How is supply chain disruption impacting land values in England?

Shortages of key building materials and labour have become more critical themes, but land values continue to rise

2 minutes to read

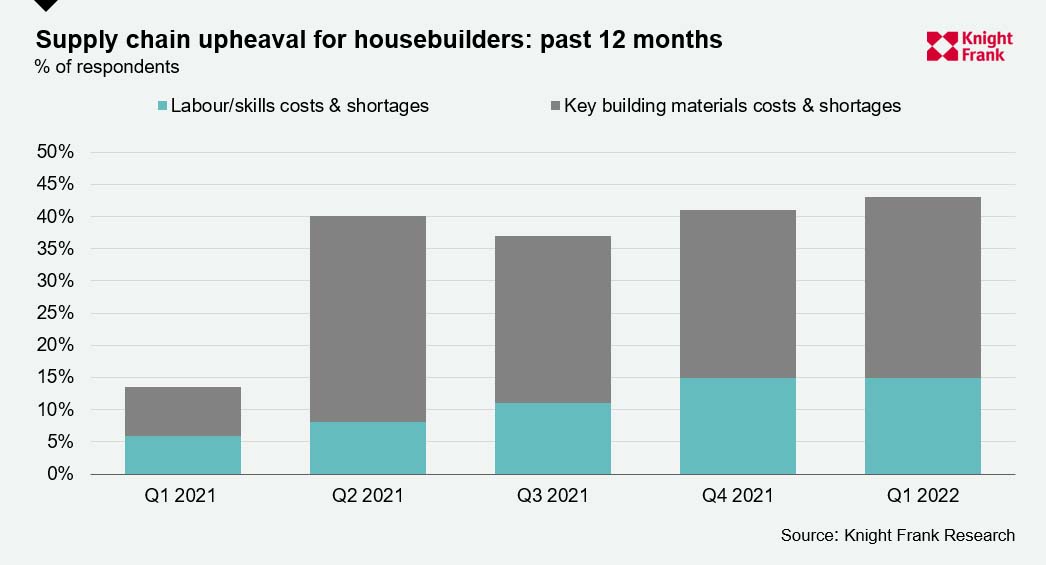

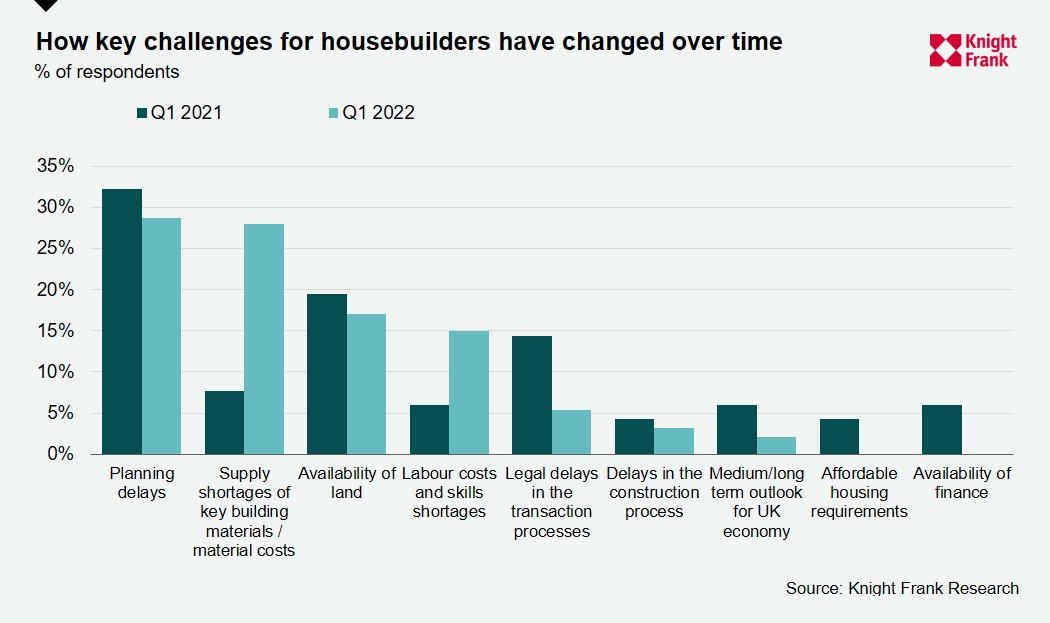

Over the past 12 months, housebuilder concerns over supply chain disruption and the resulting increase in costs have continued to grow.

In our fifth quarterly Residential Development Land Index survey, over two fifths of respondents (43%) said these were the most challenging factors for their businesses in Q1 2022. This is the highest proportion yet since we launched the survey a year ago in Q1 2021, when just 14% of respondents flagged these concerns.

Breaking this down further, concerns over labour have risen from 6% in Q1 2021 to 15% this quarter, while concerns over key building materials have grown from 8% in Q1 2021 to 28% this quarter.

Impact on land values

Despite the increasing cost of materials and labour, land values have so far continued to rise. Greenfield development land values rose 5% in Q1, with urban brownfield land values up 0.4%, according to our latest Residential Development Land Index.

Values in Prime Central London have been more subdued but rose in Q1 for the first time since autumn 2020. PCL prices increased 2.5%, boosted by a relaxing of travel restrictions, a stronger PCL sales market and limited availability of land, particularly for larger sites.

Housebuilders have largely been able to offset the increase in build costs due to continued house price inflation and a limited supply of land coming through the planning system, with 85% of respondents saying that land availability was either ‘limited’ or ‘very limited’ this quarter, up from 70% in Q4 2021.

But moving forward land values are expected to come under pressure as house price inflation cools, and build costs continue rising.

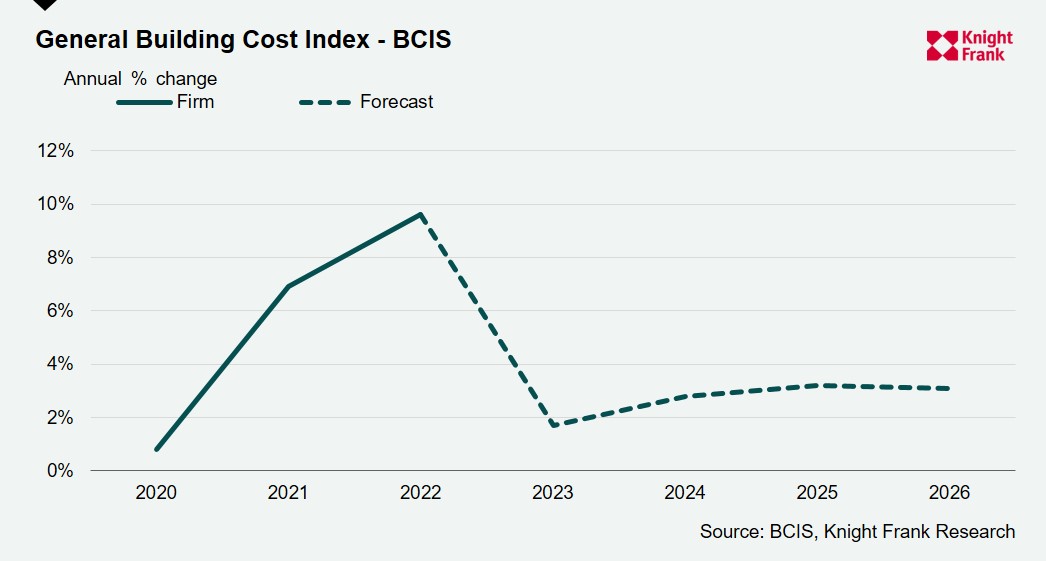

Overall, the Build Cost Information Service (BCIS) is forecasting build costs to increase 9.6% in 2022, up from 6.9% in 2021, before easing to 1.7% in 2023, according to its General Building Cost Index, which measures the movement in the cost of labour, material and plant to a contractor.