Price growth peaks in country market due to improving supply and buyer caution

Prime Country House Index 291.9 / Quarterly price change 0.7% / annual price change 8.2%

3 minutes to read

Price growth slowed in the UK country house market in the three months to June, as buyers become more circumspect against the backdrop of rising living costs and supply continued to normalise.

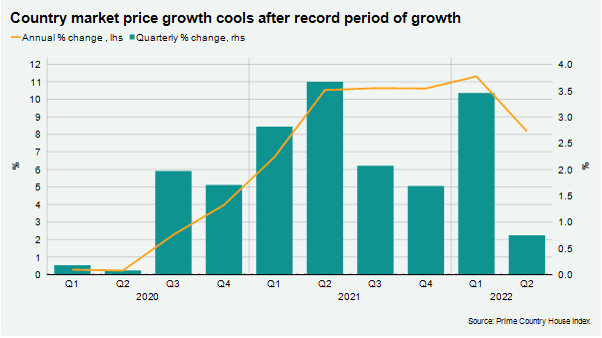

Average prices rose by 0.7% in the second quarter, compared with 3.5% in the three months to March.

It was the weakest quarterly growth since the market reopened in May 2020 after its enforced closure. It meant the annual change fell from 11.3% in March to 8.2% (see chart).

“Best-in-class properties continue to fly off the shelves and attract competitive bidding but homes with minor issues, such as road noise, that would have flown a year ago are no longer moving quite as quickly. In that sense the market is normalising,” said Ross Davies, head of Knight Frank’s Tunbridge Wells office.

The country market has experienced a boom during the last two years, as the pandemic drove demand for space and greenery through the roof. This saw the average price of a property in the country market reach a new high in the first quarter of the year after a period of sustained double-digit growth.

Price growth outside of London had been relatively muted before the pandemic with the country market underperforming prime central London (PCL) in the period since the global financial crisis in 2007. However, it has closed the gap in the past two years with average prices growing by 18% in PCL and 20% in the country market since the start of 2020.

While sentiment is softening due to concerns over the rising cost of living, including the prospect of higher mortgage costs, there remains plenty of frustrated demand in the system.

Supply was tight as the shelves emptied quickly during the stamp duty holiday and some sellers held off from coming to market due to a shortage of purchase options, producing a vicious circle of low stock.

The number of active buyers in June was unchanged on a year ago and with supply improving this has led to a flurry of deals. The number of offers accepted in the quarter was the highest since Q2 2021, when the closing window of a stamp duty holiday led to frenetic market conditions.

The Bank of England’s next bank rate decision is next month, but the average interest rate on a five-year fixed-rate mortgage (at an LTV of 75%) has climbed by two percentage points to 2.7% in the past year in anticipation of further increases.

“We have a lot of very motivated buyers looking to secure something and lock in a deal before mortgage rates climb further. Now supply has improved they feel they’ve seen a good selection of properties and have decided to act,” said Mark Proctor, head of the South West region at Knight Frank.

The gap between new prospective buyers (demand) and new instructions (supply) was the narrowest it has been since the start of the pandemic in the three months to June. New prospective buyers were +18.8% and new instructions +6.9% versus the five-year average (excluding 2020).

We expect this and increasing economic headwinds to place downwards pressure on prices in the second half of the year and annual growth in the country to be 7% this year.