How will a rise in the cost-of-living impact residential rents?

With inflation predicted to reach 11% by October, many are wondering what a rise in the cost of living will mean for residential rents.

3 minutes to read

Inflation is running at multi-decade high and continues to rise; meanwhile this year household budgets are expected to see one of the biggest squeezes in real terms for a generation.

Simply put, Build to Rent (BTR) assets offer defensive characteristics well-suited to these conditions. Shorter leases and a frequent turnover of tenants enable rents to keep pace more closely with inflation. The potential this sector holds is not lost on investors; in 2021 a record £4.3 billion was spent in the UK BTR sector, and a further £1.2 billion was committed in the first quarter of 2022.

Will upwards pressure on residential rents continue?

Rental growth is at a multi-year high across the UK; last year rents rose at their fastest pace in over a decade while the ONS reported annual growth reached levels last seen in 2017. This growth is, in part, being driven by an ever-deepening mismatch between supply and demand. Knight Frank’s research shows the number of properties available to rent during Q1 2022 was over a third lower than the five-year average pre-pandemic. At the same time demand from tenants is rising.

For now, this shortfall is outweighing any potential drag on values caused by an increase in the cost-of-living, meaning upwards pressure on rents is expected to continue. Strong wage growth relative to rents in recent years is contributing to this.

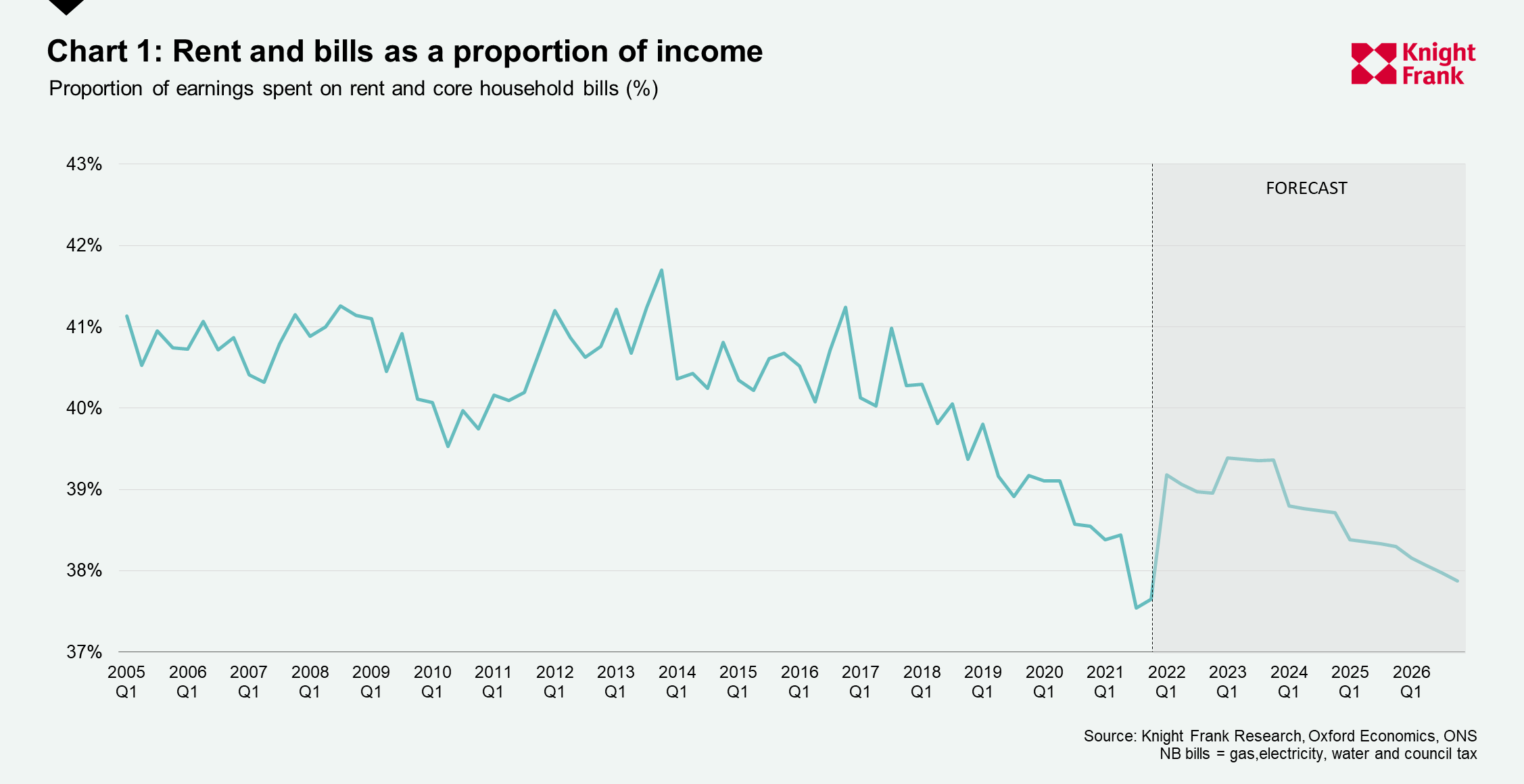

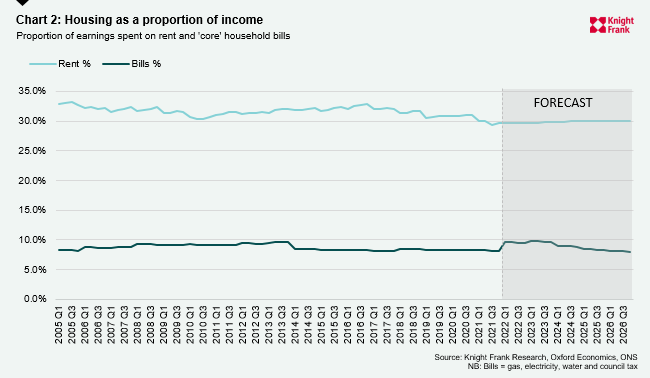

The proportion of earnings spent on rent has been steadily declining in recent years. Our research indicates that the average household spent 37.5% of their pre-tax income on rent and bills in 2021, down from a high of 42% in 2013. This figure, however, is expected to rise; Knight Frank forecasts that the proportion of earnings spent on rent and bills will spike at close to 40% in 2022 and 2023. Add in the prospect of rising food and transport costs on top, and there is the potential for affordability to be pushed to less sustainable levels.

Is there headroom for rental outperformance?

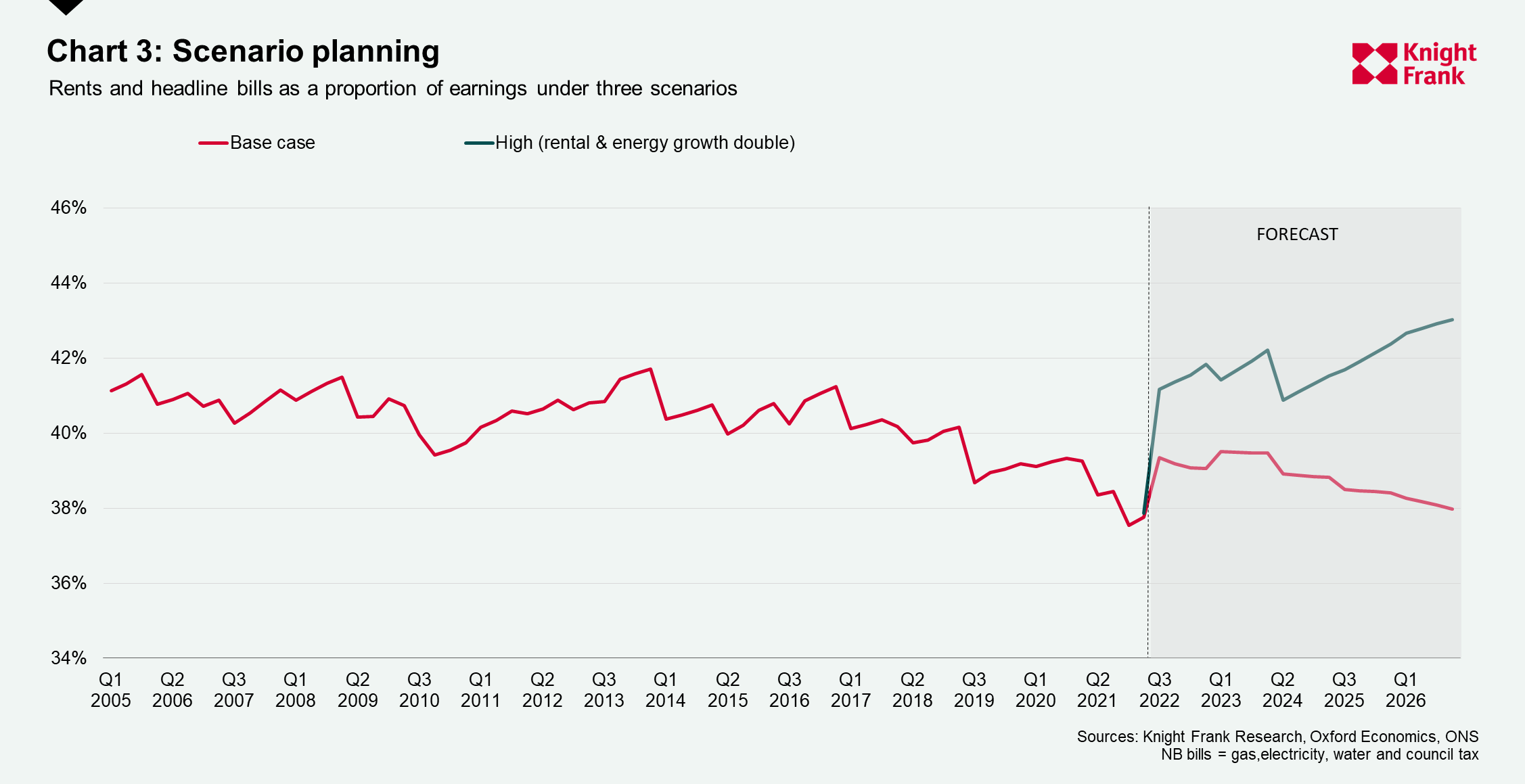

Given the current climate, many clients are asking us if there is headroom for rental outperformance. Mapping both base case and high growth scenarios paint two slightly different pictures.

In a base case scenario, strong growth in earnings and a return to a less inflationary environment suggests there is room for further steady growth in rents. However, various factors such as different property types, locations and asset classes will affect rental growth, and we should expect to see both under and over-performance over the coming year. Equally, surging prices of energy, commodities and food – caused in part by the war in Ukraine and coupled with existing global supply chain constraints – mean that there is a risk higher consumer prices could be sustained for longer.

In a high growth scenario, the proportion of earnings spent on rent and core bills would rise to 43%. While this would be the highest share on record since the analysis began in 2005, it does also support our view that there may be headroom for higher growth in rents without affordability being too greatly impacted.

For BTR investors and developers, the prospect of positive rental growth should help mitigate challenges including build cost inflation, rising energy prices and labour shortages, all of which have impacted scheme viability.

The current economic backdrop also has implications for demand. Rising interest rates, in part driven by high inflation, mean the financial benefits of buying versus renting is declining.

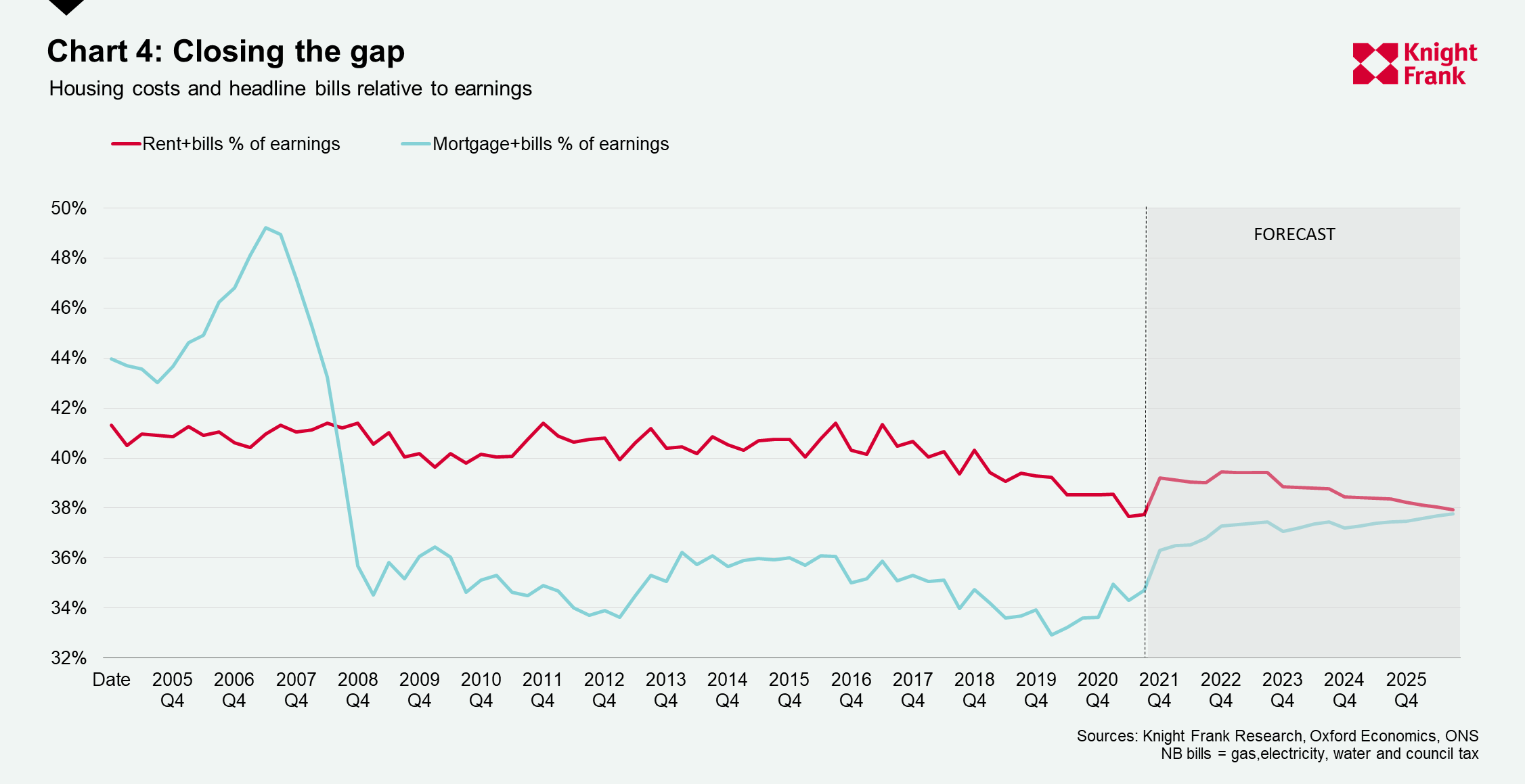

Whilst the cost of servicing a mortgage and paying core bills are still well below their pre-GFC levels as a proportion of income, they are expected to rise as mortgage rates trend back up. As the two move closer together, one consequence will be more households remaining in the rental sector for longer.

Overall, while we do expect short-term inflationary pressures will act as a moderating force on current larger rent rises as the year progresses and as household finances are stretched, longer-term the market will continue to be underpinned by strong fundamentals of tight supply, high demand and a robust outlook for earnings growth. This supports our view that there is headroom for further rental growth.