Prime cities house price growth slows again

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Global house prices

Rising interest rates and a deepening sense of economic uncertainty is now weighing on house price growth across many global cities.

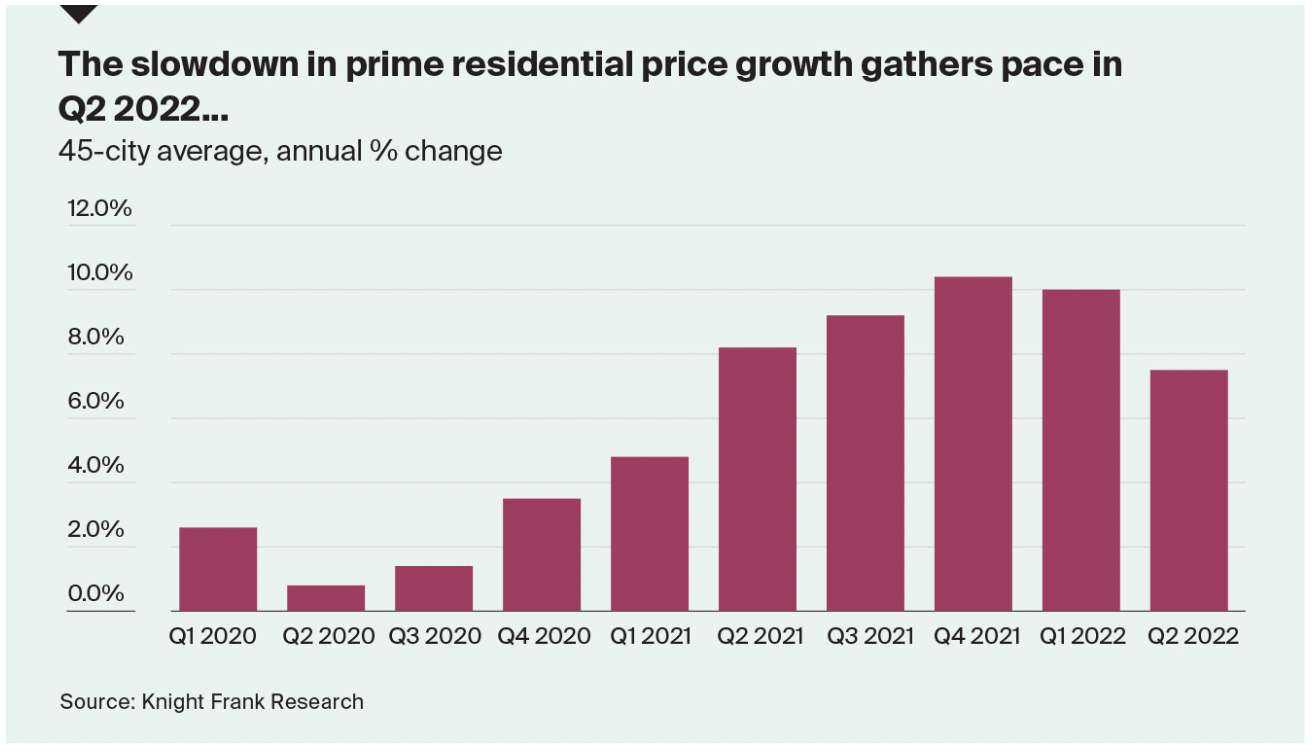

Prime prices across the 45 cities tracked by our index climbed 7.5% during the year to Q2, down from 10% in the previous quarter (see chart). This is still a story of slowing growth rather than falling prices. The rate of annual growth slowed in 19 of the 45 cities, while just six are registering declines - the same as the previous quarter.

The slowdown is being felt most in markets driven largely by domestic purchasers. Auckland, Wellington, Toronto and Stockholm registered some of the largest slowdowns during the quarter. At the other end of the scale, Dubai leads the annual rankings with growth of 64.8%, despite the city registering its first quarterly price fall.

UK house prices

UK house price growth slowed to 0.1% during the month of July, the slowest rate of growth for a year, according to Nationwide. That brings annual growth to 11%.

House prices have retained their momentum in the face of the cost of living squeeze and souring consumer confidence due to the supply/demand imbalance. We're already seeing signs of rebalancing on that front and rising mortgage rates will drag on activity as the year progresses, bringing annual price growth back into single digits before the end of the year.

A 50-basis point interest rate hike from the Bank of England looks likely tomorrow - that decision will be published at midday. Anything less will further weigh on the pound, which is already the second-worst performing major currency since Russia’s invasion of Ukraine, according to Bloomberg.

Residential development

A lack of available development land is fuelling growth in the price of certain types of residential development land. Greenfield land remains the strongest performer, with prices up 13.9% annually, followed by prime central London, which rose by 2.5%.

Both major housebuilders and Housing Associations are looking to build pipelines amid a dearth of opportunities, all while competing with hotel, office and industrial buyers. The shortage of development opportunities is such that 74% of the SME and volume housebuilders who responded to our latest survey suggested that they were actively looking at land with any level of planning status, including strategic land.

Our survey showed that, while increasing costs of living pressures were weighing on buyer sentiment, build cost inflation and pressures on the supply chain continue to have the biggest impact on the sector. Official forecasts suggest build costs will increase 11.4% in 2022 (up from 6.9% last year), before easing to 2.8% in 2023.

In this environment, signs are already emerging that housing delivery rates could slow moving forward. Nearly 40% of our survey respondents said they expected new starts to fall in the third quarter, as a result of land shortages (only 14% of responses suggested land supply was adequate), the end of help-to-buy and the effect of the Department of Fisheries and Rural Affairs (DEFRA) Nutrient Neutrality rules on schemes gaining approval.

US jobs

The US jobs market is showing the first signs of cooling, according to data published yesterday.

Employers posted 10.7 million vacant positions at the end of June, a sharp drop from the previous month, though vacancy levels remain well above historical norms - see chart below courtesy of the New York Times.

The official monthly jobs report will give more detail when it's published on Friday, and economists expect that to show the unemployment rate sticking at a near 50-year low. Whatever that shows, it's still a secondary data point in the eyes of the Fed. Officials continue to signal that interest rates will continue to rise until inflation is under control, whatever pain that causes in the jobs market.

Mortgage rates have risen rapidly since the turn of the year, but have ticked down slightly from recent highs as investors bet that interest rates will fall again through 2023.

In other news...

Office markets around Europe continue to perform despite economic uncertainty.

Property sales in Provence climb 28% in the first half of 2022.

Elsewhere - The Met Office says last month was driest July in England since 1935 (Reuters), Eurozone mortgage rate rises threaten house price growth (FT), the UK is already in recession, says think tank (Bloomberg).

Photo by Riley Edwards on Unsplash