Regen ag fund, Pork abyss, Woodland carbon

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

5 minutes to read

Elon Musk may not end up buying Twitter, but I still can’t get my head around the fact that he is even considering paying over US$40 billion for a social media platform that has never made a profit and, in the scheme of things, seems to add very little to human existence. I would argue that eating is slightly more important, but the entirety of the endeavours of all the UK’s farmers created an income of barely £6 billion last year - a measly 0.5% of the country’s GDP. And over half of it was made up of Basic Payment Scheme subsidies anyway. Meanwhile, a European fund wants to invest €1 billion into regenerative agriculture. If I was a farmer I’d be working out a way to get my hands on some of that cash, after all BPS won’t be here for much longer.

Please get in touch if we can help

Andrew Shirley, Head of Rural Research

In this week’s update:

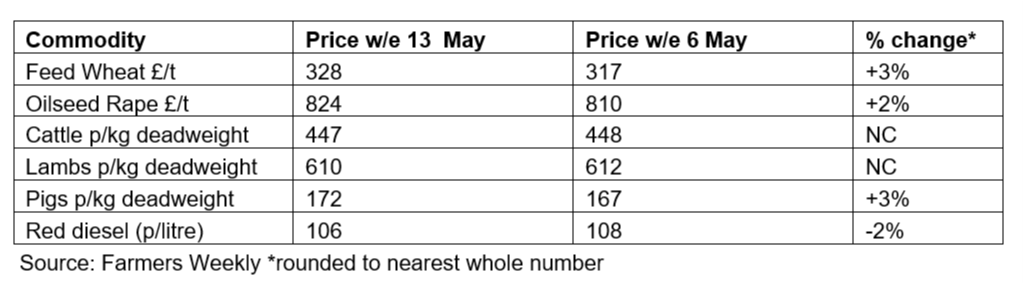

• Commodity markets – Wheat up, but pigs on the abyss

• Farm incomes – Profits up in 2021

• Planning podcast – Implications of the Queen’s Speech

• Woodland carbon – Rules tightened

• Renewable energy - Welsh government solar clamp down

• Overseas news – Euro companies launch regen ag fund

Commodity markets – Wheat up, but pigs on the abyss

Despite a belated rise in pig prices – up 16% over the past 12 months – the industry remains in dire straits. The National Pig Association reckons 80% of producers risk going out of business over the next year unless things improve. Spiralling feed and energy costs have further hit margins that were already unsustainable even before Russia’s invasion of Ukraine. Farmers lost almost £60 per animal reared during the first three months of the year. Exacerbating the situation, wheat prices were pushed to record highs last week off the back of the USDA’s latest World Agricultural Supply and Demand Estimates that revised downwards world wheat stocks and US harvest forecasts.

Farm incomes – profits up in 2021

The government’s first estimates of total income from farming (Tiff) across the UK were released last week. They show that farming had it best year in real teams since 2013 with Tiff hitting almost £6 billion, compared with £5.3 billion in 2020.

Although costs increased during the year, increases in output from both the arable and livestock sectors more than compensated. However, it is worth noting that subsidy payments to farmers still made up over half of Tiff highlighting their continued importance to farm profitability.

Illustrating that point, new findings from the Countryside and Community Research Institute estimates almost £900 million will be lost from the economy of southwest England over the next five years due to the scrapping of the Basic Payment Scheme.

Planning podcast – Implications of the Queen’s Speech

More details of the government’s intentions for planning reform were revealed in last week’s Queen’s Speech. In the latest edition of our Intelligence Talks podcast series, my colleague Anna Ward quizzes Knight Frank’s heads of planning and energy – Stuart Baillie and David Goatman – about the likely impact on housing development.

They discuss the impact of shelving comprehensive planning reform and giving local residents more say over development, and assess government plans to toughen up net zero rules, with housebuilders mandated to reduce carbon emissions in new homes by 30% from next month.

Woodland carbon – Rules tightened

From October 1st, investors will no longer be able to use the cost of land as part of the financial additionality test used to ascertain if woodland planting schemes qualify for carbon credit payments under the Woodland Carbon Code.

The additionality test is in place to ensure that any payments deliver levels of carbon sequestration above and beyond those that would have been provided without them. Or, to put it another way, to prevent already commercially viable forestry schemes from claiming an extra subsidy.

The rapidly rising cost of land has apparently been used to justify claims on the basis that tree-planting schemes would not be viable without the credits.

Future schemes may now have to include a greater proportion of slower-growing native species to qualify for the credits. The move could also take some of the heat out of the burgeoning market for tree-planting land.

Renewable energy – Welsh government solar clamp down

I’ve talked often about the land use tensions between food, the environment and energy that are developing in the countryside. It was interesting, therefore, to read in this week’s Farmers Weekly that, despite calls for more solar schemes to cut the UK’s carbon emissions and boost energy security, the Welsh government has stirred up controversy by ruling in favour of food.

New guidance for planning authorities says that consent should be refused for solar schemes on land classed as “best and most versatile”.

The government insists this kind of land is vital for “future sustainability”. Others argue much of it is only suitable for grass and therefore covering it with panels will not impact food production.

Overseas news – Euro companies launch regen ag fund

Three leading European businesses have combined to create a fund that will invest in firms involved with regenerative agriculture. Insurer Axa, consumer goods giant Unilever and French asset manager Tikehau Capital will each put €100 million into the fund and hope to raise a further €700 million from external investors, reports the Financial Times.