Your Leading Indicators | Moderating Forecasts | Robust Labour Markets | Rate Hikes

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Economic outlook moderates, but it is all relative

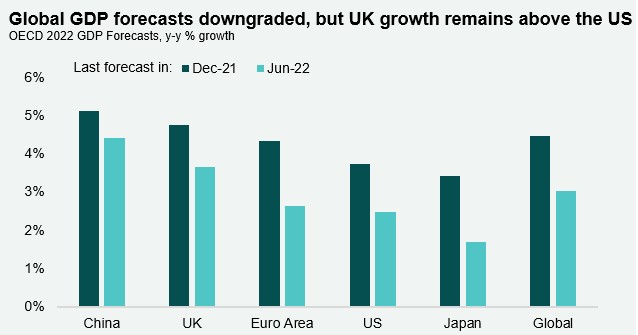

Following last week’s OECD forecasts, which outlined that the UK’s economy is expected to stall next year, data released yesterday showed UK GDP fell by -0.3% m-m in April. However, the OECD still expects the UK economy to grow faster than that of the US, Japan and Euro area this year, while sectors such as construction are still showing signs of positivity, with output increasing +3.9% y-y in April.

Robust labour market defies economic narrative

UK unemployment rose slightly to 3.8% in April, however the employment rate grew to 75.6% and the number of job vacancies hit a new record, keeping the labour market extremely tight. While the strength of the UK labour market may seem to be at odds with the prevailing economic narrative, a potential upshot of this could be that even just a perception of a weaker outlook might tempt a few more people back into offices.

More interest rate hikes ahead?

US and UK central banks are widely expected to tighten interest rates at their meetings later this week, with markets already factoring in a 25bps rate hike from the Bank of England. While real estate investors are typically wary of rate hikes due to the perceived negative impact on pricing, our analysis has found that it can take up to three years for this to fully wash through.

Download the latest dashboard