Future demand: Who’s occupying?

While the south east is home to a broad base of organisations from all industries, the region has long since demonstrated a strong relationship with innovation-led sectors.

9 minutes to read

The rapid growth of the telecommunications, media and technology (TMT) sector in the late 1990s for example, served as a catalyst for the development of the leading business parks in the region. Many of these sites today are recognised as major UK technology hubs housing both global technology behemoths and the major names of tomorrow. Most recently, life sciences has gained recognition. The south east now has 39% of the UK’s life sciences jobs. With the technology and life sciences sectors combined attracting 87% of committed venture capital funding in 2021, and double digit employment growth forecast, getting a full understanding of each is required to capture the next wave of demand growth.

First, the bigger picture

The UK tech industry is booming. According to the analysis for UK Digital Economy Council, the UK accounted for a third of the total £89.5 billion that flowed into the European tech ecosystem in 2021, with capital investment into UK start-ups and scale-ups reaching £29.4 billion. This total represents a year-on-year increase of more than 100% and is double the amount raised in the second largest market, Germany. But what does this rapid rate of growth mean for the south east office market?

Understanding the south east cluster

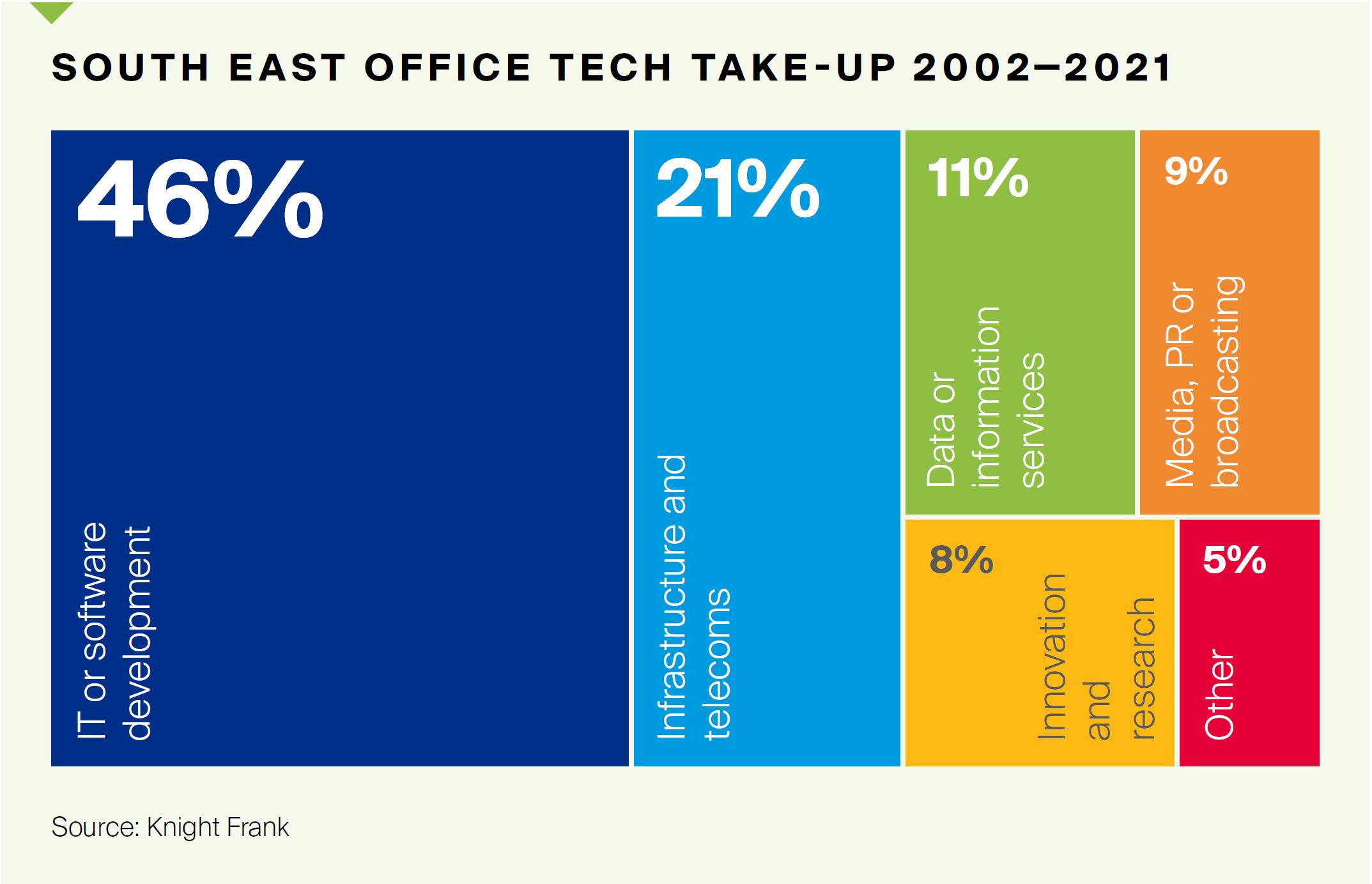

The technology sector in all its guises has maintained a prominent place in the fortunes and development of office markets in the south east. The region is home to companies delivering everything from innovative research and development to high tech software and hardware. Indeed, analysis of office take-up in the south east between 2002 and 2021 shows that some 900 occupier leasing transactions derived from the TMT sector. These deals account for nearly 15 million sq ft of office space, more than any other business sector over this period.

Click to enlarge image

Click to enlarge image

"Thames Valley accounts for 65% of office take-up in the south east over the past 20 years"

Of the major south east office market areas, the Thames Valley has been the principal target location. Today considered a top 10 UK technology hub, resident firms include Microsoft, Oracle, Vodafone, Télefonica, Symantec and McAfee. These companies exert a considerable draw to the area, attracting skills, infrastructure investment, and nurturing an innovative culture. From an office space perspective, take-up in the Thames Valley over the same 20-year period (2002—2021) shows that the technology sector transacted 9.6 million sq ft of office space. This represents 65% of total technology sector activity recorded across the wider south east.

But is a more granular view of tech needed to understand the market?

Segmentation of office take-up over the past 20 years identifies the main sources of demand. Close to 6.2 million sq ft or 46% of office space acquired over this time derives from IT or software development companies. The south east is also a significant location for telecoms and infrastructure companies, responsible for 2.8 million sq ft or 21% of take-up since 2002. The most active period for this sub-sector, though, was pre- 2011, driven by the rapid growth of mobile and fibre-derived applications.

Click to enlarge image

Focusing on the technology hotspots

The south east is home to a range of innovative tech clusters which are highly regarded both nationally and globally. Several of these centre around Oxford and Cambridge (health and computing); Thames Valley (global IT infrastructure firms); and Brighton (gaming and immersive tech). According to Tech Nation, 49,000 digital tech firms are located in the south east, employing more than 320,000 people. Digital turnover in 2021 was £91billion, approximately 12% of the UK total.

The current number of seven unicorn companies looks set to expand, with 11 “futurecorns” in the pipeline. New businesses are heavily supported. The ScaleUp Institute identifies the south east as the most successful for scale-up companies alongside London. Meanwhile Data City’s Top UK Tech Cities list includes three south east hubs (Milton Keynes, Brighton, Reading) in its national top 10 for digital teams seeking emerging technology clusters. This is unsurprising given the mix of local and global, new and more established businesses that create a diverse, vibrant environment.

Analysis for the UK Digital Economy Council placed Cambridge as the leading regional tech city in the UK thanks to its combination of high levels of VC funding, VC rounds, advertised tech salaries, number of high-growth tech companies and future high-growth companies. Other major tech hubs, according to level of venture capital investment received, include Oxford (£344 million), Milton Keynes (£49 million), Brighton (£17 million) and Guildford (£15 million).

In terms of office market activity, granular analysis of office take-up over the past five years confirms the market dominance of Reading as a tech hub, with the city accounting for 16% of tech take-up during the period. Closer inspection shows that Reading is particularly attractive to infrastructure and telecoms firms, with HQ deals by Virgin Media and Three UK underpinning its position.

Click to enlarge image

What next?

Digital technologies have advanced more rapidly than any innovation in history, reaching around 50% of the developing world’s population in just two decades and transforming societies. Most recently, the Covid-19 pandemic has triggered a quantum leap in digital adoption at personal, organisational and industry levels. Technology is now so integral to businesses in all sectors and to the workings of everyday life that it is becoming increasingly difficult to distinguish between pure technology companies and those underpinned or transformed by technology.

With technology-derived employment in the region forecast to grow 11% by 2030, well ahead of the national average, the south east is set to be central to the next wave of technological progress, further extending its global influence and reputation as a tech centre.

Life sciences – expanding and evolving

The south east, and the Golden Triangle area (Oxford/Cambridge/London) in particular, is proving an attractive destination for life sciences companies due to its concentration of human, financial and knowledge capital. Home to three of the world’s top 100 universities for life sciences, more than 200 hospitals and innovative companies including Lonza, CMR Surgical, Exscientia and Oxford Nanopore, it also offers a successful innovation ecosystem and world-leading facilities.

Occupational demand from life sciences companies is rapidly accelerating. Take-up across the main markets reached 583,375 sq ft in 2021, or 18% of the total.

Where is demand coming from?

Future demand will derive from life sciences companies which have thrived during the pandemic, alongside several key drivers, each with a clear real estate dynamic:

The convergence of technology and life sciences

Convergence is driving rapid business restructuring and process re-engineering amongst incumbents, alongside an urgent need for tech talent. New fast-growth occupiers are emerging, alongside a trend for greater collaboration between tech and life sciences companies. Real estate will be an essential component in facilitating business transformation and attracting, retaining or reskilling talent. Exscientia and CMR Surgical are exemplars of this new breed of tech-enabled life sciences occupier, with both companies acquiring space in the south east in 2021.

Winning the battle for talent

UK vacancies in life sciences roles rose to 127,000 in the period December to February 2022, 91% up on the previous year. According to recruiters Cpl Life Sciences and data analysts Vacancysoft, the south east dominated the hiring landscape for life scientists in 2021, with laboratory roles most in demand. At the heart of the talent conversation lies real estate.

The rising ESG agenda

There is growing bottom-up and top-down pressure for life sciences companies to act in relation to ESG, particularly as life sciences real estate can use up to 10 times the energy of a traditional office. Occupiers in the south east setting bold targets include AstraZeneca which is aiming for zero carbon emissions from its global operations by 2025.

Organisational restructuring and rethinking supply chains

A recent EY survey of 250 life sciences CEOs revealed that 78% either have adjusted or are planning to adjust their global operations or supply chains to increase resilience.

The trend for collaboration is driving the expansion of life sciences clusters, which plays to the region’s strengths. Incumbents are also restructuring via mergers, divestitures and acquisition. UK life sciences M&A reached £10.5 billion in 2021, with deals involving companies based in the south east including the acquisition of Kymab by Sanofi, and GW Pharmaceuticals by Jazz Pharmaceuticals. As M&A activity increases, a real estate dimension invariably emerges.

An appetite for expansion

We also forecast significant expansion-led demand fuelled by booming public and private investment and sectoral growth deriving from factors including: the ageing population; huge unmet needs; NHS reform; a shift from treatment to prevention; technological and scientific advancements; continued demand for vaccines and diagnostics related to Covid-19; and consumers taking greater control over their health and wellbeing.

At national level, the UK government has committed to record levels of R&D spending, set to increase by £5 billion to reach £20 billion per annum by 2024–25. At regional level, one of the cornerstones of public investment is the Oxford-Cambridge Arc, which aims to further grow the economies of both cities as well as the towns in between, and to strengthen links between industry and academia. The universities are also playing their part: Oxford University Innovation created 31 new companies in 2021 bringing the total number through its doors to 270. A previous start-up, Oxford Nanopore, now employs more than 600 people. Cambridge University has also spun out 137 companies since 2011, including Gyroscope Therapeutics and CellCentric.

Over the past five years, more than £4 billion has been raised at a later stage, usually the point at which life sciences companies move into larger, more bespoke space. This is a 242% increase compared with the previous five years (2012—2016). Top sub-sectors by volume and value of deals were drug discovery, healthcare technology systems, therapeutic and surgical devices and diagnostics. Examples of expansion-led real estate

activity include:

- Altos Labs signed a 10-year lease on 51,000 sq ft of space in the Portaway Building, Granta Park, Cambridge. The company raised US$3 billion from investors in January 2022, having previously raised $270 million of Series A venture funding from investors including Jeff Bezos, putting its pre-money valuation at US$1.1 billion.

- Vaccitech, the company responsible for the technology behind the Oxford/AstraZeneca vaccine, took 31,000 sq ft in the Zeus development at Harwell Business Park. The company raised US$110.5 million in its initial public offering in 2021.

Click to enlarge image

Demand from the life sciences sector shows no signs of abating. Capturing this demand, whether disruption-led or expansionary, will require an understanding of the sector trends along with proactive prospecting through tracking occupier activity. Providing real estate for this expansion will drive speculative development in core life sciences markets. The focus for this supply must be lab enabled or lab ready to meet the greater percentage of occupier demand in these submarkets. Our predictions are that Oxford and Cambridge together could see 5 million sq ft of development over next five years - with existing demand to satisfy this pipeline.

Download Navigating the property lifecycle PDF