A difficult moment to tackle UK housing policy

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

Mortgage market reform

Boris Johnson made a string of housing policy announcements yesterday and I think it's fair to say the response has been muted.

Among them were proposals for housing benefit to be put towards mortgages - Resolution Foundation chief executive Torsten Bell picks through what little detail there is on that. We got Right to Buy for Housing Association tenants, plus a review of the mortgage market due back in the autumn. The latter will look at improving mortgage availability for those with low deposits and is most worth paying attention to, though there is little worth saying without more detail.

Context is important, and it's worth remembering that a not insignificant number of housing policies get proposed and dropped. Starter homes and planning reform are good illustrations of things that are easy to announce and hard to implement. In what feels like a prescient column in this morning's Times, James Forsyth suggests Downing Street is rushing out policies that are worthy of consideration but "need more time in the oven". This sticks out:

"Remember how planning, the government’s most significant pro-growth reform, was dropped after the Chesham and Amersham by-election defeat. But things are now more perilous than ever: it will take the opposition of only a small number of MPs for policies to be abandoned. Any issue that even a handful of Johnson-supporting MPs dislike is a no-go. This acts as a check on radicalism."

Cooling

A new RICS Residential Market Survey confirms that the UK housing market is in cooling territory. New buyer enquiries fell into negative territory following eight months of positive readings and came back flat or negative in nine of the twelve regions.

New instructions were largely flat and the survey returned a weak reading for new appraisals. That would suggest the supply of housing will remain tight for the time being, though it conflicts with what we're seeing at Knight Frank. The number of UK sales instructions in May, according to our data, were the fifth highest monthly total in a decade. The jump from April to May was 33%.

Anyway, the prevailing issue with low supply continues to support expectations for house price growth in the RICS survey. A net balance of +42% of respondents believe house prices will be higher this time next year, down from +78% in February.

More cooling

Earlier this week Halifax said UK house prices climbed 1% in May. That's the eleventh consecutive monthly rise, though the rate of growth was the slowest we've seen so far this year. Here is Knight Frank Head of UK Residential Research Tom Bill:

“House prices have begun their gradual return to earth as the cost of living squeeze tightens, mortgage lenders withdraw their cheapest products and the supply of homes increases as owners sense prices are peaking.

"The trigger for this much-needed rebalancing between supply and demand appears to have been the Bank of England raising the base rate to 1% and the grim language it used to describe the economic outlook. While the brakes will be applied, the low rate of unemployment means the housing market shouldn’t screech to a halt and we expect single digit growth by the end of this year.”

Stagflation

Inflation, rising interest rates, an energy embargo triggered by the war in Ukraine and an uncertain outlook for China's economy is a potent mix. The World Bank this week cut its forecast for 2022 global growth to 2.9%, down from 5.7% in 2021.

The group warned of an increasing risk of "stagflation" - a combination of high inflation, high unemployment and little to no growth. The most worrying aspect, however, is the looming debt crisis for developing nations.

Foreign debt in low-income countries rose by $15.5bn to about $166bn in 2020. The proportion subject to variable interest rates has risen to 35%, from about 20% in the early 2000s. Many have borrowed heavily in dollars, which has strengthened significantly since the beginning of the war. Those that are also commodity importers are being squeezed on all fronts - Adam Tooze has more on that in his excellent Chartbook newsletter.

The OECD also updated its economic outlook this week and if you were hoping for a more upbeat assessment than the World Bank, you'll be disappointed. The group expects growth in the UK to "grind to a halt" next year, registering the lowest growth in the G20. Inflation is going to be particularly challenging here, partly because the UK is suffering with both the energy price crunch hitting Europe, plus the broad rises in prices of goods and services we're seeing in North America. The FT has a good piece on that today.

Wine

If that section got you reaching for a bottle of something interesting, we've got the perfect follow up.

Knight Frank published The Rural Report 2022 this week, covering the key issues facing rural landowners and advisors. That includes the impact of the energy crunch, restorative agriculture, and why it could be the best moment in decades to sell land. You can enjoy the teaser video here.

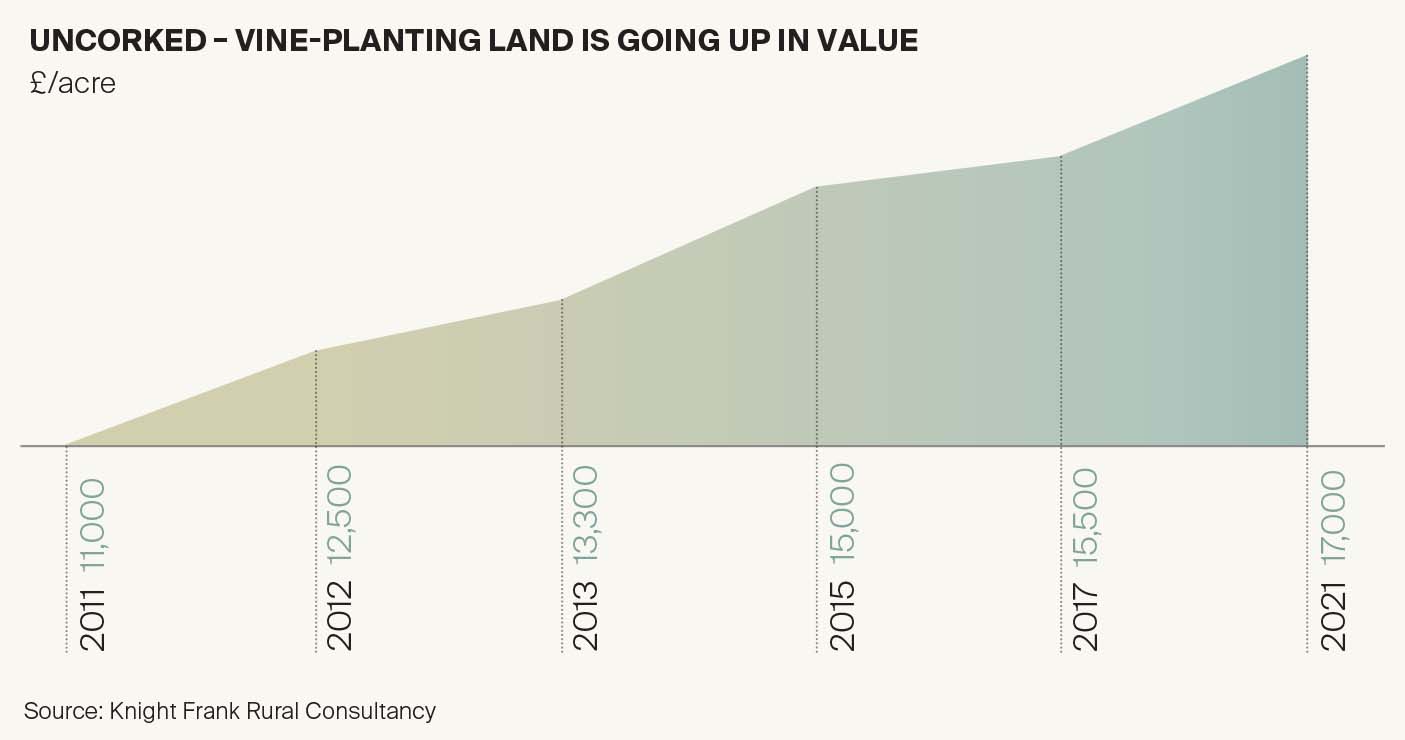

But first, Andrew Shirley meets Knight Frank’s new Head of Viticulture Ed Mansel Lewis to quiz him about the burgeoning market for UK vineyards and how prospective winemakers can add value to their enterprises - read it here. Ed has been at the heart of the UK’s wine industry for over a decade and has been involved with some of the sector’s landmark sales. Land values have climbed rapidly (see chart) - will it continue? Here's Ed:

“I wouldn’t be surprised to see land trading at £20,000/acre within two years. Since the Covid-19 pandemic wine consumption in the UK has risen sharply and producers are suddenly realising they can’t produce enough of the stuff. I know of five significant businesses that are looking to each acquire plots of a minimum of 80 acres.”

“Thirty acres will give you around 100,000 bottles a year, so 80 acres of extra domestic wine production in an emerging market is pretty significant.”

In other news...

Australia launches its own Help to Buy. Michelle Ciesielski weighs up the details.

Kate Everett-Allen on price growth on Italy’s East Ligurian coastline.

Elsewhere - the runners and riders for next conservative leader (oddschecker), modular construction 'emits 45% less carbon than traditional methods' (Housing Today), green shoots from China (Reuters), and finally, forget Right to Buy, what about Right to Rent? (New Statesman).