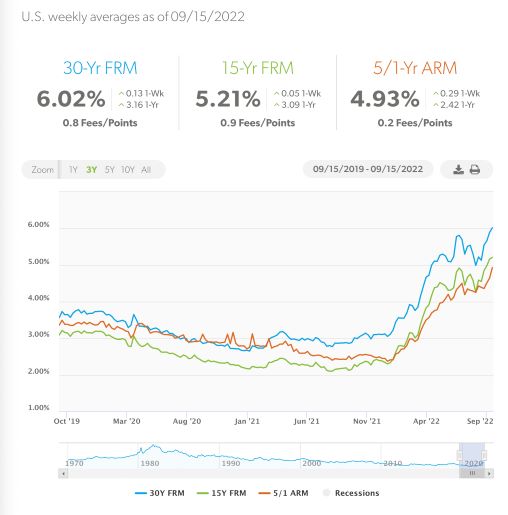

The average 30-year mortgage rate surpassed 6% for the first time since 2008 this week, according to Freddie Mac (see chart). Declines in house prices are likely to continue as a result, though they are likely to be capped by inadequate supply, the group said.

Of course, the US is no isolated case, and tightening monetary policy is weighing on spending in several major economies. Kate Everett-Allen took a closer look at how all of this is effecting key housing markets yesterday.

Rate hikes and tax cuts

UK consumers believe inflation will remain at 4.9% a year from now, according to The Bank of England's closely-watched Inflation Attitudes Survey, out yesterday. That's the highest reading for that metric since the survey began more than two decades ago. Satisfaction with the Bank's handling of inflation also hit the lowest level on record.

The measure of inflation expectations is one of many metrics suggesting the Bank will opt for a bumper hike of either 0.5% or 0.75% at its meeting next week. In a neat illustration of the current divergence of monetary and fiscal policy, the government will hold an "emergency mini budget" on September 23rd, suggesting we'll get a rate hike on Thursday followed by tax cuts on Friday.

The mini budget will likely include scrapping the limit on banker bonuses in an attempt to boost Britain's competitiveness, according to various reports yesterday. The BoE yesterday took the unusual step of supporting that move.

Country living

Offers accepted in the UK country house market were up 33% last month versus the five-year average, suggesting transaction volumes are set to remain high in the coming months, according to the latest analysis from Chris Druce.

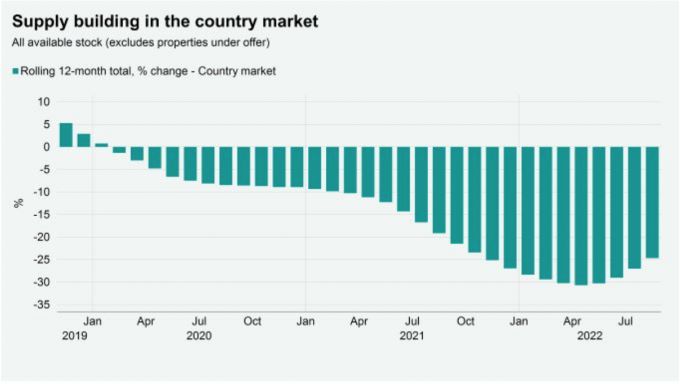

At the same time, supply continues to build from a low base as buyers look to capitalise on rising prices and act before mortgage rates rise further, which will keep downwards pressure on prices for the time being. The amount of homes available for sale in the country market has been gradually increasing and at -25% in the 12 months to August vs the previous year, was the narrowest gap since October (see chart).

In other news...

The Fed must avoid Volcker’s mistake on inflation (FT), and finally, Germany is working on a historic takeover of three gas companies (Bloomberg).

Photo by Markus Krisetya on Unsplash